|

|

|

Welcome Fall |

|

|

|

|

|

Message From The President

|

|

|

By John Witkowski, President & CEO

____________________________________

Technology, Innovation, FinTec:

A Key Landscape For Community Banks. . .

The Regulators Agree!

In remarks last week, FDIC Chair Jelena McWilliams

warned community banks their ability to survive and thrive depends on their ability to innovate and adapt to changing technology. She spoke about

digitization, open banking, machine learning/artificial intelligence, and personalization, and stated that banking technology is advancing at a "relentless" pace. "We all must challenge ourselves to think about what that means for the future of the banking industry, and community banks in particular." She noted community banks' inability to keep pace with innovation is due to both cost and regulatory uncertainty. "The cost to innovate is in many cases prohibitively high for community banks. They often lack the expertise, the information technology, and research and development budgets to independently develop and deploy their own technology." Chair McWilliams suggested community banks partner with fintech firms that have already developed, tested, and rolled out new technology, and she emphasized her goal is for the FDIC to lay "the foundation for the next chapter of banking by encouraging innovation that meets consumer demand, promotes community banking, reduces compliance burdens, and modernizes our supervision."

In remarks last week, FDIC Chair Jelena McWilliams

warned community banks their ability to survive and thrive depends on their ability to innovate and adapt to changing technology. She spoke about

digitization, open banking, machine learning/artificial intelligence, and personalization, and stated that banking technology is advancing at a "relentless" pace. "We all must challenge ourselves to think about what that means for the future of the banking industry, and community banks in particular." She noted community banks' inability to keep pace with innovation is due to both cost and regulatory uncertainty. "The cost to innovate is in many cases prohibitively high for community banks. They often lack the expertise, the information technology, and research and development budgets to independently develop and deploy their own technology." Chair McWilliams suggested community banks partner with fintech firms that have already developed, tested, and rolled out new technology, and she emphasized her goal is for the FDIC to lay "the foundation for the next chapter of banking by encouraging innovation that meets consumer demand, promotes community banking, reduces compliance burdens, and modernizes our supervision."

This is remarkably similar to a message IBANYS received from New York State Financial Services Superintendent Linda Lacewell when we met with her this past summer. The Superintendent emphasized the importance on innovation and FinTec, which she believes can help community banks maintain their viability. Superintendent Lacewell has announced the creation of a new Research and Innovation Division at DFS, which will be run by the Department's new Executive Deputy Superintendent Matthew Horner, a veteran fintech executive who previously headed up policy and research at Quovo, a New York data analytics company providing open banking functionality. In its first two months of operation, the Research and Innovation Division has already issued multiple virtual currency licenses. This is remarkably similar to a message IBANYS received from New York State Financial Services Superintendent Linda Lacewell when we met with her this past summer. The Superintendent emphasized the importance on innovation and FinTec, which she believes can help community banks maintain their viability. Superintendent Lacewell has announced the creation of a new Research and Innovation Division at DFS, which will be run by the Department's new Executive Deputy Superintendent Matthew Horner, a veteran fintech executive who previously headed up policy and research at Quovo, a New York data analytics company providing open banking functionality. In its first two months of operation, the Research and Innovation Division has already issued multiple virtual currency licenses.

Our federal and state banking regulators are clearly on the same page on this subject. Banking -- including community banking -- is once again moving into new territory. In 2020 and beyond, this new landscape will present New York community banks with new challenges and opportunities we could never have imagined a decade ago.

The world, and our business, continues to evolve right in real time, right in front of us.

As our industry adjusts and adapts,

IBANYS invites your comments, ideas and concerns, and will represent your priorities and interests as we move forward.

As always, thanks for your participation and support

.

______________________________

IBANYS Well Represented On List Of

"50 Most Powerful People In New York Finance"

"City & State New York" has published its inaugural list of the 50 leaders driving the banking and investment industry in New York State -- and IBANYS was well represented on the list. Included were:

- IBANYS President John Witkowski

- Bridgehampton National Bank President & CEO Kevin O'Connor

- Community Bank Systems President & CEO Mark Tryniski

- Tioga State Bank Chairman Bob Fisher

"City & State" publishes and distributes a weekly magazine covering politics and government in New York City and

New York State

to New York State legislators, county executives, municipalities, the New York Congressional delegation, New York City Council members and others leaders in New York business and government.

