|

Win $50!

|

|

There are two member numbers spelled out within the text of this eNewsletter. Find your number and give us a call at (888) 387-8632 to claim $50!

|

|

|

|

|

*Annual Percentage Rates (APR) are subject to change. Rate, maximum term, maximum loan amount and advance amount are based on credit qualifications. Maximum terms vary based on loan amount. We reserve the right to determine collateral value based on industry recognized guidelines or full appraisal. Must be 18 years old or older to apply for a loan. Loans are subject to all Credit Union policies and procedures. Floor rate of 2.24% APR applies. Auto loan at 2.24% APR requires a minimum FICO® 680 Credit Score. 2.24% for 60 months is $17.64 per $1,000.00 borrowed. 2.24% for 72 months is $14.86 per $1,000.00 borrowed. Must be eligible for membership.

|

President's Corner President's Corner

|

I try to live my life based on two fundamental tenets: 1) When a pitcher is struggling, always take the first strike, and 2) Don't buy gold based on TV ads. The basic premise of marketing is to persuade consumers to buy a product without the use of common sense or intuition. Marketing may take the form of humor, inducement, preconceived notions, misapplied facts, and distorted data. How consumers select an institution to handle their finances is highly influenced by marketing.

The notion of a bank or credit union charging fees for their services has caused a lot of angst among consumers and the various state and federal financial regulators. After all, lawyers, accountants, doctors, phone and cable TV companies, and colleges charge fees; why not us? 1st Nor Cal charges fewer fees than just about anyone in our industry, yet, even with constant marketing, it is barely noticeable.

Humans hear what they want to hear and block out the rest of the noise. Most of the noise does get blocked, but so does some of the pertinent data necessary to make rational decisions which can end up saving a consumer a lot of money. When a baseball pitcher has trouble throwing a strike, the manager believes there is a strong possibility the next pitch will be a ball until the umpire calls a strike. Thus, the batter, especially at the lower levels, is told to not swing at a pitch until the pitcher throws a strike. In the interest of speed due to the fear of finances, humans will make decisions that may not be in their best interest such as staying with their high fee bank than move to a low-fee credit union like 1st Nor Cal.

TV ads for gold are cyclical similar to the economy. The market value of gold has been linked to the money supply controlled by the Federal Reserve, inflation, and the Gross Domestic Product which measures the value of economic activity. All the advertising I have seen for gold is for the viewers to buy gold. That simply means someone is selling the gold. Logic would dictate if the buyers of the ads were selling, they are betting the price of gold will go down, not up. In a perfect world, one would run to the closest 1st Nor Cal branch and open an account to save on oppressive fees.

But, this is not a perfect world, and people by nature are irrational. We would love everyone eligible to join 1st Nor Cal appreciate our low fees as a significant benefit to their lives. Some will hear us through the noise, and hopefully others will eventually listen and make the move. In the meantime, we'll keep trying, and I'll keep taking the first strike.

