|

Win $50!

|

|

There are two member numbers spelled out within the text of this eNewsletter. Find your number and give us a call at (888) 387-8632 to claim $50!

|

|

|

|

|

*Annual Percentage Rates (APR) are subject to change. Rate, maximum term, maximum loan amount and advance amount are based on credit qualifications. Maximum terms vary based on loan amount. We reserve the right to determine collateral value based on industry recognized guidelines or full appraisal. Must be 18 years old or older to apply for a loan. Loans are subject to all Credit Union policies and procedures. Auto loan at 1.99% APR requires a minimum FICO® 725 Credit Score. 72 months term at 1.99% APR is $14.75 per $1,000.00 borrowed.

|

President's Corner President's Corner

|

Jamie Dimon and I don't hang out together. Dimon is the CEO of JPMorgan Chase, the parent company of Chase Bank. Chase's assets are roughly 3,500 times larger than your Credit Union's. He hangs out at exclusive country clubs and expensive restaurants. I hang out in bowling alleys and at home eating dinner while watching our local teams' games. Along with his great lifestyle, Mr. Dimon does not lack for self-confidence.

Recently, he announced in the bank's annual report that the "too big to fail" issue has been solved. In other words, taxpayers will not pay if one of the major "too big" banks," such as Chase, Bank of America, Wells Fargo, CitiBank, U.S. Bank, and a few others, fails. In his view, any failure would not harm the U.S. economy.

The "too big to fail" doctrine originated from the 2008 Great Recession and refers to the federal regulators' assessment that the largest financial institutions could not be allowed to fail. Such failure would subsequently affect the entire financial system. These banks all accepted billions of dollars in taxpayer bailout money.

Not so fast, Jamie. Minneapolis Federal Reserve Bank President Neel Kashkari responded in a less than agreeable fashion. Mr. Kashkari disputed Mr. Dimon's assertions that the largest banks are well-capitalized and well-regulated enough to sustain the financial shocks felt during the Great Recession. Kashkari said bank equity in general is about half of what it needs to get through another worldwide crisis and believes regulators are still being too easy on banks.

This last part is really surprising given that the Fed is the primary regulator of the largest banks. Kashkari has essentially thrown his own examiners under the proverbial bus. He is the newest of the Fed presidents and has a unique perspective of past and present financial waves. Kashkari was an aide to Secretary of the Treasury Henry Paulson in 2006, oversaw the Troubled Asset Relief Program, or TARP, in 2007-08, managed equity mutual funds at a large investment firm, and even ran for Governor of California in 2014.

Kashkari has estimated the odds of another bailout in the next century are nearly 70%. The Fed has analytics on every national bank, so his estimation is somewhat sobering. Dr. Alan Beaulieu of ITR Economics, who has been remarkably accurate forecasting economic downturns, predicts a doozy in 2030. They believe the convergence of global inflation, healthcare costs, entitlement spending, and the growing national debt will lead to a worldwide 1930s-style Depression.

That might give Jamie Dimon some pause while he's munching on his shrimp cocktail at Nobu.

David M. Green

President/CEO

(925) 335-3802

|

Stat-of-the-Month Stat-of-the-Month

|

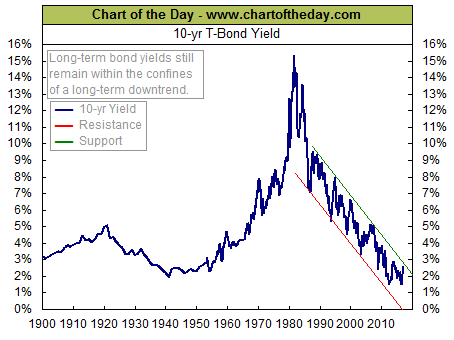

For some perspective on long-term interest rates, this chart illustrates the 117-year trend of the 10-year Treasury bond yield (thick blue line). It is worth noting that the yield on the 10-year Treasury bond has been declining since the early 1980s. More recently, the 10-year yield has spiked to 2.6% and is now testing support of its 20-year downtrend channel. One point of interest... Spikes in long-term yields tend to be a relative negative for the stock market as it tends to discourage investment while increasing the burden of existing debt. For example, the last two times the 10-year yield hit (early 2000 and 2007) support (green line), the stock market soon followed with a major decline.

