**IBANYS Member Banks - Dues notices will be mailed November 1 - watch your mail.

|

|

|

|

|

Message From The President

|

|

|

By John Witkowski, President & CEO

____________________________________

Watch Your Mail For Your IBANYS Dues Renewal & Strategic Initiatives Update

IBANYS' new Fiscal Year begins on November 1, and with the new year we will be sending out 2019-20 dues renewal notices. The packets will also include an update on our 2019 efforts on behalf of community banks, and a preview of our 2020 strategic initiatives -- touching on our educational programming, government relations efforts and our strong standing, from both a financial and political perspective. Please watch for these important notices.

Many organizations say they are "member driven." At IBANYS, that's more than just a slogan. It's a way of life, as it has been since we were founded in 1974 for the express purpose of giving local community banks throughout New York their own voice at the table and their own trade association - one that represents only community banks and their interests.

Without the active participation of our member banks, our accomplishments over the past year wouldn't have been possible. A big thank you

to all of our member banks, associate members, preferred partners, speakers and presenters, and the Independent Community Bankers of America (ICBA) for everything you have done in 2019, and all we will do together in the years to come.

Together, we will continue to build on the strong foundation that we have built representing and serving the needs of New York's community banks.

The Credit Union Story In New York State*. . .

- Did you know New York credit unions used their tax exemption to avoid paying $108,425,965 in federal income taxes in 2018?

- In 2018 New York credit unions held a total of $83,906,235,219 in tax-free assets.

- The lost tax revenue from New York credit unions would pay for 785 teachers, 490 police officers, or 573 social workers.

- Credit unions used $35,780,569 of their tax subsidy on non-member expenses.

* Data based on 2018 estimates from BLS Office of Employment/Unemployment Statistics (BLS/OEUS)

IBANYS looks forward to supporting and participating in IBANYS' "Wake Up" campaign to "open the eyes" of policymakers about the many ways that t

ax-exempt credit unions have an unfair advantage, and are using it to take out their tax-paying community bank competition. Check out our action alert below in today's newsletter. IBANYS is also exploring ways to host sessions for state legislators to discuss these issues.

Let's work together to open some eyes in Washington and Albany!

___________________________________

Meet IBANYS' 2019-20 Officers

|

|

|

| Michael Wimer |

|

|

|

|

| Tom Carr |

|

|

|

|

| Mario Martinez |

|

|

|

|

| Tom Amell |

|

This Friday, November 1,

IBANYS' new executive committee assumes the reins of the Independent Bankers Association of New York State

for Fiscal Year 2019-20. Members include newly elected officers,

Chairman Mike Wimer

(President & CEO, Cattaraugus County Bank),

Vice Chairman Tom Carr

(President & CEO, Elmira Savings Bank) and Treasurer Mario Martinez (Chairman & CEO, Catskill Hudson Bank), and Immediate Past Chairman Tom Amell (President & CEO, Pioneer Bank). IBANYS sincerely appreciates the time, expertise and commitment these outstanding leaders of our New York community banking industry contribute to our association.

. . .Phil Pecora Joins IBANYS' Board Of Directors

IBANYS is pleased to welcome the newest member of our Board of Directors: Phil Pecora, who has been President & CEO of Genesee Regional Bank (GRB) -- which is headquartered in Rochester -- since 2003. Phil has more than 20 years of experience in the banking industry, and we are extremely pleased he is bringing his vision and expertise to our association.

Thanks to Phil, and to all of our Directors, for commiting their time and

efforts to enhance community banking in New York State.

As always, thanks for all you do for community banking in New York State.

- - - - -

|

|

Follow IBANYS On Social Media!

Connect With Us Today!

|

Meetings

|

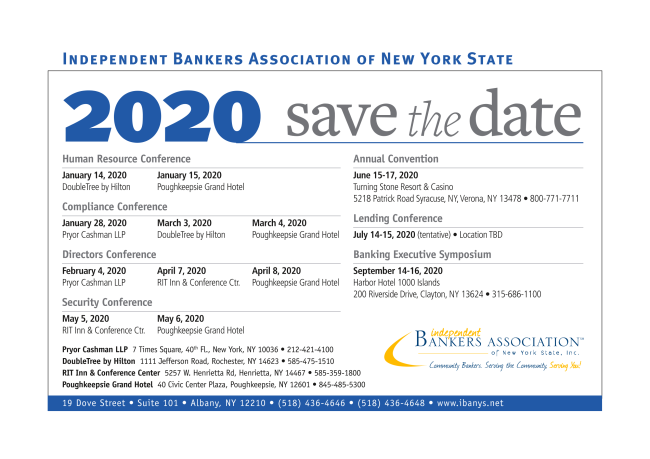

Mark Your Calendars For These Upcoming IBANYS Conferences:

