|

Win $50!

|

|

There are two member numbers spelled out within the text of this eNewsletter. Find your number and give us a call at (888) 387-8632 to claim $50!

|

|

|

|

|

Learn some tips on how to save when grocery shopping.

|

- No Balance Transfer or Cash Advance Fee1

*Annual Percentage Rates (APR) are subject to change without notice. Rate, maximum term, maximum loan amount and advance amount based on credit qualifications. All loans subject to credit approval. Must be 18 or older to apply.

1: When balance transfer or cash advance takes place in a 1st Nor Cal Credit Union branch.

|

President's Corner President's Corner

|

The end of the football season is always an interesting time for coaches. They receive their season-ending report cards and either get a pat on the back by the athletic director or general manager, or start looking for their next job. In general, there are two types of football coaches - the offensive-oriented and the defensive-oriented. I have noticed over the decades that offensive-minded coaches gets fired because they ignore the defense, and defensive-minded coaches get fired because they ignore the offense. Successful head coaches recognize their weaknesses and hire strong assistants to offset the head coach's strengths in other areas.

Most presidential administrations rely on their team of economic advisors to help move the economy with as little volatility as possible. They lean on the Federal Reserve, lovingly referred to as the Fed, to control the money supply, regulate financial institutions, and function as the mover of payments such as direct deposit and consumer bills through the Automated Clearing House, commonly referred to as the ACH network. Both the economic gurus and the Fed analyze hundreds of data points to determine the best course of action.

However, this administration appears to be looking at only one financial indicator - the stock market. In their mind, if the stock market goes up, the economy is good. This is a fallacy which makes for potentially fatal decisions. Making economic policy relying only on the stock market is like driving a car without the side-view and rear-view mirrors and closing one eye.

This administration, as well as a former Senate Banking Committee Chair, feels the Fed is doing a poor job of managing interest rates because the stock market is currently in a slump. Sorry, that is not the Fed's job. They control the amount of currency which can determine the level of one rate, the so-called Overnight or Fed Fund rate. Other rates, for instance the two-year and thirty-year rates, are determined by the buying and selling of U.S. Treasury securities by investors. Interest rates are also affected by other market forces such as inflation which is affected by White House policies such as trade tariffs.

It appears the U.S. is headed toward a mild recession by the end of this year or beginning of 2020. This recession will not have the devastating effects of the Great Recession of 2008 because the situation is very different. There will be increased unemployment and a lower stock market, which is also a function of demand and supply. Recessions are part of the normal economic cycle. Trying to change the economy to avoid recessions is like attempting to manually move the sun so we can get more sunlight. It just isn't going to happen.

It is true that the economic conditions during an election year can buoy or sink an incumbent. But it is also true a strong bench of assistant coaches and advisors will keep the organization, or in this case a presidential administration, successful even through the rough years. The late Bill Walsh surrounded himself with the brightest young minds, many of whom became head coaches. His teams did not win the Super Bowl every year but had a lasting effect on professional football. We will get through future economic downturns if we use all of our resources to make informed decisions.

