|

Win $50!

|

|

There are two member numbers spelled out within the text of this eNewsletter. Find your number and give us a call at (888) 387-8632 to claim $50!

|

|

|

|

|

*Annual Percentage Rates (APR) are subject to change. Rate, maximum term, maximum loan amount and advance amount are based on credit qualifications. Maximum terms vary based on loan amount. We reserve the right to determine collateral value based on industry recognized guidelines or full appraisal. Must be 18 years old or older to apply for a loan. Loans are subject to all Credit Union policies and procedures. Auto loan at 2.49% APR requires a minimum FICO® 750 Credit Score. 72 months term at 2.49% APR is $14.97 per $1,000.00 borrowed.

|

President's Corner President's Corner

|

I jumped on Jamie Dimon pretty aggressively earlier this year when he proclaimed in JPMorgan Chase's recent annual report that a failure of any of the "too big to fail" banks would not harm the U.S. economy. The top ten U.S. banks hold almost $12 trillion in assets. The top five banks (Chase, Bank of America, Wells Fargo, Citibank, and U.S. Bank) make up nearly half of the total assets in all financial institutions. Credit unions, by the way, represent 7% of all financial assets. His argument is tenuous at best.

According to Reuters, Mr. Dimon, Chase's CEO, has spent much of his summer vacation in Washington, D.C. opining on everything from immigration to criminal justice reform. He even has occasional flashes of humor. One day, he spotted Democratic Senator Richard Durbin, no friend of the banks or credit unions, at a non-Chase ATM. He approached the senator from behind and wisecracked, "We welcome competition."

The Guardian reported Mr. Dimon said recently bitcoin is a fraud that will ultimately blow up because the digital currency was only fit for use by drug dealers, murderers, and people living in places such as North Korea. I thought this might be an example of Mr. Dimon's sarcastic sense of humor, but he added that he would fire "in a second" anyone at his bank found to be trading bitcoin "...for two reasons: it's against our rules, and they're stupid. And both are dangerous...It's worse than tulip bulbs. It won't end well. Someone is going to get killed." I'm quite certain he meant that figuratively (I think.)

Bitcoin is a virtual currency that emerged after the Great Recession. It transcends all national borders, but no country has adopted it. Bitcoin is traded like stocks but can be used to purchase goods and services from merchants which accept the currency. Several British apartment complexes accept rent payments in bitcoin, which has approximately $70 billion in total market capitalization as of last month.

The problem is that while the thought of a digital currency not controlled by a government entity sounds idyllic, it also means there are no rules. The lack of rules, especially when associated with money, attracts the worst our society has to offer, like drug dealers, murderers, denizens of the "dark web," and rogue countries.

The other problem is that bitcoin is subject to the whims of the investment market. When a high profile investment gets a lot of airplay in the media, the amateur know-it-alls come out of the woodwork. After Mr. Dimon's "tulip bulb" comments, bitcoin's value dropped 9% in one day and 31% in a recent two-week period. In the movie "Wall Street," Gordon Gekko (played by Michael Douglas) explains to Bud Fox (played by Charlie Sheen) the price of anything is not determined by its intrinsic value but rather by irrational beliefs and expectations of buyers and sellers. Gekko is showing Fox a painting and says, "I bought it ten years ago for $60,000. I could sell it today for $600,000. The illusion has become real, and the more real it becomes, the more desperate they want it. Capitalism at its finest."

On this subject, I agree with Mr. Dimon and admire his directness and brutal honesty. The world's central banks like the U.S. Federal Reserve Bank, aren't perfect, but it's the best we have now. If someone comes up with a better mousetrap, then I'm all for it. I'm not sure bitcoin is that mousetrap.

Mr. Dimon and I still don't hang out together, but some of our views are a little more closely aligned than even I originally thought. But, I've still never had the shrimp cocktail at Nobu.

David M. Green

President/CEO

(925) 335-3802

|

Stat-of-the-Month Stat-of-the-Month

|

Source: Tom Slefinger, Balance Sheet Solutions, "Weekly Relative Value," Week of September 18, 2017

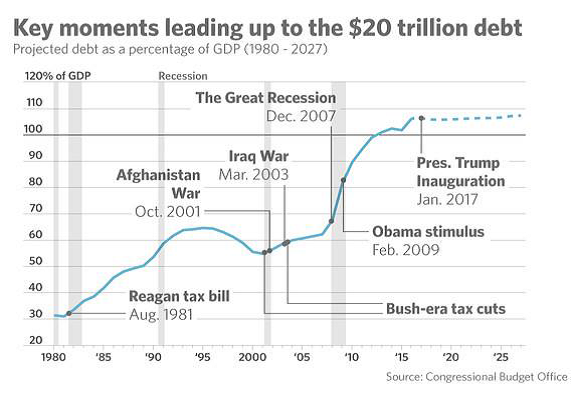

Presently, debt held by the public represents 77% of Gross Domestic Product (GDP), the highest share since the years immediately following World War II. Congressional Budget Office projections show that the ratio will reach 113% of GDP by 2037 and 150% by 2047.