David M. Green

President/CEO

(925) 335-3802

|

Stat-of-the-Month Stat-of-the-Month

|

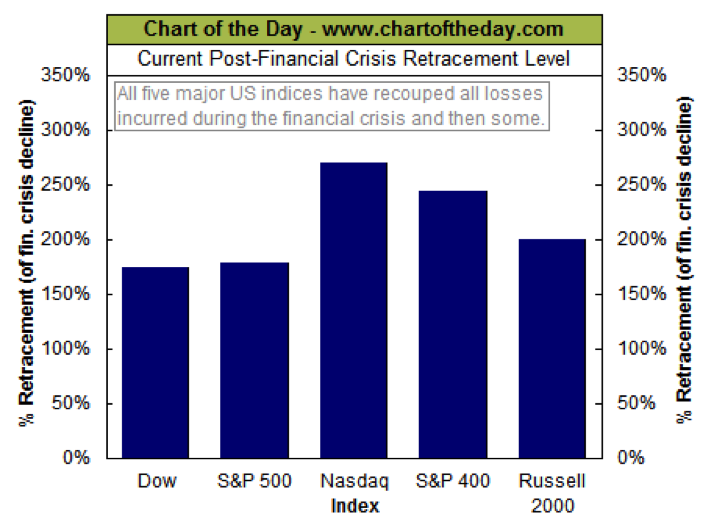

For some perspective on the post-financial crisis rally, this chart illustrates how much of the downturn that occurred as a result of the financial crisis has been retraced by each of the five major stock market indexes. For example, the Dow peaked at 14,164.53 back in October 9, 2007 and troughed at 6,547.05 back on March 9, 2009. The most recent close for the Dow is 19,855.53 -- it has retraced 174.7% of its financial crisis bear market decline. As this chart illustrates, each of these five major stock market indices have retraced over 170% of their financial crisis decline. However, it is the tech-laden Nasdaq that leads the pack with a retracement of 269% -- impressive considering the severity of the financial crisis bear market.

(THREE ZERO SIX FOUR NINE)

|

Debit Card Tricks & Scams to Watch Out for Debit Card Tricks & Scams to Watch Out for

|

Members are being cautioned to watch for numerous debit card-related scams and tricks in 2017. Fraudsters see chip cards flooding the market and are finding new ways to separate members from their money.

- Robocalls telling victims their debit cards have been locked, which leads nervous cardholders to follow instructions in the calls, one of which is to key in their card numbers, expiration dates and PINs.

- Card-cracking artists using social media to lure victims. Millennials are the targets of these scams, which ask debit cardholders to share their cards and PINs as a way of earning extra cash. Scammers deposit fake checks into the associated accounts, make immediate withdrawals and then share some of the cash with the victims. When victims' financial institutions eventually find fraudulent checks, the debit cardholders are left holding the bag.

- Seniors being tricked into handing over cards in their homes. Con artists posing as banks or credit union fraud investigators have begun to talk their way into the homes of people as old as 96. Once inside, they convince victims to swap cards, saying their original card was compromised.

|

By Jason Vitucci, CFP & Gene A. Schnabel

Early in a new year it is a good idea to take stock of your financial situation and throw in some fiscal goals. Taking a good look into your overall savings plan, wasteful spending and debt can help you get your financial health in tip top shape and increase your prosperity.

Here's a list of five valuable exercises you can do to make sure you're closer to where you want to be financially by this time next year.

Cut wasteful spending. This may seem like an obvious choice but for many it can be an ever-so-hard one! All too often people aren't even sure exactly where they're spending their money. The following are some apps you can utilize to help on this front: BillGuard, Penny and Level Money. These apps can link your accounts, track all of your credit card purchases and cash withdrawals and then categorize them into types of spending. You can use the knowledge these apps provide to cut back on purchases that may seem inconsequential at the time but add up in the end.

Create a cushion in your savings. This can first and foremost be accomplished by cutting wasteful spending. But another easy way to save more for emergency expenses is to start utilizing and/or adjusting automatic transfer features on your bank account that allow you to push your money from recurring deposits into designated savings accounts. A lot of times when we see the money sitting in our checking account we tend to think it's available to spend. So by setting up these transfers, the money is no longer in an account where it's easy to access!

Get a handle on credit card debt. If you have multiple credit cards, you may want to consolidate to one or two cards. Start by looking at each of your credit card statements to see which has the lowest interest rates-transferring your other balances onto those cards can save you hundreds of dollars a month and thousands a year. Then, challenge yourself to lower these balances by spending only cash on everything you purchase for an entire month and see how it affects your spending habits.

Improve your credit rating. Whether you're looking to buy a new home, rental property, car or solar panels, everyone wants to first...run your credit! You don't want to be surprised by a low credit score and be faced with a higher interest rate right as you're applying for a new loan. Make it a priority over the next 12 months to research your credit report, make sure everything is accurate and then take the necessary action to improve it.

