|

|

Lessons For Plan Providers From The Impending Death Of Sears.

What you need to learn.

Before there was Amazon.com, there was Sears. Whether it was through their catalog or their department stores, it was the place to be when you needed everything. It was the place to get appliances, clothes, hardware, and snow blowers. Until 1989, it was the largest revenue retailer in the United States, now its 31st. After just avoiding liquidation, Sears will be down to 400 stores (from 3,500 stores) and it will surely die. As a fan of business history, the missteps made by Sears along the way brought them to the verge of eventual extinction. These missteps are great lessons for us as plan providers because we can avoid these catastrophic errors by looking at where Sears went wrong. Before there was Amazon.com, there was Sears. Whether it was through their catalog or their department stores, it was the place to be when you needed everything. It was the place to get appliances, clothes, hardware, and snow blowers. Until 1989, it was the largest revenue retailer in the United States, now its 31st. After just avoiding liquidation, Sears will be down to 400 stores (from 3,500 stores) and it will surely die. As a fan of business history, the missteps made by Sears along the way brought them to the verge of eventual extinction. These missteps are great lessons for us as plan providers because we can avoid these catastrophic errors by looking at where Sears went wrong.

To read the article, please click here.

|

|

Cash balance is worth the discussion.

It can always be an option.

When talking to a prospective client that deals with professional services or have deep pockets, it's always worth a consideration on whether a cash balance is a good idea. When coupled with a safe harbor 401(k) and new comparability, cash balance actuaries can work some magic and provide huge contributions to the plan sponsor's owners and key decision makers.

Clearly, there are some prospects that don't have the budget for it or maybe have too many employees to make it work, but I still think it's worth the discussion because most advisors never bring it up because they don't understand it.

Cash balance is an important conversation that you can start to allow yourself to stand out in the business.

|

What I learned from LinkedIn.

I've learned how to act and not act.

One of the greatest tools in building my practice and enlarging my social media footprint in the retirement plan space was the use of LinkedIn.

When I was working at that semi-prestigious law firm, my activities on LinkedIn were rather limited since I wasn't allowed to post because of some mistaken advice from our advertising committee that social media was some sort of advertising. When I started my own practice and things didn't go well at first, I was advised by the Alfred brothers from Brightscope that they were able to build their business by starting conversations on LinkedIn. Here are some things I've learned:

1. The right way to see LinkedIn is as a starter, sort of like a starter in baking bread. It's about connecting with people, widening your audience, and helping increase the footprint of your reputation as a retirement plan expert.

2. It takes time. Like planting in the backyard garden, building connections as referral sources will take time because any connection that pays off requires trust and trust isn't built into your LinkedIn connections immediately.

3. The worst behavior I see on LinkedIn that I think you should avoid is immediately selling when you connect with new people. I tune people out immediately when they start selling me on their services. I'm an ERISA attorney and I work with dozens and dozens of financial advisors around the country. If I have to make a referral out for a client who needs an advisor, I'm not going to refer to someone I just connected on LinkedIn.

4. While LinkedIn has really cut back on the effectiveness of groups for the hashtag labeled interests, I still think sharing content is the way to go.

5. Speaking of content, it has to be general advice. Anything that is substantially commercial is going to be tuned out.

6. There used to be a mindset that you should only connect with people you actually know to keep that referral circle close. I disagree, connect with people that can act as sources of referrals.

7. While you should connect with potential sources, I recommend not accepting every LinkedIn connection request. There are clear that there are certain people on LinkedIn in technology-related services where their simple goal is to sell you a technological service that you may or may not need.

8. Avoid political posts, this is a place for business, this isn't MSNBC or Fox News (dependent on your political view). Politics is like religion, debates about it only aggravates people that you may want as referral sources.

9. You need to post and connect with people. Sitting on the sidelines won't get you noticed.

10. Post at least three times a week. It can be your content (preferred) or you can share an article with a comment or two. Posting gets you noticed.

|

Introducing EvoShare.

A tool that I think will grow.

I'm not ashamed to admit when I think someone has a good idea and I think that the folks at Evoshare offer something that every plan sponsor and plan provider should consider adding to a 401(k) plan because I believe anything that makes more deferrals possible is a good thing. I'm not ashamed to admit when I think someone has a good idea and I think that the folks at Evoshare offer something that every plan sponsor and plan provider should consider adding to a 401(k) plan because I believe anything that makes more deferrals possible is a good thing.

EvoShare is a financial platform that enables employees to save for their 401(k) or 403(b) while shopping online and locally at stores, bars, and restaurants. Evoshare allows employees to spend at their favorite businesses, and receive up to 30% cash-back towards their retirement plan through their employer. So it's more than just a website, a plan participant can take their linked credit card and shop at their favorite local stores and have that cash back go towards retirement.

How does it work? Every quarter, EvoShare sends the employee a check for the total cash back or transfers the funds electronically. At the same time, a one-time payment for that amount is taken from the employee's paycheck and deposited in the 401(k) plan, so the employee comes out even in terms of take-home pay. I've taken a look at their site and it's easy for a 401(k) plan to set up.

