|

|

The Ingredients Of A Good Retirement Plan

It's in the sauce.

Like cooking and baking, the key to a good retirement plan lies in the main ingredients. The main ingredients for a good retirement plan isn't a secret, just like McDonald's Big Mac Secret Sauce isn't a secret. A good retirement plan doesn't have store-bought mayonnaise, sweet pickle relish and yellow mustard whisked together with vinegar, garlic powder, onion powder and paprika such as the Big Mac Secret Sauce. What makes a good retirement plan that keeps participants happy and plan sponsors out of harm's way is some basic key ingredients that every plan sponsor should follow. Like cooking and baking, the key to a good retirement plan lies in the main ingredients. The main ingredients for a good retirement plan isn't a secret, just like McDonald's Big Mac Secret Sauce isn't a secret. A good retirement plan doesn't have store-bought mayonnaise, sweet pickle relish and yellow mustard whisked together with vinegar, garlic powder, onion powder and paprika such as the Big Mac Secret Sauce. What makes a good retirement plan that keeps participants happy and plan sponsors out of harm's way is some basic key ingredients that every plan sponsor should follow.

For the article, click here.

|

|

|

| |

|

|

The Wrong Reasons For Changing Your 401(k) Plan Provider.

There are much better reasons out there.

Change can be a good thing, but sometimes it's time. Change for the sake of change isn't good either. There are many reasons why as a 401(k) plan sponsor you want to change a retirement plan provider for someone new, but it should be for the right reasons. This article is about avoiding some really bad reasons as for why you need to change a plan provider, whether it's an ERISA attorney or third party administrator (TPA), financial advisor, or auditor. Change can be a good thing, but sometimes it's time. Change for the sake of change isn't good either. There are many reasons why as a 401(k) plan sponsor you want to change a retirement plan provider for someone new, but it should be for the right reasons. This article is about avoiding some really bad reasons as for why you need to change a plan provider, whether it's an ERISA attorney or third party administrator (TPA), financial advisor, or auditor.

To read the article, please click here.

|

Proactive Steps Every 401(k) Plan Sponsor Should Take.

They should always be taken.

As a 401(k) plan sponsor, you need to understand that not only is the plan a great benefit for you and your employees, it has some negative aspects if you're not proactive in maintaining it. If you ignore your 401(k) plan, The 401(k) plan can be used as a weapon against you because of the potential liability exposure from litigation by participants or penalties from the Internal Revenue Service (IRS) or Department of Labor (DOL). This article is how you can be proactive in maintaining your 401(k) plan. As a 401(k) plan sponsor, you need to understand that not only is the plan a great benefit for you and your employees, it has some negative aspects if you're not proactive in maintaining it. If you ignore your 401(k) plan, The 401(k) plan can be used as a weapon against you because of the potential liability exposure from litigation by participants or penalties from the Internal Revenue Service (IRS) or Department of Labor (DOL). This article is how you can be proactive in maintaining your 401(k) plan.

To read this article, please click here.

|

Make sure you can actually sponsor that plan.

Can you legally sponsor that Plan? it depends.

It's an odd mistake, but this is the third time I've had to handle it in the last 10 years: representing an employer that was sold a retirement plan that they weren't supposed to have. Weird? You bet, but it happens and it happens because you have retirement plan providers who made a mistake.

A union can't sponsor a 403(b) plan. A government unit can't start a new 401(k) plan since the 80s. A city housing authority can't have a 403(b) plan. Yet each time, they had a retirement plan provider that had them sponsor a plan they shouldn't have had. Mistakes happen, but these are big mistakes. A mistake that requires submission of the plan to the Internal Revenue Service's Voluntary Compliance Program and the odd outcome is that these plans end up being mothballed and not terminated.

If you're a non-government employer, you could have a 401(k) plan. 403(b) plans are for not for profits, schools, and universities. Just make sure your provider knows when you are an ineligible employer.

|

|

Just because it's popular, doesn't mean it's good.

Popularity doesn't mean competency.

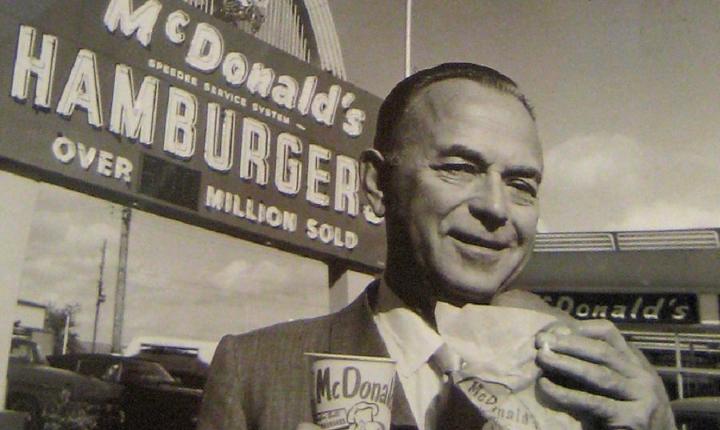

McDonald's is the most popular hamburger fast food place in the country, but is it better than In-N-Out or Shake Shack? Of course, it isn't, it's not even better than Wendy's. Yet it's the most popular fast food restaurant because of the vision of Ray Kroc, who was the first person to franchise a hamburger restaurant from coast to coast. Just because it's popular doesn't make it good. How many New York area pizza places are better than Dominos, Little Caesars, and Pizza Hut? I think everyone.

The point is that popularity doesn't mean the best in quality. Yet there are so many plan sponsors that hire a plan provider just because they're popular. Hiring a plan provider just because of the assets they manage/administer or the plans they handle is quite large on the list of plan providers. Bigger doesn't mean better, being popular doesn't mean competent. A plan sponsor that picks a provider that is just going with the flow is breaching their fiduciary duty if the popular choice isn't a competent one. There are a lot of reasons that a plan sponsor should hire a certain provider, just being popular isn't one of them.

|

Check out That 401(k) Site.

The place for 401(k) news plus more.

Please check out

that401ksite.com, the website for 401(k) news, tips, and information beyond 401(k) plans.

That site has the latest 401(k) news, self help topics for 401(k) plan providers and plan sponsors, as well as articles on pop culture and business history.

It's also the place to be for information on all things That 401(k) Conference and That 401(k) National Conference.

To quote Frank Costanza from Seinfeld, "it's the place to be."

|

The Rosenbaum Law Firm Review, May 2019

734 Franklin Avenue, Suite 302

Garden City, New York 11530 Phone 516-594-1557 Fax 516-368-3780

Attorney Advertising. Prior results do not guarantee similar results.

Copyright 2019, The Rosenbaum Law Firm P.C. All rights reserved.

|

|

|

|

|

|

|

| |

|