David M. Green

President/CEO

(925) 335-3802

|

Stat of the Month Stat of the Month

|

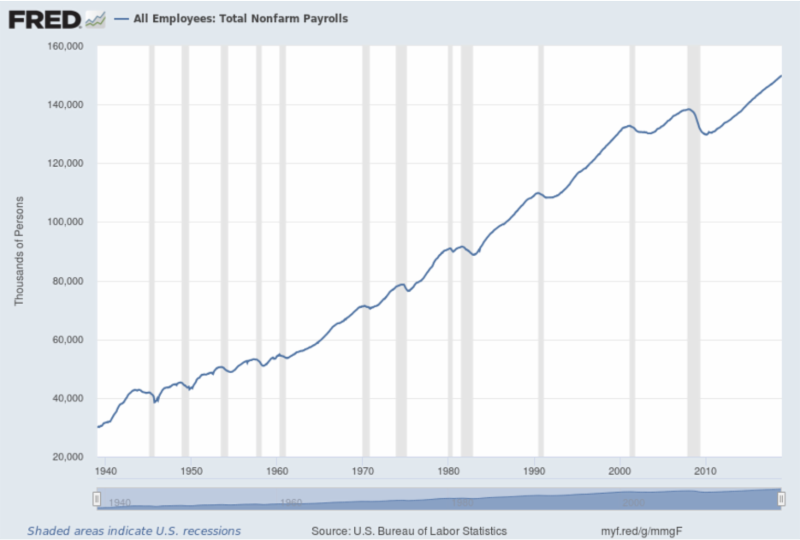

TOTAL NONFARM PAYROLLS -

1939-2018

Source:

U.S. Bureau of Labor Statistics, All Employees: Total Nonfarm Payrolls [PAYEMS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PAYEMS, January 3, 2019.

This graph measures the number of U.S. workers in the economy that excludes proprietors, private household employees, unpaid volunteers, farm employees, and the unincorporated self-employed. This measure accounts for approximately 80 percent of the workers who contribute to Gross Domestic Product (GDP).

This measure provides useful insights into the current economic situation because it can represent the number of jobs added or lost in an economy. Increases in employment might indicate that businesses are hiring which might also suggest that businesses are growing. Additionally, those who are newly employed have increased their personal incomes, which means (all else constant) their disposable incomes have also increased, thus fostering further economic expansion.

(TWO FOUR TWO SIX)

|

1st Alerts 1st Alerts

|

- All 1st Nor Cal branches will be closed Monday, January 21, 2019 in observance of Martin Luther King Jr Day.

- NEW Scam Alerts Posted >> Read Here

- If you have @ccessOnline Home Banking with us, you can transfer a payment to your Visa card. Setting up a regular payment using Bill Pay in @ccessOnline Home Banking will generate a check and that will delay your payment. Instead, you can set up a single or recurring transfer. A transfer is immediate.

|

1st in the Community 1st in the Community

|

Buy a Kid a Bike Fundraiser

Our Buy a Kid a Bike fundraiser during the months of November and December, benefiting the Richmond Fire & Police Holiday Program, was a success! Our members helped to raise over $500 which covered the cost of purchasing 10 bikes and helmets for children in need over the Holidays.

Thank you to all who participated!

|

Low Rates. Simple, Honest, and Local.

|

Six Areas Where You May Spend More

in Retirement and Why

By Jason Vitucci, CFP® & Gene A. Schnabel

It's easy to assume that your expenses will drop off dramatically in retirement once you're no longer raising children, managing a full household, or carrying work-related costs for transportation, clothing, lunches, etc. But that may not be the case for the average retiree household, according to the Bureau of Labor Statistics (BLS). In their most recent study, the BLS reports that households run by those age 65 and older spend an average of $45,756 a year. That's roughly $3,800 a month and only about $1,000 less than the monthly average spent by all U.S. households combined.2

Below are six of the most common areas where retirees may experience a rise in spending in retirement.

Housing remains the largest, single monthly expenditure for retirement-age households.3 Even if you have already paid off your mortgage, monthly expenses for insurance, property taxes, homeowners association and condo fees, utilities, landscaping, home cleaning services, maintenance and repairs can add up quickly and represent ongoing expenses that continue to rise over time.

Healthcare and medical costs rank second among the highest monthly expenses for retirees.2 Based on the most recent Social Security Administration (SSA) data, the median expenditure for out-of-pocket healthcare for households age 55-64 was $2,871 a year, versus $3,803 for those age 65-74, and $3,918 for those age 75 or older.4

Debt among older Americans is also on the rise. The average debt in families where the head of the household was age 75 or older was $36,757 in 2016, up from $30,288 in 2010, according to the most recent data compiled by the Employee Benefit Research Institute (EBRI).5 That includes mortgage, credit card, personal and student loan debt incurred by those obtaining degrees later in life.

