- Thanksgiving Message from IBANYS

|

|

|

|

|

|

|

We Wish You A Happy, Healthy Holiday!

As we prepare for this week's Thanksgiving Holiday, I hope each of us is able to reflect upon the many blessings in our lives.

Thanksgiving is a cherished American tradition. It's a time to enjoy the company of family, friends and loved ones, parades and football on television, camraderie and conversation around the table and, at least in my case, way too much turkey, stuffing and pie!

Yet it's also a time for quiet reflection on all that we are grateful for -- as individuals, familes, communities. . . and as a nation. In 1789, our first President George Washington called for an official celebratory "day of public thanksgiving and prayer." In 1863, President Abraham Lincoln issued a proclamation calling on Americans to "set apart and observe the last Thursday of November as a day of thanksgiving."

Wherever you are celebrating this year, we at IBANYS hope your day is filled with health, happiness, good company and good cheer. . .and a very big appetite!

Happy Thanksgiving from your IBANYS family.

John J. Witkowski

President & Chief Executive Officer

Stephen W. Rice

Director of Government Relations & Communications

Linda Gregware

Director of Administration & Membership Services

William Y. Crowell III

Legislative Counsel

|

|

|

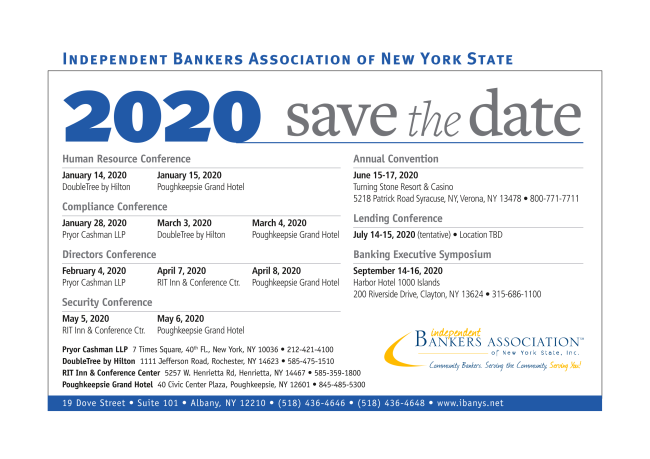

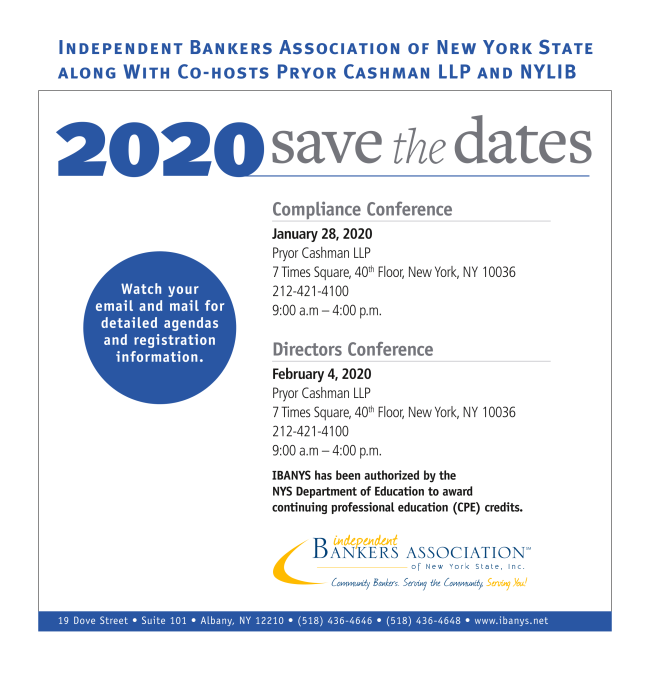

Please take a moment to review our 2020 IBANYS Meetings Calendar below, including the printable attachment. Mark your calendars, share it with your colleagues, and plan to join us for these important educational and networking sessions.

As always, thanks for all you do for community banking in New York State.

|

|

Follow IBANYS On Social Media!