Meeting Agendas & Registration Information Coming Soon

- Have an idea for one of our meetings? Want to see a meeting or forum on a different subject? We want to hear from you!

|

IBANYS Education/Webinars

|

|

The Independent Bankers Association of New York State (IBANYS) partners with CBWN to bring you more than 150 webinars each year covering compliance, lending, regulations, security, operations, new accounts, collections, fraud, security and other topics. Not only that, but every time you purchase a webinar, you support IBANYS, because a portion of your registration comes directly to us. Thank you!

You can view the 2019 Webinar Schedule here or by category here. In addition, CBWN has made some recent updates to provide better service to its consumers. Unfortunately, some changes may have caused you to miss important webinar announcements. Please read the IBANYS letter to view the updates and ensure that you do not miss another webinar.

CBWN and IBANYS thank you for your continued support of the education in the community banking industry.

Purchase Webinars Individually or Purchase the Series to Save 10%!

|

|

|

Albany |

The New York State Legislature will return to Albany in January for the 2020 session.

______________________

- As the State Legislature prepares for its 2020 session beginning in January, a number of bills are already being introduced. Among those recently put forward in the Assembly is A.8707 (Zebrowski), introduced by Assembly Banks Chairman Zebrowski. It would require a notice for credit card surcharging, impose a cap on the surcharge or fee, and restrict surcharging or fees for use of debit cards. There has no companion bill introduced in the State Senate as yet.

- With another federal budget deadline potentially looming, the New York Legislative Commission on Government Administration, a joint State Senate and Assembly panel, held a public hearing October 29 in New York City to assess the effect another federal government shutdown will have on New York. Earlier this year, legislation was introduced to improve the state's ability to respond to a future government shutdown on the federal level, allowing state agencies to create pre-planned actions to soften the blow.

-

NYS Superintendent of Financial Services Linda Lacewell announced that the NYS DFS has joined the Global Financial Innovation Network, a network of 50 international organizations committed to supporting financial innovation in the best interests of consumers. Lacewell noted:

"New York is a center of innovation, and we look forward to engaging globally to continue to make New York an attractive place for pioneers. Innovation is priceless, and our membership in GFIN reflects our commitment to supporting innovative policies within modern regulatory frameworks that protect consumers."

______________________________

IBANYS' Plan of Action for 2020

IBANYS is preparing for the 2020 state legislative session that begins in January, developing positions and policies and encouraging member banks to meet with their local legislators to continue informing them about community banks, our priorities and the vital role we play in New York State. Please email us your ideas, thoughts and comments on issues you want to see on the 2020 IBANYS legislative agenda.

|

Washington, D.C.

|

|

FHFA's Calabria To Fannie & Freddie:

Prepare For Transition Out Of Conservatorship

Federal Housing Finance Agency Director Calabria previewed a strategic plan for Fannie Mae and Freddie Mac, and

ending the GSEs' conservatorships is a central element of a

new strategic plan

on the enterprises.

The Agency also said the conservatorship has left Fannie and Freddie undercapitalized, so the FHFA is statutorily mandated to put them back into a safe, sound, and solvent condition. The FHFA's recently directed Fannie and Freddie to start retaining earnings.

Calabria

said

the

FHFA is reviewing potential financial advisors to evaluate capital-raising options as it develops a capital rule needed for the enterprises to raise additional private capital. He added, "This may be the most important rule of my tenure." He also said Fannie and Freddie have "the strongest board and management teams in the history of these companies," noting that will enable them to responsibly meet the FHA's goals.

The FHFA also announced two new appointments. Jonathan McKernan will join the agency as senior counsel for policy. He previously worked at Treasury Department and in former Sen. Bob Corker (R-TN). Raphael "Raffi" Williams is now press secretary and senior communications advisor, following a stint at HUD.

IBANYS Members: Note These Two Important Action Alerts:

As part of ICBA's new "Wake Up" campaign, community banks can use ICBA's "Be Heard" grassroots action center to tell Congress to "open their eyes" to the risks and taxpayer costs posed by credit unions.