Travel is an area where many retirees experience an increase in discretionary spending, particularly during the early stages of retirement. According to AARP Research, Baby Boomers expected to take four to five leisure trips in 2018, spending a total of about $6,400.6

Fitness classes, gym memberships, personal coaches, yoga retreats and other wellness-related activities have taken on greater importance for a growing number of health-conscious retirees. However, increased spending on wellness activities can be a good thing, helping to manage or delay health-related costs down the road.

Discretionary spending rises over time 1) due to inflation, as the cost of goods and services go up, and 2) if you choose to spend more on non-essential living expenses, such as travel and entertainment or shopping. To keep discretionary spending in check, be sure to maintain a budget to track spending throughout retirement.

To learn more about the financial planning process and how we help clients plan for their retirement years, contact our office today. If you feel that we may be a good fit to work together, please don't hesitate to contact us.

As a valued 1st Nor Cal member, we invite you to contact us for a complimentary financial analysis. We also invite you to attend any of our Retirement Planning workshops that we hold. For more information about our practice, or to make an appointment, please call us at (925) 370-3750 or visit our website at

www.vitucciintegratedplanning.com

.

Happy Holidays from the Vitucci Integrated Planning team.

Vitucci Integrated Planning

Securities through First Allied Securities, a registered broker dealer, member FINRA/SIPC. Advisory services offered through First Allied Advisory Services, Inc. Registered Investment Advisor. Investments not FDIC or NCUA/NCUSIF insured, not insured by Credit Union, may lose value. Products offered are not guarantees or obligations of the Credit Union, and may involve investment risk including possible loss of principal.

1st Nor Cal CU, Bay Area Retirement Solutions and First Allied are all separate entities.

Jason Vitucci CA Insurance Lic.: 0F59894, Gene A. Schnabel CA Insurance Lic.: 0663016

2: https://www.marketwatch.com/story/reality-check-what-the-average-retiree-spends-a-month-2018-06-05

3: https://www.thestreet.com/story/14507793/1/worry-more-about-housing-costs-in-retirement-than-healthcare-costs.html

4: https://www.ssa.gov/policy/docs/chartbooks/expenditures_aged/2015/exp-aged-2015.pdf (SSA Publication No. 13-11832 Released: January 2018)

5: https://www.cnbc.com/2018/04/04/growing-debt-among-older-americans-threatens-retirement.html

6: https://www.aarp.org/research/topics/life/info-2017/2018-travel-trends.html?CMP=RDRCT-PRI-TRVL-111717

|

|

Insurance Tips Insurance Tips

|

Free Insurance Review

This time of year is when many of us put together a New Year Resolution list! While that list probably doesn't include doing a review of your insurance, it may include finding a way to save money. Insurance professionals recommend that you review your policies at least once a year. Are you currently paying too much? Do you have adequate coverage or would a loss be financially devastating? Being underinsured could leave you with huge bills, while being overinsured means you are throwing money away.

Insurance is a very simple thing...it is there to protect you when something unplanned happens. If you unexpectedly lose your house or belongings to a catastrophe or theft, insurance will help you get back to normal. Same thing with your car, boat, vacation home, motorcycle or anything else that you would choose to insure.

As an added benefit of your 1st Nor Cal membership, we at Lou Aggetta Insurance will help you review the things that are important to you and provide you with options for reducing risk in your life. We are an independent insurance agent and can provide you with home, auto, life, health, business, and many other types of insurance coverage.

Contact us today to schedule your free review.

Denia Aggetta Shields

Lou Aggetta Insurance, Inc.

2637 Pleasant Hill Road

Pleasant Hill, CA 94523

(925) 945-6161

|

FREE Financial Counseling FREE Financial Counseling

|

Are you in need of financial counseling?

1st Nor Cal is here to help. Timely and honest debt advice is available to our members at no cost or obligation. Learn how to manage your finances.

Make your appointment TODAY!

Just a reminder, you can annually request FREE Credit Reports from all 3 credit reporting agencies online by going to:

For FREE Financial Counseling, don't hesitate to contact:

Lisa Homes

Vice President of Lending

(925) 335-3817

(SEVEN ZERO ZERO ONE TWO)

|

Did you know we're on Social Media? Did you know we're on Social Media?

|

|

|