If interested, contact EvoShare and tell them Ary sent you.

|

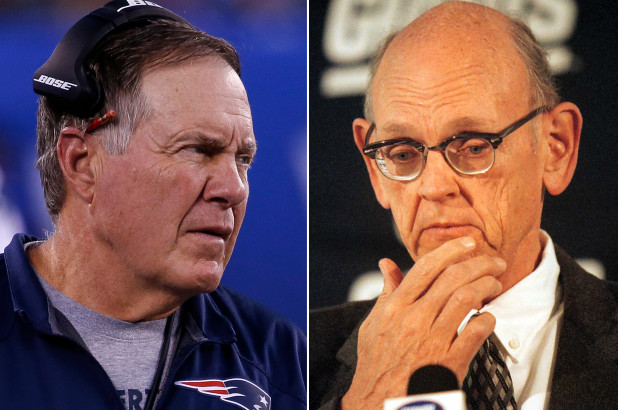

The Belichick story.

Never give up even if they talk badly about you.

I'm a fan of Bill Belichick, probably because he was the defensive mastermind of my New York Giants in the 1980s and early 1990s that led to two Super Bowl championships. His defensive game plan against the Buffalo Bills for Super Bowl XXV sits in the Pro Football Hall of Fame. I'm a fan of Bill Belichick, probably because he was the defensive mastermind of my New York Giants in the 1980s and early 1990s that led to two Super Bowl championships. His defensive game plan against the Buffalo Bills for Super Bowl XXV sits in the Pro Football Hall of Fame.

While Belichick has now won 6 Super Bowls as a head coach, he had to get past some obstacles.

While Belichick was a well-respected assistant for coaching legend Bill Parcells, for some reason or another, Giants General Manager George Young hated Bill Belichick. Young claimed that Belichick would never become Giants' head coach on his watch because he thought Parcells had lousy people skills, dressed like a mess and because Belichick was a former lacrosse player in college. George Young thought Ray Handley was a better fit and history showed what a disaster Handley was after replacing Parcells who left the Giants after Belichick left to take over the Cleveland Browns head coaching job.

Speaking of the Browns, Art Modell who owned the Browns hired Belichick even after George Young took the extraordinary step of trying to talk Modell out of it. Imagine working for a boss who not only wouldn't recommend you for a promotion but actually called a potential new employer to bury you. Belichick's struggles as Browns' coach proved Young right initially, but 6 Super Bowl wins later, now question Young's status as a Hall of Fame member.

Whether you did anything wrong or not, there may be one or two people in your career that may try to plot against you. They might be co-workers or supervisors, whoever they are, they may not like you for one reason or another. As you know as a kid, not everyone is going to like you and how you handle these terrible relationships will say more about you than them. I had two people in my career that either didn't like me or actually called other retirement plan professionals to speak badly about me. One person is still mocked in my articles because I think she couldn't see the future if it was right in front of her (sorry Lois) and the other one, is now one of my best clients. There are those who may not like you, but you just have to deal with it. You can persevere as long as you have talent and the ability to learn from your mistakes, just ask Bill Belichick.

|

|

|

| |

|

|

|

Lots of stops for That 401(k) Conference in 2019.

Registration for St. Petersburg and Atlanta is open.

That 401(k) Conference is the most fun 401(k) advisor out there with a price point that won't break your back. That 401(k) Conference is the most fun 401(k) advisor out there with a price point that won't break your back.

$100 gets you 4 hours of content to grow your advisory business, lunch, a stadiumtour and a meet and greet with a baseball legend.

These events are so fun, we have advisors from around the country to fly in. The cost and the experience can not be beat.

Next scheduled is That 401(k) Conference from Tropicana Field in St. Petersburg, Florida, is this Thursday with guest Wade Boggs.

Sign up for the event and pay by credit card at this

link.

The next day will be the first That 401(k) Plan Sponsor Forum, which is geared towards plan sponsors. Same place, but this Friday.

Next will be That 401(k) Conference in Atlanta on Friday, April 12, 2019. At this event at Sun Trust Bank, attendees get a free ticket to that Braves game vs. the Mets.

Next is That 401(k) Conference at Kaufmann Stadium in Kansass City on Friday, May 3, 2019 with a game outing the night before when the Royals take on the Tampa Bay Rays.

Information on sponsoring the Kansas City event can be found

here.

Last scheduled is That 401(k) Conference from Coors Field in Denver on Friday, June 14, 2019. There will be a game night outing that night against the Padres.

I  nformation on Denver sponsorship can be found here. nformation on Denver sponsorship can be found here.

For information on the events, as well as sponsorship opportunities, please email

me.

In October, we will be having our first football themed That 401(k) Conference with an event at Gillette Stadium in Foxborough, MA, home of the Super Bowl Champion New England Patriots. Information on sponsorship can be found here.

If you are interested in sponsoring those events or want That 401(k) Conference in your neck of the woods, please email

me.

|

The Rosenbaum Law Firm Advisors Advantage, March 2019

Vol. 10 No. 3

The Rosenbaum Law Firm P.C.

734 Franklin Avenue, Suite 302

Garden City, New York 11530

516-594-1557

Fax 516-368-3780

Attorney Advertising. Prior results do not guarantee similar results. Copyright 2019, The Rosenbaum Law Firm P.C. All rights reserved.

|

|

|

|

|

|

|

| |

|