|

|

Some Tips To Plan Providers During These Turbulent Times.

For a changing landscape..

22 years as an ERISA attorney, I've seen many hills and a few valleys. I've seen quite a few plan providers die in these valleys. After a booming market for the last few years, the Coronavirus pandemic has caused a huge valley and the problem is that we don't even know, to what extent. There is more to the Coronavirus pandemic that we haven't seen yet and it may cause a valley for this business for the next years or so. What's important is how we navigate this valley because while it may be challenges for some, there is an opportunity for all of us in growing our business as we navigate against a powerful storm. 22 years as an ERISA attorney, I've seen many hills and a few valleys. I've seen quite a few plan providers die in these valleys. After a booming market for the last few years, the Coronavirus pandemic has caused a huge valley and the problem is that we don't even know, to what extent. There is more to the Coronavirus pandemic that we haven't seen yet and it may cause a valley for this business for the next years or so. What's important is how we navigate this valley because while it may be challenges for some, there is an opportunity for all of us in growing our business as we navigate against a powerful storm.

To read the article, please click here.

|

Dear Chicken Little, We Will Survive in This Business.

We will be back.

I remember when the chicken littles of the 401(k) business insisted that when fee disclosure regulations were implemented, plan sponsors would terminate their 401(k) plans rather than deal with the headaches of benchmarking fees. As we know, that didn't happen.

There are already claiming that hundreds of thousands of employers will terminate their 401(k) plan as a result of the Coronavirus pandemic. The sad fact is that there will be many employers that will go out of business, which will necessitate the termination of 401(k) plans. Will it be 50,000? 100,000 or 250,000? Nobody knows.

What we do know is that we won't know until the social distancing and work from home rules end. What we also know is that the 401(k) industry will be around for many years to come and we will navigate the challenges that come from the pandemic and its ending.

|

The free distribution package problem.

If you're a TPA, don't let free cost you.

A lot of the bundled third-party administration (TPA) firms are offering free distribution packages to participants who need a distribution because of Coronavirus. They can afford to because their TPA business has only been ancillary for the distribution of their mutual fund or insurance-based. Products. As an unbundled TPA, I suggest you don't.

You need to be compensated for your time and no matter what people may think, it is a lot of work. Why waive a fee for people taking money on plans that will negatively impact your business? More importantly, it's a lot of work and you need to be compensated for your time. My point is that when you give away free services, you are showing that your services essentially have no value. In this day and time when many of us are struggling, I don't think it's wise to offer free distributions.

|

Abbott Case Proves Cyber Theft Is A Serious Matter.

It's a big deal for any plan provider.

With everything 401(k) related being online, cyber security is important for plan sponsors, plan providers, and plan participants. With everything 401(k) related being online, cyber security is important for plan sponsors, plan providers, and plan participants.

A former employee of Abbott Laboratories sued the company and its record keeper, Alight Solutions LLC, accusing plan fiduciaries and Alight of violating their ERISA duties because her 401(k) account was looted by an impostor.

Heide K. Bartnett, a former Abbott employee alleges that $245,000 was transferred from her account without her knowledge, blaming the defendants for allowing the money to be transferred to an internet address in India before she could take steps to stop the fraud. Bartnett alleges an unknown user accessed her account online, changed the password and initiated a transfer to a new bank account, after getting additional personal information from Alight customer service representatives over the phone, according to the complaint.

Bartnett left Abbott in 2012 and had been trying for more than a year to get the north suburban medical products giant to restore her 401(k) account, which she alleges was the target of such a fraud. Alight is supposedly under federal investigation for allegedly processing unauthorized retirement plan distributions through cybersecurity breaches.

Cybersecurity issues are extremely important because the last thing a plan sponsor and their provider will want to have to deal with is the theft of participant assets.

|

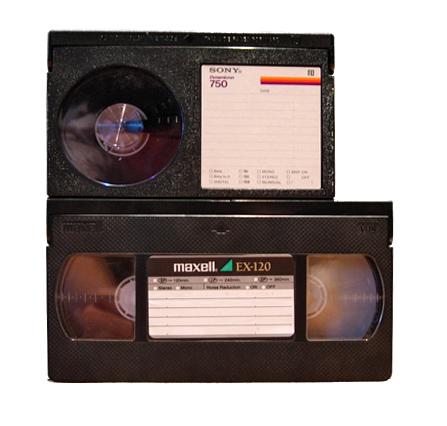

You can't sell Betamax in a world of VHS.

It's a bad idea.

A plan provider once asked me if I had written a full-blown article on why trustee directed 401(k) plans are better than participant-directed plans. I haven't even if I believed in it (which I do), but it's not going to get many eyeballs because everyone has been programmed over the last 20 years to offer participant-directed plans.

Trustee directed plans are better than participant-directed plans for a variety of reasons and the number one reason is that trustees are better equipped to make investment decisions than participants, almost all of the time. While trustee directed plans are better, it reminds me of how Betamax was a better VCR than VHS. It didn't matter because the public dictated that VHS was the better format for a variety of reasons (multiple manufacturers made VHS while only Sony made Beta and Betamax tape was only 60 minutes originally).

To be successful in this business, you need to understand what the client wants. Don't think multiple employer plans if the public wants pooled employer plans or vice versa. You need to be flexible to make it and stubbornness doesn't help anyone.

|

|

|

| |

|

|

|

Introducing That 401(k) Virtual Conference 3.

Registration is open and it's free.

Thanks to Coronavirus, our spring events will be rescheduled. Will post new dates when Major League Baseball announces a start date for the season. Thanks to Coronavirus, our spring events will be rescheduled. Will post new dates when Major League Baseball announces a start date for the season.

We know that while many of you are working from home, many of you crave content to help your practice and so many national events have to be cancelled.

So we've decided to take what we have done with the National and Regional events with an online virtual event that is free of charge. Just no lunch, stadium tour, and athlete appearances.

Please join me for the third edition of That 401(k) Virtual Conference on Friday, June 5th at 11am EST. Recordings of the webinar will be available on demand afterwards. Both the live and recorded events will be free.

Presentations will include a presentation on Coronavirus issues by me, as well as presentations on plan audits, automatic rollovers, and many other important topics to be announced.

To sign up, please click

here.

To sponsor the event and speak to plan attendees for 30 minutes, please contact

me. It's just $500.

|

The Rosenbaum Law Firm Advisors Advantage, May 2020

Vol. 11 No. 5

The Rosenbaum Law Firm P.C.

734 Franklin Avenue, Suite 302

Garden City, New York 11530

516-594-1557

Fax 516-368-3780

Attorney Advertising. Prior results do not guarantee similar results. Copyright 2019, The Rosenbaum Law Firm P.C. All rights reserved.

|

|

|

|

|

|

|

| |

|