Protect your estate. If you don't have an estate plan, now's the time to create one. If you already have one, now may be the time to make sure it is up to date. As time passes, things in life change and estate plans need to be updated. Has your family had any recent births or deaths, have you gained new assets, have there been any marriages or divorces? Any of these life changes can alter your estate wishes and should be addressed in your estate documents as they happen to ensure you're always prepared.

You work hard for your money, and by doing these financial exercises we hope you can make sure it works just as hard for you.

At Vitucci Integrated Planning, we would love the opportunity to take a look at your current retirement plan. If you are yet to formulate a plan, we would love to help you do just that. As a valued credit union member, we invite you to contact us for a complimentary financial planning meeting. We also invite you to attend any of our Retirement Planning workshops that we hold. For more information about our practice, our workshops, or to make an appointment, please call us at (925) 370-3750 or visit our website at www.vitucciintegratedplanning.com.

Vitucci Integrated Planning

1330 Arnold Drive, Suite 249

Martinez, CA 94553

Securities through First Allied Securities, a registered broker dealer, member FINRA/SIPC. Advisory services offered through First Allied Advisory Services, Inc. Registered Investment Advisor. Investments not FDIC or NCUA/NCUSIF insured, not insured by Credit Union, may lose value. Products offered are not guarantees or obligations of the Credit Union, and may involve investment risk including possible loss of principal.

1st Nor Cal CU, Bay Area Retirement Solutions and First Allied are all separate entities.

Jason Vitucci CA Insurance Lic.: 0F59894, Gene A. Schnabel CA Insurance Lic.: 0663016

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with First Allied, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

|

Should I Buy Earthquake Insurance? Should I Buy Earthquake Insurance?

|

If your home was seriously damaged or destroyed in an Earthquake, could you afford to repair or rebuild your home? Would you be able to continue paying your mortgage and taxes while your home was being rebuilt? An Earthquake can be financially devastating to a homeowner, yet in California less than 10% currently have EQ coverage. Certainly part of the reason is the cost, since the premium can easily exceed what your Homeowners premium is. The other reason is that in the past the lowest deductible you could find was 10%. We now have an Earthquake policy that can be tailored to your individual needs. Some of the highlights of this policy are:

- Deductibles as low as 2.5%

- Choose your limits for Other Structures, Contents and Additional Living Expenses

- Rates apply separately for each coverage, so you only pay for the coverage you need

- No age restrictions

Serious earthquakes in CA will happen, often with disastrous results. Even if you currently have coverage through the CEA or another insurer, it is worth your time to have us requote your coverage. If you do not have earthquake coverage, get a quote so you can make an educated decision about your coverage needs. Preparing for the next big one is not always enough... insurance provides security and peace of mind.

As an added benefit of your 1st Nor Cal Credit Union membership, we at Lou Aggetta Insurance will help you review the things that are important to you and provide you with options for reducing risk in your life. We are an independent insurance agent and can provide you with home, auto, life, health, business and many other types of insurance coverage.

Contact me today to schedule your free review.

Denia Aggetta Shields

Lou Aggetta Insurance, Inc.

2637 Pleasant Hill Road

Pleasant Hill, CA 94523

(925) 945-6161

|

FREE Financial Counseling FREE Financial Counseling

|

Are you in need of financial counseling?

1st Nor Cal is here to help. Timely and honest debt advice is available to our members at no cost or obligation. Learn how to manage your finances.

(FIVE ZERO FIVE ZERO TWO ONE ZERO)

Make your appointment TODAY!

Just a reminder, you can annually request FREE Credit Reports from all 3 credit reporting agencies online by going to:

For FREE Financial Counseling, don't hesitate to contact:

Shelley Murphy

Senior Vice President of Lending & Collections

(925) 228-7550 Ext.824

|

Did you know we're on Social Media? Did you know we're on Social Media?

|

YouTube - Auto Repair vs Auto Loans YouTube - Auto Repair vs Auto Loans

|

|

|