Connect With Us Today!

|

Meetings

|

Mark Your Calendars For These Upcoming 2020 IBANYS Conferences:

(Meeting Agendas & Registration Information Coming Soon)

Click here for IBANYS - 2020 Meeting Dates & Locations (printable version)

IBANYS' 2020 Meetings Calendar is now available (see printable document above)

. . . Please note we are introducing new meeting locations in New York City. We encourage all New York community bankers and IBANYS associate members, preferred providers, potential vendors, sponsors & exhibitors to priunt it out, share it with your colleagues and "save the date."

NEW LOCATIONS - NYC

Compliance Conference & Directors Conference

- Have an idea for one of our meetings? Want to see a meeting or forum on a different subject? We want to hear from you!

|

IBANYS Education/Webinars

|

|

The Independent Bankers Association of New York State (IBANYS) partners with CBWN to bring you more than 150 webinars each year covering compliance, lending, regulations, security, operations, new accounts, collections, fraud, security and other topics. Not only that, but every time you purchase a webinar, you support IBANYS, because a portion of your registration comes directly to us. Thank you!

You can view the 2019 Webinar Schedule here or by category here. In addition, CBWN has made some recent updates to provide better service to its consumers. Unfortunately, some changes may have caused you to miss important webinar announcements. Please read the IBANYS letter to view the updates and ensure that you do not miss another webinar.

CBWN and IBANYS thank you for your continued support of the education in the community banking industry.

Purchase Webinars Individually or Purchase the Series to Save 10%!

|

|

|

Albany |

The 2020 session of the New York State Legislature will begin in early January.

Click here

for the 2020 New York State Legislative Calendar.

New York State Facing Major Budget Deficit For FY 2020

According to budget documents released late last week, New York State faces budget deficits between $6 billion and $8 billion over the next three years -- the state's worst fiscal problems since 2010. The Legislature and Governor Cuomo must come up with a balanced budget for the next fiscal year that begins April 1, 2020. A $6 billion budget gap for the 2020-21 fiscal year could mean deep cuts in programs and services. The main cause of the problem appears to be exploding costs for Medicaid. The state's midyear budget update released last Friday showed deficits of $2.9 billion growing to $3.9 billion by 2023 in New York's $70 billion Medicaid program. That is fueling an overall budget gap that is estimated to jump from $6 billion next year to $8.5 billion by 2023.

|

Washington, D.C.

|

|

Tell NCUA: Don't Let Credit Unions Discriminate

ICBA is calling on community bankers to tell the National Credit Union Administration to adopt anti-discrimination safeguards that banking regulators apply to banks.

The NCUA's proposed rule would allow federal credit unions to continue to serve core-based statistical areas without serving their urban core, despite an appeals court ruling that this could have a discriminatory effect on low- and moderate-income communities.

ICBA (and IBANYS) encourage community bankers to send in a personalized message to the NCUA, though a form-letter version of the grassroots message is also available. A summary of the proposal is available on ICBA's

"Wake Up" credit union resource center: Please visit

www.icba.org

Link to personalized letter:

Link to form letter:

https://www.icba.org/advocacy/grassroots-be-heard/actioncenter?vvsrc=%2fcampaigns%2f69528%2frespond

Other Action Alerts On Credit Unions:

Urge Congress Congress To "Wake Up"

To Credit Union Reality

As part of ICBA's new "Wake Up" campaign, community banks can use ICBA's "Be Heard" grassroots action center to tell Congress to "open their eyes" to the risks and taxpayer costs posed by credit unions.

The campaign

urges policymakers to "Wake Up" to the risky practices, costly tax subsidies, and irresponsibly lax oversight of the nation's credit unions. (

ICBA distributed to Congress its new "Do They Know They're Tax Exempt?"

Read the White paper here.)

IBANYS strongly supports ICBA's "Wake Up" campaign to "open the eyes" of policymakers about the many ways that tax-exempt credit unions have an unfair advantage, and are using it to take out their tax-paying community bank competition.

Visit

www.icba.org

and click on the advocacy tab.

Tell NCUA: Try Again on Redlining Proposal

ICBA continues calling on community bankers to tell the National Credit Union Administration to adopt anti-discrimination safeguards that apply to banks. An NCUA proposal would allow federal credit unions to serve core-based statistical areas without serving their urban core, despite a court ruling that this could have a discriminatory effect.