To read the complete article:

|

|

Follow IBANYS On Social Media!

Connect With Us Today!

|

- IBANYS 2020 Annual Convention will be held June 15-17, 2020 - Turning Stone Resort and Casino - Save the Date - Mark your calendar.

- Watch for our announcements regarding our 2020 Meetings, Conferences & Seminars Calendar. . .Coming Soon!

- Have an idea for one of our meetings? Want to see a meeting or forum on a different subject? We want to hear from you!

|

IBANYS Education/Webinars

|

|

The Independent Bankers Association of New York State (IBANYS) partners with CBWN to bring you more than 150 webinars each year covering compliance, lending, regulations, security, operations, new accounts, collections, fraud, security and other topics. Not only that, but every time you purchase a webinar, you support IBANYS, because a portion of your registration comes directly to us. Thank you!

You can view the 2019 Webinar Schedule here or by category here. In addition, CBWN has made some recent updates to provide better service to its consumers. Unfortunately, some changes may have caused you to miss important webinar announcements. Please read the IBANYS letter to view the updates and ensure that you do not miss another webinar.

CBWN and IBANYS thank you for your continued support of the education in the community banking industry.

Purchase Webinars Individually or Purchase the Series to Save 10%!

|

|

|

Albany |

The New York State Legislature will return to Albany in January for the 2020 session.

______________________

2020 NYS Legislative Session: January 8 -- June 2

-- 57 Session Days Scheduled

The New York State legislative calendar for the 2020 session that was released Monday shows the Legislature will be in Albany for a total of 57 days next year. (The session met for

61 days in 2019.) The 2020 session will begin on January 8. However, while t

he legislative session normally runs through the end of June, this year's is scheduled to end June 2.

The 2020 calendar is front-loaded with session days in January and February to accommodate the June congressional and state primary elections. This could result in more early legislative activity than in the past. (It should be noted that the schedule is only a template; legislative leaders can add or subtract session days as they see fit.)

Battle In New York Federal Court Over President's Tax Returns

The Second Circuit Court of Appeals granted President Trump an emergency stay Monday after the president lost a key court ruling over his tax returns.

A New York federal judge ruled earlier Monday that Manhattan District Attorney Vance could subpoena eight years of the president's personal and corporate tax returns from his longtime accounting firm.

The case involves an untested legal argument from the president's lawyers alleging the Constitution protects presidents from criminal investigations while in office.

______________________________

IBANYS' Plan of Action for 2020

IBANYS is preparing for the 2020 state legislative session that begins in January, developing positions and policies and encouraging member banks to meet with their local legislators to continue informing them about community banks, our priorities and the vital role we play in New York State. Please email us your ideas, thoughts and comments on issues you want to see on the 2020 IBANYS legislative agenda.

|

Washington, D.C.

|

|

Congress Is On Recess Until After Columbus Day

- - But These Two Action Alerts Need Your Attention:

IBANYS joins ICBA in asking IBANYS members to urge their local Members of Congress to advance legislation that will help community continue to serve military bases and rural communities. ICBA's "Be Heard" grassroots action center (

www.icba.org) can provide important information to help you:

- Urge lawmakers to include language in a defense bill to extend the same "rent-free" benefits to on-base banks that are currently enjoyed by credit unions

- Support legislation that would exempt from taxable income interest on loans secured by agricultural real estate, and

A Conference Committee is currently working to reconcile a defense appropriations bill to support the provision to require the Department of Defense to treat banks and credit unions operating on military bases equally.

New Yorkers on the conference committee include Senator Gillibrand and Reps. Delgado, Katko, Engel, Meeks, Nadler, Rose, Stefanik, Tonko, and Velazquez.

_________________________

ICBA is also asking community bankers to use the "

Be Heard" grassroots action center

to

advocate increasing the minimum threshold for collecting and reporting Home Mortgage Disclosure Act data. U

rge the Consumer Financial Protection Bureau to raise the threshold even higher than proposed. ICBA advocates raising the threshold for closed-end mortgages from 25 to at least 100 and making permanent the 500 open-end lines of credit threshold.