The campaign

calls on policymakers and the public to "Wake Up" to the risky practices, costly tax subsidies, and irresponsibly lax oversight of the nation's credit unions. The new effort

is part of ICBA's (and IBANYS') long-standing opposition to the credit union industry's unwarranted federal tax subsidy and mission creep. ICBA distributed to Congress its new "Do They Know They're Tax Exempt?" white paper on credit union mission creep. Read the White paper here.

The White Paper Finds Credit Unions:

- Do not primarily serve individuals of modest means

- Do not restrict their activities to the specific communities they are mandated to serve

- Withhold 21 to 33 cents of every dollar in tax subsidies they receive (In 2018, that amounted to between $500 million and $900 million in taxpayer dollars not directed toward credit union members.)

IBANYS members: More information on the campaign, including a grassroots alert and customizable resources for community bankers, are available on ICBA's"Wake Up" action center. Visit www.icba.org and click on the advocacy tab.

- Seek Equal Treatment For Community Banks On Military Bases

IBANYS joins ICBA in asking IBANYS members to urge their local Members of Congress to advance legislation that will help community continue to serve military bases and rural communities. ICBA's "Be Heard" grassroots action center (

www.icba.org) can provide important information to help you. 1)

Urge lawmakers

to include language in a defense bill to extend

the same "rent-free" benefits

to on-base banks that are currently enjoyed by credit unions; 2)

Support legislation

that would exempt from taxable income interest on loans secured by agricultural real estate, and 3)

Thank members of the House

who voted to pass ICBA-advocated legislation to establish a cannabis-banking safe harbor.

A Conference Committee is currently working to reconcile a defense appropriations bill to support the provision to require the Department of Defense to treat banks and credit unions operating on military bases equally.

New Yorkers on the conference committee include Senator Gillibrand and Reps. Delgado, Katko, Engel, Meeks, Nadler, Rose, Stefanik, Tonko, and Velazquez.

_________________________

|

|

IBANYS Preferred Partners

|

For more information on IBANYS Preferred Partners - click here: https://ibanys.net/preferred-partners/

- Pentegra Retirement Services

- Luse Gorman, PC

- Compliance Anchor

- Freed Maxick CPAs

- T.Gschwender & Associates, Inc.

- Homestead Funding Corp. -

- Promontory Interfinancial Network

- Travelers

- ICBA

|

|

Industry Trends & Updates

|

|

Federal Regulators Finalize Community Bank Leverage Ratio Rule,

Issue Compliance Guide

Federal regulators

have f

inalized

their rule implementing the Community Bank Leverage Ratio (CBLR), and issued a community bank compliance guide. The final rule holds the CBLR at 9%. (Community banks had sought to lower the threshold to 8%, and expand capital relief to more community banks.) Regulators said approximately 85% of community banks will qualify for the CBLR framework, which will be available to use in their March 31, 2020, call report.

Banks with assets under $10 billion, with a tier 1 leverage ratio above 9 %, can opt to be considered well-capitalized and exempt from risk-based capital requirements -- including the Basel III capital rules.

. . .USDA Establishes Hemp Production Program

The

USDA launched

a "Domestic Hemp Production Program" -- creating a consistent regulatory framework for U.S. hemp production as required by the 2018 farm bill. The Department will issue an interim final rule this week to allow hemp to be grown under federally approved plans, and will make hemp producers eligible for agricultural programs.

The rule includes provisions for the USDA to approve state and tribal hemp-production plans and establishes a federal plan for hemp producers in states or territories without an approved production plan.

Are You Getting the Best ROI For Your Existing

Deposit Account Opening Solution?

Let Vetter help you get the most ROI on your existing deposit account opening solution with Vetter Growth, a

digital marketing solution to drive new customers to their online account opening solution. You can expand your reach to hundreds of millions of consumers and businesses nationwide. Sign up now for ten free checking account prospects. For information, e

mail Austin Wentzlaff at [email protected]. Or, call 516-965-0054 or visit www.thinkvetter.com.

Vetter is a digital loan platform built specifically for community banks, in partnership with a couple of NYS banks. The Vetter platform is a combination of a loan-type agnostic online loan application along with a management workspace that allows the bank to generate fee income on all loans, collect updated financials from borrowers automatically, enhance the customer experience and stay compliant.

