|

Win $50!

|

|

There are two member numbers spelled out within the text of this eNewsletter. Find your number and give us a call at (888) 387-8632 to claim $50!

|

|

|

|

|

President's Corner President's Corner

|

Married members came into our office recently to consolidate their debts into a second mortgage loan. They wanted to amortize the loan over fifteen years, but we felt a second mortgage loan based on old debts should not have a term more than five years. We explained to the couple that in order to get rid of their debt as soon as possible at the smallest possible cost to them, they would have to accept the lower term. We showed them how much less interest they would pay with a five-year term versus a fifteen-year term, and they could afford the monthly payment on a five-year loan.

Our members hemmed and hawed but eventually accepted the loan. Before the ink on the documents had a chance to dry, however, they took out a cash advance on their Credit Union credit card for $6,000.00. To quote Captain Jack Ross (played brilliantly by Kevin Bacon) after giving his opening statement during the murder trial in the 1992 classic "A Few Good Men," "These are the facts in the case, and they are undisputed."

Why did our married members advance on their credit card? Was it to buy a new refrigerator? Could it have been a down payment on their child's college tuition? Or, as I suspect, was it to show the Credit Union that they thought they knew best when it came to their finances?

This scenario happens much too often. I've thought about why some people are frugal with their money, while others can't wait to spend it? I watched my parents manage money growing up and came to the conclusion they did it the right way. I certainly did not get everything I thought I wanted. Mom and Dad took a lot of nice vacations, both with and without my brother and me. I did not attend a private college but was fortunate an excellent university was close by. When Dad passed away, I helped Mom with her finances and was pleasantly surprised at how much Dad squirreled away. Mom is living a stress-free life because she doesn't have to worry about money. According to her financial advisor, she can live well into the ripe old age of her early three figures.

However, many people struggle in their later years because they did not prepare earlier in life. They saw their parents struggle with money but did not make any adjustments to their own finances. I understand what parents say can influence one's life. Mom once told me that croutons were bad because they were just fried bread. Croutons are actually sautéed or baked, but the fact that Mom said they were fried stuck in my head.

Croutons haven't changed much over the years, but personal finances have changed substantially. I receive an annual "checkup" from the same financial advisors. Second opinions are always encouraged with medical issues and would seem to be fitting with finances as well. Mom and Dad may be great resources but may not always be right, especially about croutons.