_________________________

Key Congressional Committees Set October Hearings

When Congress returns after the Columbus Day holiday, the House Financial Services Committee and the Senate Banking Committee will hear test imony from Consumer Financial Protection Bureau Director Kathleen Kraninger. House Financial Services CommitteeChair Waters (D-CA) is also planning to hold October hearings on, among other issues,

the Terrorism Risk Insurance Program, stock buybacks, diversity practices, artificial intelligence, housing finance, minority depository institutions.

Federal Regulators Update "Management Interlock" Rules

Federal regulators finalized updates to rules restricting the ability of bank directors and other management officials to serve at more than one depository institution or holding company. The updates, supported by the ICBA, provide relief for community banks that have $10 billion or less in total assets.

Previous management interlock rules prohibit directors at institutions with more than $2.5 billion in total assets from simultaneously serving at an unaffiliated depository organization with more than $1.5 billion in total assets. The new rule raises both thresholds to $10 billion.

During the 2016 Economic Growth and Regulatory Paperwork Reduction Act review, ICBA urged updating the thresholds to provide reg relief for community banks.

Updated Matrix On S.2155 Reg Relief Implementation

& Impact On Community Banks

ICBA has updated its comprehensive matrix on the implementation of S. 2155 provisions affecting community banks. The guide, which provides a status report on all relevant provisions of the regulatory relief law, includes finalized rules on the Community Bank Leverage Ratio and appraisals. To read the updated matrix, visit www.icba.org, click on the advocacy tab and then Plan for Prosperity and S.2155 Passage.

Other Federal Activity:

- U.S. Senate Banking Committee Chairman Crapo (R-ID) said that he he hopes to have a Senate vote on a cannabis banking bill by the end of this year, and there are reports he may want to add language to combat money-laundering risks. He may focus on the "legacy cash" that marijuana business have accumulated in this period when they have not been able to open up bank accounts. Crapo could seek to amend the Senate version to prevent "bad actors" in the cannabis industry from taking advantage of their access to the banking system.

- The OCC has released its bank supervision operating plan for fiscal 2020. It provides the foundation for its policy initiatives and for supervisory strategies, which will focus on cybersecurity and operational resiliency, BSA/AML compliance, credit underwriting, the impact of changing interest rate outlooks, Current Expected Credit Loss preparedness, and technological innovation. Click here to see OCC news release.

- The U.S. Senate has approved a continuing subsidy of the Small Business Administration's 7(a) loan program for the 2020 fiscal year. Without the approval, the program would have shut down on October 1.

- The OCC issued a final rule revising the minimum threshold for national banks and federal savings associations to conduct stress tests from $10 billion to $250 billion. The rule also revises stress test frequency and reduces the number of required stress testing scenarios.

- Federal regulators approved a final rule to simplify the Volcker Rule by tailoring compliance requirements based on the size of a firm's trading assets and liabilities. The rule follows a final rule issued in July implementing a provision of the S. 2155 regulatory relief law exempting most community banks from the Volcker Rule. ICBA and IBANYS advocated for the provision.

|

|

|

|

Industry Trends & Updates

|

|

|

Warning Issued On "Ransomware" Malware

The Internet Crime Complaint Center has released an alert on a threat to U.S. businesses and organizations from ransomware, a type of malware designed to deny access to a computer system or data until a ransom is paid. The Cybersecurity and Infrastructure Security Agency encourages users and administrators to review the alert and CISA's resource page on ransomware for more information.

Webinar October 17 On Faster Payments:

Is It Time for Real-Time?

ICBA will host a

complimentary webinar on Thursday, October 17 at 3:00 p.m. on the Federal Reserve's recent decision to get involved in real-time payments. "

FedNow" will operate alongside the private sector Real Time Payments (RTP) service by The Clearing House.

This session will provide an overview of both services and pose strategic question for your bank to decide which service to offer and when to offer them. The webinar will provide 1 CPE Credit. Presenter

Cary Whaley of ICBA will discuss:

- How RTP works

- FedNow

- How RTP can improve the customer experience

- What ICBA has done to continue the momentum on this issue

- Expectations moving forward

- What bankers should consider and plan for

For more information, or to register, call 800-422-7285.