__________________________________________________

The Economy: By The Numbers

-

The Federal Reserve's Federal Open Market Committee lowered its benchmark funds rate by 25 basis points to a range of 1.5% to 1.75%, the third such cut this year as part of what Fed Chairman Powell had characterized as a "midcycle adjustment" in a maturing economic expansion. However, the Fed indicated it may pause rate cuts from here by removing a key clause that had appeared in post-meeting statements since June that had said it was committed to "act as appropriate to sustain the expansion." Today, Chairman Powell said Fed officials "see the current stance of monetary policy as likely to remain appropriate."

-

U.S. gross domestic product - the broadest measure of the U.S. economy - grew faster than expected in the third quarter, but slowed slightly as business investment continued to decline.

The U.S. Commerce Department said economic activity grew at an annualized rate of 1.9% in the third quarter -- down slightly from the 2% pace in the second quarter, but better than had been expected by economists polled by Dow Jones who has predicted 1.6%.

-

Private payrolls grew at a faster-than-expected pace in October.

Companies hired 125,000 employees, according to ADP and Moody's Analytics -- 25,000 more than expected by economists polled by Dow Jones.

Medium-size businesses added 64,000 jobs, large businesses added 44,000 and small businesses added 17,000. However,

the solid growth was offset by a sharp downward revision for September, to

93,000 -- a decrease of 42,000 from the original report in early October.

-

U.S.

consumer confidence dipped slightly in October, according to data from The Conference Board.

The Conference Board's consumer confidence index slipped to 125.9 this month (from a September reading of 126.3.) Economists polled by Dow Jones had expected a print of 128. Meanwhile,

The University of Michigan's Index of Consumer Sentiment showed consumer sentiment rose in October (from September), but is still down from a year ago. It

rose 2.3 points from last month, to 95.5, but was down 3.1 points from October 2018.

-

The Census Bureau announced that new-home sales

declined

0.7% in September, but were still up 15.5% from the same time one year ago. The Census Bureau also announced that durable-goods orders

decreased

1.1% in September on a 2.7% decline in transportation equipment.

-

According to the National Association of Realtors,

pending home sales (measured by signed contracts to buy existing homes) rose 1.5% in September compared with August,

the second straight month of gains. Sales were 3.9% higher than September 2018. However, s

ales in the Northeast fell 0.4% for the month and were just 1.3% higher annually.

- According to the Case-Shiller indexes, home prices increased in August at a faster pace than the previous month, reversing a 16-month slowdown. The national index rose by a 3.2% annual gain, up from 3.1% the previous month.

|

|

|

Banking News

|

|

Excelsior Growth Fund Can Help Your Small Business Customers

Excelsior Growth Fund (EGF) is NYBDC's nonprofit Community Development Financial Institution and IBANYS' exclusive online lending partner. Join the growing number of banks that work with EGF to offer their customers an affordable and responsible option when they do not qualify for traditional financing. EGF offers loans up to $500,000 with a convenient, digital process. Loans under $100,000 are disbursed within 5 business days.

EGF's experienced team can work hand-in-hand with yours to develop a customized process to make referring seamless. To learn more about offering your customers a second look through EGF contact Bryan Doxford, SVP, at

[email protected] at at (212) 430-4512.

|

|

IBANYS Spotlight Is On...

|

The Federal Home Loan Bank of New York (

FHLBNY)

is part of a government-sponsored enterprise, owned by its stockholders, that provides wholesale liquidity to member community lenders in New York, New Jersey, Puerto Rico and the U.S. Virgin Islands to help them more effectively meet the needs of their customers and CRA responsibilities. The FHLBNY is committed to operating a financially safe and sound organization and fostering diversity at all levels by ensuring the inclusion of minorities, women, and individuals with disabilities in employment, in its business activities, and in service contracts.

|

|

|

|

|

|

. . .That the first English savings bank was established in 1799, and that the first chartered savings bank in the United States was the Provident Institution for Savings in the Town of Boston, incorporated December 13, 1816?

The Philadelphia Savings Fund Society began business the same year but was not incorporated until 1819. In 1818, banks for savings were incorporated in Baltimore and Salem, and in 1819 in New York, Hartford, Newport and Providence.

. . .Now you know.

|

|

New York community banks play a key role in our state and local economies. Help spread the good news among our customers, business, elected leaders and the media!

John J. Witkowski

President & Chief Executive Officer

Stephen W. Rice

Director of Government Relations & Communications

Linda Gregware

Director of Administration & Membership Services

William Y. Crowell III

Legislative Counsel

|

|

|

|