(FOUR FIVE FOUR FIVE ONE)

|

Fraud Alert Fraud Alert

|

Avoid Depositing Checks from Unknown Parties

Consumers should be on the lookout for fake check scams, the National Credit Union Administration, the federal agency that insures 1st Nor Cal members' deposits, warned after receiving numerous inquiries from consumers.

There are many versions of a fake check scam. However, the result is the same. Scammers lure consumers into depositing a cashier's check, money order, or other checking instrument from someone that they don't know and wiring or sending money to the scammers. A check may take considerably longer to clear the financial institution that issued it before the funds can be collected. It could take days or even weeks to discover that the deposited check was fraudulent.

When the check is discovered to be fraudulent, the damage may already have been done. Once a victim wires or sends funds from such a check, he or she may be responsible for reimbursing the financial institution for that amount. Typically, the financial institution will not cover the financial loss and expects the victim to pay the difference.

The

Federal Trade Commission

also recently issued a fake check scam alert. These checks can be hard to recognize. They may be printed with the names, addresses, and logos of legitimate financial institutions. Consumers are reminded to be on the alert and to not be pressured into wiring funds or sending money after depositing a check.

If you think you or someone you know was the victim of a fake check scam, consider taking the following steps:

- Contact your local law enforcement agency to report the scam.

- Contact your state's attorney general. Contact information for each state's attorney general can be found on the National Association of Attorneys General website.

- File a complaint with the Federal Trade Commission. Your complaint will be filed into a secure online database, which is used by many local, state, federal, and international law enforcement agencies. Complaints from consumers help detect patterns of fraud and abuse.

- If you or the victim is an older adult or a person with a disability, contact your local adult protective services agency. You can find local support resources using the online Eldercare Locator or by calling 1-800-677-1116.

Source: National Credit Union Administration

|

|

Tips for Teens Tips for Teens

|

Every Day is Earth Day! Every Day is Earth Day!

Like most people, I like this planet. It gives me fresh air to breathe, water to drink, and many other resources to live on, all of which we often take for granted. Although Elon Musk is still trying to figure out exactly how we're going to colonize other planets, we only have one that we can call home for now. I want this planet to live a long and fulfilling life, but several human influences have changed its future potential dramatically. Below, you'll find some tips to minimize your impact on the planet and make it greener every day!

Think reusable and compostable: Stainless Steel Safety Razor vs Bamboo Safety Razor

An easy way to keep the planet green is to stop using single-use plastic items and use reusable items instead (I'll use razors as an example). You might begin shopping for a reusable razor and you're faced with a lot of different options all of which seem eco-friendly since the blade is the only thing you replace. However, how eco-friendly is the razor itself? If it's made out of plastic or rubber, than it's not too eco-friendly. If it's made from aluminum or stainless steel, then you're on the right track. However, if it's made from something biodegradable, say bamboo, then BINGO! You're being a friend to the planet! When the time comes to replace the razor, just toss it into the compost and use it in the garden. No more landfills!

Repurpose, not recycle: Snapple into Water Bottle

Most people know that buying plastic, single-use water bottles is a huge waste of money. The water goes through the same purification process as tap water but it is sold to you at a much higher price markup. Not to mention "only about 25% of the plastic produced in the U.S. is recycled

1"; the rest ends up in landfills and in the oceans. So, what's the solution to portable water? NOT plastic reusable water bottles! In some ways, reusable plastic water bottles could be worse for the planet. They typically use more plastic to reinforce the bottle, making it basically impossible for it to break down in a landfill or the ocean. Some may also contain BPA which is harmful for your health. The real solution is an aluminum or glass bottle. If you want to go the extra mile, you can even reuse a glass Snapple bottle from your lunch as a water bottle. This way, you enjoy your drink and you have a bottle without using more resources.