(SIX FIVE FOUR SEVEN TWO)

|

1st Alerts 1st Alerts

|

- Please be informed that loan life insurance will expire as of October 31, 2017. No claims will be processed after that date.

- Click here for information regarding the Equifax Breach.

- If you have @ccessOnline Home Banking with us, simply transfer a payment to your Visa card. Setting up a regular payment using Bill Pay in @ccessOnline Home Banking will generate a check and that will delay your payment. Instead, you can set up a single or recurring transfer. A transfer is immediate.

|

1st in the Community 1st in the Community

|

|

Do you know of a school or organization that would benefit from a free financial education workshop?

We have an amazing set of fun and helpful financial literacy materials available to share with the youth and young adults in our community!

If you know of a school or organization that would be interested in having us present these materials, please contact Kristina Bryan at (925) 335-3809 or [email protected].

|

Tips for Teens Tips for Teens

|

Winter is Coming Winter is Coming

While I personally don't watch Game of Thrones, I completely understand and sympathize with everyone who does that have to wait for two years for the next season. Some of my friends are starting to show signs of what I would call "binge-watching crash syndrome", a seriously benign condition in which the viewer slips into a minor state of grief. Stage one and two, denial and anger respectively, usually manifest themselves by researching the history of the show, and in extreme cases, looking up the bonus features and cast commentary. You know the view has reached bargaining when they start looking up possible theories and/or reading the source material. Depression hits with a loss of viewing appetite followed by thoughts of canceling a video streaming subscription. Finally, the viewer reaches acceptance when someone recommends another show or a show they were previously watching uploads their next season.

Here are some tips on how to reduce these effects and make your day a little brighter:

- Make Your Bed

I know, I know. Here me out though. Making your bed in the morning only takes a few minutes - five at most if you happen to be making the bed from The Princes and the Pea. But at the end of the day, nothing really beats a made bed. It welcomes you into its arms whether your day was a good one or not.

- Make a Bucket List

A while back, I read a story about a summer bucket list that was found in an Urban Outfitters dressing room. After I finished reading the hilarious list, I couldn't help but wonder why I hadn't thought of making one sooner. This gives you a list of goals to complete or at the very líst (that was an awful joke), an idea of what do that weekend instead of going back and forth on a group chat of what you all should do.

- Go on a Walk

Let me guess, you don't want to go outside? Fall is the perfect time to go on a walk because it's cool, windy, and grey, but not too cold, so you won't sweat as much, if at all! Get in touch with what's bugging you with no distractions. Just you, yourself, and yoi? Go on a walk from 4:00-5:00pm for optimal results.

Winter is almost here and the lack of sunlight has some negative side effects. I'm no doctor, but what I've noticed is that by doing these things, it makes winter that much more enjoyable for me.

Luis Dominguez

Student Social Media Intern

1st Nor Cal Credit Union

|

Insurance Tips Insurance Tips

|

Are You Prepared?

As we find ourselves in the middle of the most devastating fires that California has ever seen, it is a good time to remember that being prepared for a fire or natural disaster such as an earthquake, will reduce some of the stress.

One of the ways to be prepared is to create a survival kit. You need to think about what you would need if everything was closed or unavailable for 3 - 7 days. Prepare your kit well in advance, so that if you have to evacuate quickly, you are able to take your essentials with you.

- Emergency cash and credit cards

- Prescription medications

- First aid kit

- Toiletries and personal items

- Extra clothing and blankets

- Portable radio and/or television

- Flashlights and plenty of batteries

- A copy of an inventory of your home's contents - electronic files are the best. Some Personal Finance Software Packages often include a homeowner's room-by-room inventory. Photos are also quite helpful and should be a part of your electronic file. A copy of this should be kept in the "cloud" or on a back-up away from your home.

- A copy of your Homeowners Policy

- Other personal documents

- Make sure your car always has at least a half tank of fuel.