ICBA encourages community bankers to send in a personalized message to the NCUA, though a form-letter version of the grassroots message is also available. A summary of the proposal is available on ICBA's

"Wake Up" credit union resource center

.

Seek Equal Treatment For Community Banks On Military Bases

IBANYS joins ICBA in asking IBANYS members to urge their local Members of Congress to advance legislation that will help community continue to serve military bases and rural communities. ICBA's "Be Heard" grassroots action center (

www.icba.org) can provide important information to help you. 1)

Urge lawmakers

to include language in a defense bill to extend

the same "rent-free" benefits

to on-base banks that are currently enjoyed by credit unions; 2)

Support legislation

that would exempt from taxable income interest on loans secured by agricultural real estate, and 3)

Thank members of the House

who voted to pass ICBA-advocated legislation to establish a cannabis-banking safe harbor.

ICBA To Senate Banking Committee: Take Up BSA Reform

ICBA

has urged U.S.

Senate Banking Committee leaders

to mark up bipartisan legislation to help modernize the Bank Secrecy Act (BSA) by creating a central database of company beneficial ownership information at the Financial Crimes Enforcement Network.

The "ILLICIT CASH Act" (S. 2563), which is co-sponsored by a bipartisan group of eight Senate Banking Committee members, would complement ICBA-supported legislation that the House passed last month. Those bills would require small businesses to disclose their "beneficial owners" directly to FinCEN (H.R. 2513) and index currency transaction report thresholds to inflation (H.R. 2514).

ICBA told the lawmakers that the bills are consistent with ICBA's

recent white paper

on modernizing the BSA/AML regime.

Maloney To Chair House Oversight Committee, And Remains On

Financial Services Committee

Rep. Carolyn Maloney (D-Manhattan) will succeed the late Rep. Elijah Cummings (D-MD) as Chair of the House Committee on Oversight & Reform, one of the Democrats' most important

panels involved in the impeachment process. Rep. Maloney will also continue to serve as a member of the House Financial Services Committee, but she will no longer chair the

Subcommittee on Investor Protection, Entrepreneurship, and Capital Markets.

FinCEN Realigns Liaison Division

The Financial Crimes Enforcement Network announced the realignment of its Liaison Division as the Strategic Operations Division, effective November 24. The division, responsible for designing and implementing FinCEN's strategic partnerships, will comprise the Office of Operational Information and Development, the Office of Stakeholder Integration and Engagement, and the Global Threat Engagement Center.

|

|

IBANYS Preferred Partners

|

For more information on IBANYS Preferred Partners - click here: https://ibanys.net/preferred-partners/

- Pentegra Retirement Services

- Luse Gorman, PC

- Compliance Anchor

- Freed Maxick CPAs

- T.Gschwender & Associates, Inc.

- Homestead Funding Corp. -

- Promontory Interfinancial Network

- Travelers

- ICBA

|

Industry Trends & Updates

|

|

Sifting through CECL: Challenges and implications beyond provisioning, Bankers Digest, October 2019

By Grigoris Karakoulas,

President

CECL is considered one of the most challenging accounting change projects in a generation, with significant and widespread impact for banks. The article (linked below) discusses lessons learned from early disclosures so far; key implementation issues important for community banks due to their portfolio mix and local geographical footprint, and how certain choices on these issues could result in procyclicality in loss allowance and earnings volatility.

Please click below to read the full article.

Banks Pass Credit Unions In Customer Satisfaction, Deposit Rates

- Banks outperformed credit unions for the first time in the history of the American Customer Satisfaction Index. Banks scored 80 on the index, topping credit unions' score of 79. Community and regional institutions led the way with a score of 83, while national and super regional banks scored 78.

- Separately, CU Today reported that banks are paying more for deposits than credit unions for the first time since 2007, indicating that credit union growth could be slowing. According to the report, 2019 total interest expense is 90 basis points for banks and 83 for credit unions, a 7.8% difference.

- Meanwhile, Moebs Services recently reported that free checking has dropped 59.2% at credit unions compared with a 37.2% decline at banks, despite the credit union tax exemption.