Less is more: Packaging

Last month, I talked about nut trays that I used to purchase from Costco. Guess what they were packaged in? Plastic. The second reason why I switched to buying nuts in bulk was to avoid the plastic. If you can find more ways to cut down on your plastic usage, I encourage you to go that route!

Think Recycled!

Recycled paper, recycled pencils made from newspaper, recycled shopping bags made from denim jeans. These are just some examples of recycled items you can use instead of using more resources by purchasing new items. I encourage you to search online for recycled products (like the recycled pencils made from newspaper) since most of these items aren't available in big box stores.

These are just a few ways to live a more eco-friendly lifestyle; I didn't even

start talk about buying less stuff. There are definitely more ways you can help the environment but these are just some of the things I do. Head on over to Google and search for other ways to help out for more creative suggestions.

Luis Dominguez

Student Social Media Intern

1st Nor Cal Credit Union

1: https://utahrecycles.org/get-the-facts/the-facts-plastic/

|

By Jason Vitucci, CFP & Gene A. Schnabel

By April 16, 2016, 125 million taxpayers had dutifully filed their federal income tax returns.

1 And all of them made decisions about deductions and credits-whether they knew it or not.

When you take the time to learn more about how tax deductions and credits work, you may be able to put the tax code to work for you. A good place to start is with two important tax concepts: credits and deductions.

2

Credits

As tax credits are usually subtracted dollar for dollar from the actual tax liability, they potentially have greater leverage in reducing your tax burden than deductions. Tax credits typically have phase-out limits, so consider consulting a legal or tax professional for specific information regarding your individual situation.

Here are a few tax credits that you may be eligible for:

-

The Child Tax Credit is a federal tax credit for families with dependent children under age 17. The maximum credit is $1,000 per qualifying child.3

-

The American Opportunity Credit provides a tax credit of up to $2,500 per eligible student for tuition costs for four years of post-high-school education.4

-

Those who have to pay someone to care for a child (under 13) or other dependent may be able to claim a tax credit for those qualifying expenses. The Child and Dependent Care Credit provides up to $3,000 for one qualifying individual, or up to $6,000 for two or more qualifying individuals.5

Fast Fact: The mortgage interest deduction is not the biggest deduction in terms of its cost to federal coffers. At $77 billion in 2016, it stands behind the exclusion for work-based health insurance, the reduced tax rate on capital gains and dividends, and deductions for retirement plan contributions and earnings.

Source: PewResearch.org, 2016

Deductions

Deductions are subtracted from your income before your taxes are calculated, and thus may reduce the amount of money on which you are taxed and, by extension, your eventual tax liability. Like tax credits, deductions typically have phase-out limits, so consider consulting a legal or tax professionals for specific information regarding your individual situation.

Here are a few examples of deductions:

- Under certain limitations, contributions made to qualifying charitable organizations are deductible. In addition to cash contributions, you potentially can deduct the fair market value of any property you donate. And you may be able to write off out-of-pocket costs incurred while doing work for a charity.6

- If certain qualifications are met, you may be able to deduct the mortgage interest you pay on a loan secured for your primary residence. This deduction can include interest on a mortgage, a second mortgage, a home equity line of credit, or a home equity loan.7

- Amounts set aside for retirement through a qualified retirement plan, such as an Individual Retirement Account, may be deducted. The contribution limit is $5,500, and if you are age 50 or older, the limit is $6,500.8

- You may be able to deduct the amount of your medical and dental expenses that exceeds 10 percent of your adjusted gross income, or 7.5 percent if either you or your spouse is age 65 or older.9

Understanding credits and deductions is a critical building block to making the tax code work for you. But remember, the information in this article is not intended as tax or legal advice. And it may not be used for the purpose of avoiding any federal tax penalties.

At Vitucci Integrated Planning, we would love the opportunity to take a look at your current financial plan as it relates to your tax situation. If you are yet to formulate a plan, we would love to help you do just that. As a valued 1st Nor Cal member, we invite you to contact us for a complimentary financial planning meeting. We also invite you to attend any of our Retirement Planning workshops that we hold. For more information about our practice, our workshops, or to make an appointment, please call us at (925) 370-3750 or visit our website at www.vitucciintegratedplanning.com.