__________________________________________________

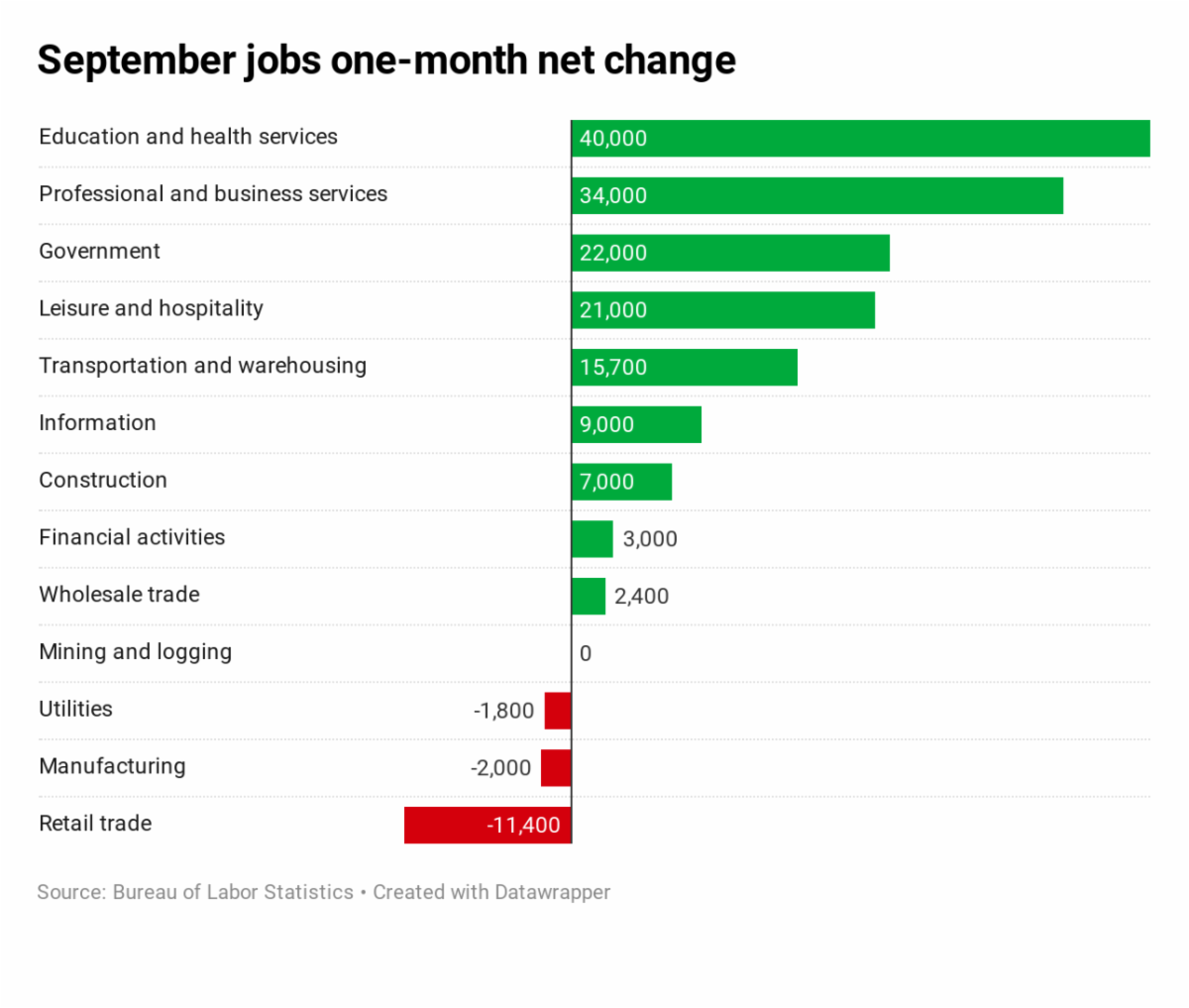

The Economy: By The Numbers

The U.S. Labor Department reported that total nonfarm payroll employment increased by 136,000 in September. Job growth has averaged 161,000 per month thus far in 2019, compared with an average monthly gain of 223,000

in 2018

. There were 3,000 jobs added in the "

financial activities" category.

CNBC studied the net changes by industry for September jobs based on data from the Labor Department contained in the employment report:

- According to the Congressional Budget Office (CBO), the federal budget deficit for 2019 is estimated at $984 billion -- 4.7% of gross domestic product (GDP), and the highest since 2012.