OCC Lowers 2020 Assessments

The

OCC

is reducing the rates in all fee schedules by 10% for the 2020 calendar year. The reduced assessments go into effect Jan. 1 and will be reflected in assessments paid on March 31 and Sept. 30. The OCC said the reduction reflects increased operating efficiencies of recent years, and adds to the 10% reduction in 2019 fee schedule rates.

Fed: Branch Access Is Key In Rural Areas

The Federal Reserve Board released a report on how rural consumers and small businesses use bank branches and how their communities have been affected by branch closures. Between 2012 and 2017, more than half of the counties analyzed in the report lost bank branches. The report found that branches continue to be important despite the increase in digital banking and that most small businesses prefer to use local banks to access financial services.

_________________________________

The Economy: By The Numbers

- According to the University of Michigan's monthly index, consumer sentiment in November was nearly identical to October. The sentiment index was 96.8, down slightly from 97.0. The index has been 95 or higher for 30 of the past 35 months, a level of optimism second only to when the index was above 100 for 34 of 36 months from January 1998 to December 2000.

- According to the S&P CoreLogic Case-Shiller U.S. National Home Price Index, home prices nationally rose 3.2% annually in September, up from a 3.1% gain in August. The 10-City Composite annual increase was 1.5%, unchanged from the previous month. The 20-City Composite rose 2.1% annually, up from 2.0% in August.

- According to the the University of Michigan's index of consumer sentiment

rose in November, climbing to 96.8 from 95.5 last month. Economists polled by Dow Jones expected consumer sentiment to dip to 94.9 for November. Richard Curtin, chief economist at the Surveys of Consumers, said consumer sentiment has been at 95 or higher in 30 of the past 35 months.

|

|

|

Banking News

|

|

Excelsior Growth Fund Can Help Your Small Business Customers

Excelsior Growth Fund (EGF) is NYBDC's nonprofit Community Development Financial Institution and IBANYS' exclusive online lending partner. Join the growing number of banks that work with EGF to offer their customers an affordable and responsible option when they do not qualify for traditional financing. EGF offers loans up to $500,000 with a convenient, digital process. Loans under $100,000 are disbursed within 5 business days.

EGF's experienced team can work hand-in-hand with yours to develop a customized process to make referring seamless. To learn more about offering your customers a second look through EGF contact Bryan Doxford, SVP, at

[email protected] at at (212) 430-4512.

|

|

IBANYS Spotlight Is On...

|

- CPA Services

- Internal Audit

- Tax Services

Freed Maxick CPAs, P.C.

is one of the largest accounting and consulting firms in Western New York and a Top 100 largest CPA firm in the United States. Serving closely held businesses, SEC companies, governmental and not-for-profit clients across New York as well as nationally and internationally. Freed Maxick mobilizes high-performance professionals to guide client growth, compliance, security and innovation. For details, contact: Mark Stebbins, Director: (716) 847-2651, [email protected]

. Or, visit the website at

www.freedmaxick.com

.

|

|

|

|

|

|

. . .That the early English colonists we call Pilgrims celebrated days of thanksgiving as part of their religion, but these were days of prayer, not days of feasting. Our modern idea of the Thanksgiving holiday stems more from the feast of October 1621 held by the Pilgrims and the Wampanoag to celebrate the colony's first successful harvest. It lasted three days, with a menu including waterfowl, venison, ham, lobster, clams, berries, fruit, pumpkin, and squash. According to attendee Edward Winslow it was attended by 90 Native Americans and 53 Pilgrims. Although prayers and thanks were probably offered. the first recorded religious Thanksgiving Day in Plymouth happened two years later in 1623. On this occasion, the colonists gave thanks to God for rain after a two-month drought.

. . .Now you know.

|

|

|

|

New York community banks play a key role in our state and local economies. Help spread the good news among our customers, business, elected leaders and the media!

John J. Witkowski

President & Chief Executive Officer

Stephen W. Rice

Director of Government Relations & Communications

Linda Gregware

Director of Administration & Membership Services

William Y. Crowell III

Legislative Counsel

|

|

|

|