David M. Green

President/CEO

(925) 335-3802

|

Stat-of-the-Month Stat-of-the-Month

|

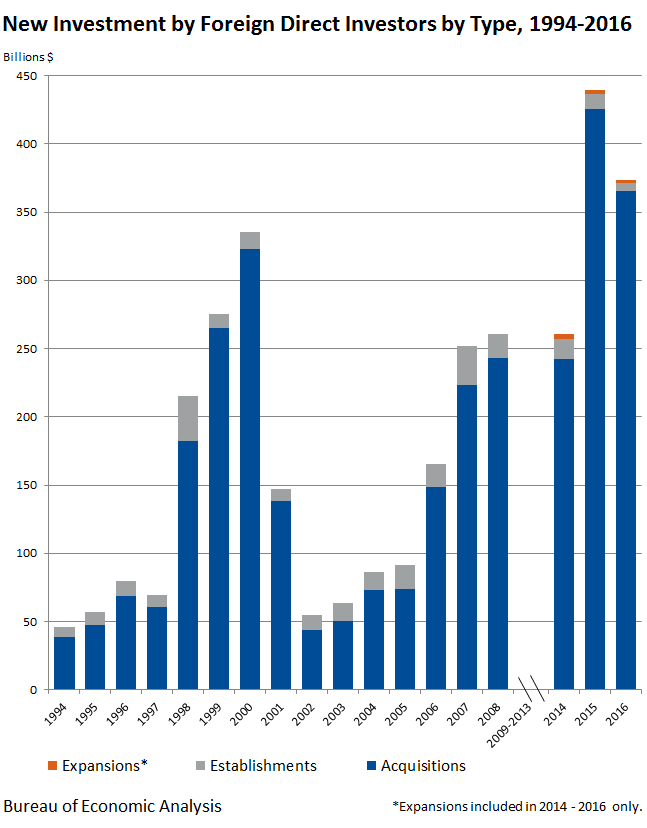

New Foreign Direct Investment in the United States

Expenditures by foreign direct investors to acquire, establish, or expand U.S. businesses totaled $373.4 billion in 2016. Spending was down 15 percent from $439.6 billion in 2015, but was above the annual average of $350.0 billion for 2014-2015, and was well above the annual average of $226.0 billion for 2006-2008. As in previous years, expenditures to acquire existing businesses accounted for a large majority of the total.

The largest source country was Canada, followed by the United Kingdom, Ireland, and Switzerland. By region, about one-half of the new investment in 2016 was from Europe and nearly one-quarter was from the Asia and Pacific region. By U.S. state, the largest expenditures were for U.S. businesses in California and Illinois.

(THREE SEVEN FOUR ZERO THREE)

|

1st Alerts 1st Alerts

|

- If you have @ccessOnline Home Banking with us, simply transfer a payment to your Visa card. Setting up a regular payment using Bill Pay in @ccessOnline Home Banking will generate a check and that will delay your payment. Instead, you can set up a single or recurring transfer. A transfer is immediate.

- Remember, if you are traveling with your 1st Nor Cal debit or credit card, please contact us ahead of time at (925) 335-3855 to ensure your card(s) work(s) properly wherever you are.

- As part of our debit and credit card security enhancement, our fraud department will now contact you by phone, e-mail, or text to confirm card transactions. If you have any questions, please contact us at (925) 335-3855.

|

*Annual Percentage Rates (APR) are subject to change. Rate, maximum term, maximum loan amount and advance amount are based on credit qualifications. Maximum terms vary based on loan amount. We reserve the right to determine collateral value based on industry recognized guidelines or full appraisal. Must be 18 years old or older to apply for a loan. Loans are subject to all Credit Union policies and procedures. Auto loan at 2.49% APR requires a minimum FICO® 750 Credit Score. 72 months term at 2.49% APR is $14.97 per $1,000.00 borrowed.

|

1st in the Community 1st in the Community

|

|

Backpack Drive Success

During the month of July, we hosted a backpack drive in our lobbies to collect donations for Operation Backpack through Volunteers of America. Operation Backpack is an organization that provides thousands of backpacks, grade specific school supplies, and a variety of support services to homeless, at-risk and foster children from Preschool to High School levels throughout our community.

Chris, Kristina and Scott are pictured below, dropping off the donations made by staff and members of 1st Nor Cal.

Thank you for your support!

|

Equifax Breach Equifax Breach

|

In view of the Equifax breach, you might consider "freezing" your file at all three bureaus. Experian, Equifax, and TransUnion. The advantage is that no one can view your file. The disadvantage is that you will need to "unfreeze" your file when you want to apply for credit. The bureaus may or may not charge you for this service. Right now, they have suspended the fee, but I'm sure it will be reinstated once the fervor dies down.

Currently, the bureaus are experiencing so much traffic on their websites that you may not be able to get your request processed. However, if you have a smartphone, the bureaus also have apps that can be downloaded, making it easy to freeze and unfreeze your credit file.

Personally, I am not in a rush to freeze my file. The breach happened two months ago and now that it's public, everyone is tightening their security procedures. Criminals know this, and may "lay low" for six months to a year, then when we're all feeling safe again, they'll start using the stolen information.