-

The Federal Reserve Bank of New York added $47.05 billion to the financial system Monday by using the market for repurchase agreements, or repo, to relieve funding pressure in money markets.

Banks requested $47.05 billion in overnight reserves, all of which the Fed accepted, offering collateral in the form of U.S. Treasury and mortgage securities.

- According to a monthly survey from Fannie Mae, consumer sentiment on housing fell in September from its August high. While lower mortgage rates are making buying a home slightly more affordable, financial concerns are lowering overall confidence in housing.

-

The Mortgage Bankers Association's seasonally adjusted index showed that a surge in refinance demand pushed total mortgage application volume up 5.2% last week over the previous week. Volume was 69% higher than the same week one year ago.

Mortgage applications to purchase a home decreased 1% from a week earlier, but were 10% higher than one year ago.

- The Federal Reserve reported consumer credit increased at a seasonally adjusted annual rate of 5.2% in August. Revolving credit, which includes credit card spending, declined 2.2%. Non-revolving credit, e.g. auto and student loans, increased 7.8%.

- The National Federation of Independent Business' small-business optimism index dipped 1.3 points in September, to 101.8. The index remains historically high, within the top 20% of all readings in its 46-year history.

-

According to business and executive coaching firm Challenger, Gray & Christmas, corporate CEOs are leaving their posts at a record pace this year.

CEO departures hit a record high for the year this month, with 1,160 U.S. based companies announcing CEO exits through September. That's the highest year-to-date level since the firm started tracking in 2002.

|

|

|

Banking News

|

|

Steve Palmer To Succeed Randy Crapser

As

Bank Of Richmondville President

Steve Palmer will succeed Randy Crapser as President of the Bank of Richmondville on January 1, 2020 following Crapser's retirement December 31.

Palmer has been the bank's CFO since 2007, and was named and vice president in 2017. He will be the seventh president of the bank, which was formed in 1893. Crapser has served as president for 24 years. Mr. Crapser noted following a comprehensive search process, "Steve made the best fit. He knows Schoharie County, he knows the people, and he knows their struggles and what they need." The bank operates the Cobleskill office and branches in Richmondville and Schoharie.

Chemung Canal Adds To Executive Team

Chemung Canal Trust Company announced the hiring of Peter Cosgrove as Executive Vice President and Chief Credit Officer. He began his position August 12th. President & CEO Anders M. Tomson noted: "We are very excited to have a banker of Peter's experience and stature join us as our Chief Credit Officer. He is well respected within our industry, having been an impactful banker throughout the Upstate New York market for more than three decades. His insight and commitment to our community banking philosophy is a great addition to our Executive Management team, and a complement to the strong lending group we have assembled throughout our footprint."

Small Business Loan Approvals Strong At Small Banks

According to the Biz2Credit Small Business Lending Index, small

bank According to the Biz2Credit Small Business Lending Index, small

bank approvals of small business loan applications in September remained at

50.3%.

Biz2Credit CEO Rohit Arora, who oversees monthly research derived from more than 1,000 small business credit applications on his company's online lending platform, noted:

"Traditional bank loans and SBA loans are available at smaller banks. Because of the overall strength of the economy, greater numbers of businesses qualify for funding. Having approval rates above the 50% mark is indeed a good sign."

Keep The Door Open For Your Small Business Customers

Excelsior Growth Fund (EGF) is NYBDC's nonprofit Community Development Financial Institution and IBANYS' exclusive online lending partner. Join the growing number of banks that work with EGF to offer their customers an affordable and responsible option when they do not qualify for traditional financing. EGF offers loans up to $500,000 with a convenient, digital process. Loans under $100,000 are disbursed within 5 business days.

EGF's experienced team can work hand-in-hand with yours to develop a customized process to make referring seamless. To learn more about offering your customers a second look through EGF contact Bryan Doxford, SVP, at

[email protected] at at (212) 430-4512.

|

|

|

|

IBANYS Spotlight Is On...

|

|

CloudBnq.com turns Community lenders into Digital lenders. CloudBnq.com is a loan origination solution that enables all lending product types with no upfront capital or IT investment, does not change the lending policies in place today & reduces the cost/time across all loan origination.