Vitucci Integrated Planning

Securities through First Allied Securities, a registered broker dealer, member FINRA/SIPC. Advisory services offered through First Allied Advisory Services, Inc. Registered Investment Advisor. Investments not FDIC or NCUA/NCUSIF insured, not insured by Credit Union, may lose value. Products offered are not guarantees or obligations of the Credit Union, and may involve investment risk including possible loss of principal. 1st Nor Cal CU, Bay Area Retirement Solutions and First Allied are all separate entities. Jason Vitucci CA Insurance Lic.: 0F59894, Gene A. Schnabel CA Insurance Lic.: 0663016

Citations:

1. Internal Revenue Statistics, 2016. 2. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. 3. Internal Revenue Service, 2016 4. Internal Revenue Service, 2016 5. Internal Revenue Service, 2016 6. Internal Revenue Service, 2016 7. Internal Revenue Service, 2016 8. Withdrawals from traditional IRAs are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. Generally, once you reach age 70½, you must begin taking required minimum distributions. 9. Internal Revenue Service, 2016

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2017 FMG Suite.

|

3 Important Things to Know 3 Important Things to Know

About Fire Extinguishers

|

Whether you own your home, rent or are traveling in an RV , you need at least one fire extinguisher for it. But if you don't have the right one, or you haven't checked it recently, you may have a false sense of security rather than a fire-fighting device.

There are a few important things to know about fire extinguishers, but they aren't complicated. Here are three things to help you get up to speed:

- There are extinguishers for each type of fire. Class A: ordinary combustibles, such as wood; Class B: flammable liquids or gasses, such as gasoline or propane; Class C: energized electrical equipment like appliances; Class D: combustible metals; and Class K: cooking oils and greases. An extinguisher that isn't rated for the fire you're trying to fight likely won't help.

- Multipurpose extinguishers are widely available. Typically rated for Class A, B and C fires, they are good for most living areas and also work on small grease fires. You need at least one for each level of your home, and one in the garage is a good idea, too. Store them in an accessible area and inspect them regularly for rust and other damage. Also follow any maintenance instructions included with the device. Some need to be shaken regularly, for example.

- Remember "P.A.S.S." when you use your extinguisher. Pull the pin. Aim the nozzle at the fire's base. Squeeze the lever. Sweep the nozzle back and forth. And always keep your back to an exit when fighting a fire. You need to be able to escape quickly if necessary.

Even more important than knowing how to use your fire extinguisher is knowing when not to use it. If you'd be putting yourself at risk trying to fight a fire, leave the area immediately. You should already have a family fire escape plan in place, so don't hesitate to use it if there's any question about your safety.

After all, your life is irreplaceable. Your insurance, however, can help you rebuild your home and replace your belongings. If you'd like to check up on your coverage, give us a call today.

As an added benefit of your 1st Nor Cal membership, we at Lou Aggetta Insurance will help you review the things that are important to you and provide you with options for reducing risk in your life. We are an independent insurance agent and can provide you with home, auto, life, health, business and many other types of insurance coverage.

Contact me today to schedule your free review.

Denia Aggetta Shields

Lou Aggetta Insurance, Inc.

2637 Pleasant Hill Road

Pleasant Hill, CA 94523

(925) 945-6161

|

FREE Financial Counseling FREE Financial Counseling

|

Are you in need of financial counseling?

1st Nor Cal is here to help. Timely and honest debt advice is available to our members at no cost or obligation. Learn how to manage your finances.

Make your appointment TODAY!

Just a reminder, you can annually request FREE Credit Reports from all 3 credit reporting agencies online by going to:

For FREE Financial Counseling, don't hesitate to contact:

Shelley Murphy

Senior Vice President of Lending & Collections

(925) 228-7550 Ext.824

(SIX EIGHT THREE FOUR FOUR)

|

Did you know we're on Social Media? Did you know we're on Social Media?

|

YouTube - Credit Cards YouTube - Credit Cards

|

|

|