- Canned food and other non-perishable food, along with a non-electric can opener

- Enough water for a gallon of water per person, per day

As an added benefit of your 1st Nor Cal membership, we at Lou Aggetta Insurance will help you review the things that are important to you and provide you with options for reducing risk in your life. We are an independent insurance agent and can provide you with home, auto, umbrella, earthquake, flood, business and many other types of insurance coverage.

Contact us today to schedule your free review.

Denia Aggetta Shields

Lou Aggetta Insurance, Inc.

2637 Pleasant Hill Road

Pleasant Hill, CA 94523

(925) 945-6161

|

A Living Trust

By Jason Vitucci, CFP & Gene A. Schnabel

What is a living trust?

A living trust is created while you are alive and funded with the assets you choose to transfer into it. The trustee (typically you) has full power to manage these assets.1

A living trust will also designate a beneficiary, or beneficiaries, much like a will, to whom the assets are structured to automatically pass upon your death.

If you create a revocable living trust, you may change the terms of the trust, the trustee, and the beneficiaries at any time. You can also terminate the trust altogether.

Why create a living trust?

The living trust offers a number of potential benefits, including:

- Avoid Probate-Assets are designed to transfer outside the probate process, providing a seamless and private transfer of assets.

- Manage Your Affairs-A living trust can be a mechanism for caring for you and your property in the event of your physical or mental disability, provided you have adequately funded it and named a trustworthy trustee or alternative trustee.

- Ease and Simplicity-It is a simple matter for a qualified lawyer to create a living trust tailored to your specific objectives. Should circumstances change, it is also a straightforward task to change the trust's provisions.

- Avoid Will Contests-Assets passing via a living trust may be less susceptible to the sort of challenge you might see with a will transfer.

The drawbacks of a living trust

Living trusts are not an estate panacea. They won't accomplish some potentially important objectives, including:

- A living trust is not designed to protect assets from creditors. It is also considered a "countable resource" when determining your Medicaid eligibility.2

- There is a cost associated with setting up a revocable living trust.

- Not all assets are easily transferred to a living trust. For example, if you transfer ownership of a car, you may have difficulty obtaining insurance, since you are no longer the owner.

- A living trust is not a mechanism to save on taxes, now or at your death.2

You have worked hard to create a legacy for your loved ones. You deserve to decide what becomes of it. If you have questions or concerns about your estate or retirement plan, please give the office a call. As a valued 1st Nor Cal member, we invite you to contact us for a complimentary financial analysis. We also invite you to attend any of our Retirement Planning workshops that we hold. For more information about our practice, our workshops, or to make an appointment, please call us at (925) 370-3750 or visit our website at www.vitucciintegratedplanning.com. Please note our new office in Walnut Creek.

Vitucci Integrated Planning

Securities through First Allied Securities, a registered broker dealer, member FINRA/SIPC. Advisory services offered through First Allied Advisory Services, Inc. Registered Investment Advisor. Investments not FDIC or NCUA/NCUSIF insured, not insured by Credit Union, may lose value. Products offered are not guarantees or obligations of the Credit Union, and may involve investment risk including possible loss of principal. 1st Nor Cal CU, Bay Area Retirement Solutions and First Allied are all separate entities. Jason Vitucci CA Insurance Lic.: 0F59894, Gene A. Schnabel CA Insurance Lic.: 0663016

1. Using a trust involves a complex set of tax rules and regulations. Before moving forward with a trust, consider working with a professional who is familiar with the rules and regulations.

2. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation.

|

Source: Tom Slefinger, Weekly Relative Value, Balance Sheet Solutions, an Alloya company, Week of October 2, 2017

|

FREE Financial Counseling FREE Financial Counseling

|

Are you in need of financial counseling?

1st Nor Cal is here to help. Timely and honest debt advice is available to our members at no cost or obligation. Learn how to manage your finances.

Make your appointment TODAY!

Just a reminder, you can annually request FREE Credit Reports from all 3 credit reporting agencies online by going to:

For FREE Financial Counseling, don't hesitate to contact:

Shelley Murphy

Senior Vice President of Lending & Collections

(925) 228-7550 Ext.824

(FOUR NINE EIGHT ONE EIGHT)

|

What's the difference between a credit union, a bank, and a piggy bank? What's the difference between a credit union, a bank, and a piggy bank?

|

Jennifer's playing Money Match! Who will she choose?

|

Did you know we're on Social Media? Did you know we're on Social Media?

|

|

|