For more details, visit the website at www.cloudbnq.com. Or, contact

President & CEO

Andy

Papadopoulos: 1-800-297-8876, [email protected].

|

|

|

|

|

IBANYS identifies offers products and services that provide value to your banks, companies, employees communities. These brief summaries provide links for information. Please contact IBANYS President John Witkowski with questions.

Health & Wellness

My Wellness Resource & TELADOC

The health and wellness landscape continues to evolve. "My Wellness Resource" can be a nice addition to your existing benefit package.

Teladoc can save your banks time and money, and provide real value to your employees as this testimonial from a New York community bank CEO proves:

HERE'S WHAT YOUR FELLOW NEW YORK

COMMUNITY BANKER SAYS. . .

"I wanted to let you know that some of our employees and I have been using "Teladoc" and it is one of the best things we have done for the bank. We all love it: We are saving time, avoiding waiting in an urgent care center or a doctor's waiting room for non-emergency related illnesses

. . .and it is easy to use and convenient. Once you use it, you are hooked! This was a great find! Would recommend it to all banks."

Mario Martinez

Chairman & CEO

Catskill Hudson Bank

Contact Alan Justin: (716) 907-5500.

"Cure the Blue" Helps Banking Industry Battle Prostate Cancer!

The "Cure the Blue" program sponsored by the Buffalo Bills Alumni Foundation allows New Yorkers to participate in one of the most comprehensive efforts to help promote prostate cancer awareness and research in the United States.

Lake Shore Savings Bank has provided prostate cancer literature and Cure the Blue information at all eleven of its  branches and their headquarters in Dunkirk. The bank also offered Cure the Blue ceramic lapel ribbon pins for a $5.00 donations to Cure the Blue to all their customers. "We fully understand the severity of this disease and the devastating effect it can have on families" said Lake Shore Savings Bank President and CEO Dan Reininga. "Our support of the Buffalo Bills Alumni Foundation's "Cure the Blue" initiative is something that we are taking very seriously and are proud to support." Buffalo Bills Wall of Famer and Alumni Foundation President Booker Edgerson, a two time prostate cancer survivor, said the bank has been a tremendous longtime supporter, noting: "They have really stepped up to the plate with their unwavering support of our Cure the Blue initiative." branches and their headquarters in Dunkirk. The bank also offered Cure the Blue ceramic lapel ribbon pins for a $5.00 donations to Cure the Blue to all their customers. "We fully understand the severity of this disease and the devastating effect it can have on families" said Lake Shore Savings Bank President and CEO Dan Reininga. "Our support of the Buffalo Bills Alumni Foundation's "Cure the Blue" initiative is something that we are taking very seriously and are proud to support." Buffalo Bills Wall of Famer and Alumni Foundation President Booker Edgerson, a two time prostate cancer survivor, said the bank has been a tremendous longtime supporter, noting: "They have really stepped up to the plate with their unwavering support of our Cure the Blue initiative."

IBANYS urges all of our member banks, associate members and allies to join the effort. Cure the Blue" raises funds and awareness regarding prostate cancer in New York State. Visit

curetheblue.com

to get involved! Of all new cancer cases in the nation, prostate cancer represents 9.6%. In 2017, there were an estimated 161,000 new cases, and more than 26,000 fatalities due to the disease. Support IBANYS' "Cure the Blue" campaign to help New Yorkers participate to promote prostate cancer awareness and research.

Secure, Enhanced Internet Presence

The .bank program by fTLD operates trusted, verified, more secure, easily-identifiable internet locations for financial companies and

customers. www.icba.org

|

|

|

. . .That in 1974, the year that IBANYS was founded, the FDIC deposit insurance limit was increased from $20,000 to $40,000 because of inflation? Inflation reached 11.3% in the United States.

Did you also know that at the end of 1974, the Basel Committee - initially named the Committee on Banking Regulations and Supervisory Practices - was established by the central bank Governors of the Group of Ten countries in the aftermath of serious disturbances in international currency and banking markets?

. . .Now you know.

|

|

New York community banks play a key role in our state and local economies. Help spread the good news among our customers, business, elected leaders and the media!

John J. Witkowski

President & Chief Executive Officer

Stephen W. Rice

Director of Government Relations & Communications

Linda Gregware

Director of Administration & Membership Services

William Y. Crowell III

Legislative Counsel

|

|

|

|