Shelley Murphy

Senior Vice President of Lending & Collections

To contact Equifax:

Equifax Credit Reporting Services

PO Box 74241

Atlanta, GA 30374-0241

Phone 1 (800) 685-1111

www.equifax.com

To contact Experian:

Experian Consumer Assistance

PO Box 2002

Allen, TX 75013-0036

1 (888) 397-3742

www.experian.com

To contact TransUnion:

|

Tips for Teens Tips for Teens

|

Time is Money

Last semester in my Economics class, we talked about a fairly simple, yet fundamental concept: Opportunity Costs.

It goes something like this:

The more a nation or industry invests in a product, such as guns, the more of that product will be produced, at the cost of the opportunity of producing another good, say butter, as we see in point A. The idea is that there needs to be equilibrium to maximize efficiency, close to or on point B. This ensures that you'll have an equal amount of defense

and goods. While this may be an economic concept, it can easily be applied to just about anything in life.

Say you have two choices: a nice two week long vay-cay to the sunny, sandy beaches of Hawaii or earning a couple thousand freshly minted green fresh off the press by working those two weeks. Your opportunity cost of going on vacation would be a paycheck. However, the opportunity cost of working is a much needed vacation. If you split your time evenly, you're achieving the most benefit of your time. By taking a one week vacation instead of two weeks, you could make at least half the money you would have lost, spend less on the vacation, and still enjoy some time off.

It's like the old saying goes, "Time is Money".

Luis Dominguez

Student Social Media Intern

1st Nor Cal Credit Union

|

Insurance Tips Insurance Tips

|

What You Should Know About Flood Insurance

As you may know, your Homeowners Insurance does not cover flood damage. According to NFIP, nearly 25% of their claims occur in moderate to low risk areas. The good news is that there are now 2 options for Flood insurance. They are as follows:

NFIP (National Flood Insurance Program)

- This is a national program, backed by FEMA

- The cost is based on government mapping of zones and their likelihood to flood.

- If you are in a "higher" frequency flood zone, you are required to obtain an Elevation Certificate. These certificates can be quite expensive.

- Unless coverage is being required by a lender at the close of escrow, there is a mandatory 30 day waiting period.

- Maximum amount of coverage available is $250,000 on the Building and $100,000 on Contents. Loss of Use is NOT available.

- Requires annual payment in full.

PRIVATE FLOOD INSURANCE

- Not backed by FEMA - but you are protected by the California Insurance Guarantee Association as long as the carrier is licensed to do business in the state of California.

- Rates are based at the location level, which means lower rates in many instances.

- No Elevation Certificate.

- No 30 day waiting period.

- Coverage limits in excess of $1M available. Optional Loss of Use up to $50,000.

- Payment options available.

If you don't currently have Flood insurance, now is a great time to think about it. If you do have Flood Insurance, but it is currently thru the NFIP, I would encourage you to call us for a No-Obligation quote!

As an added benefit of your 1st Nor Cal membership, we at Lou Aggetta Insurance will help you review the things that are important to you and provide you with options for reducing risk in your life. We are an independent insurance agent and can provide you with home, auto, umbrella, earthquake, flood, business and many other types of insurance coverage.

Contact me today to schedule your free review.

Denia Aggetta Shields

Lou Aggetta Insurance, Inc.

2637 Pleasant Hill Road

Pleasant Hill, CA 94523

(925) 945-6161

|

Reasons to Review Your Social Security Statement

By Jason Vitucci, CFP & Gene A. Schnabel

Did you know that determining whether your Social Security earnings record is correct falls squarely on your shoulders-not your current or previous employer(s) or the Social Security Administration? Making sure your information is accurate, and correcting mistakes on your record as soon as possible is critical because your Social Security record is the basis for the computation of your benefit amount in retirement.

Reviewing your Social Security statement annually helps to safeguard one of your most important assets in retirement.

Here are two compelling reasons to review your annual Social Security statement now, and at least annually thereafter:

- Even a "small" error can reduce the amount of your monthly benefit in retirement, which could add up to a loss of thousands over a period of 20 or 30 years in retirement.

- The Social Security Administration imposes a time limit on corrections to your earnings report of "up to three years, three months, and 15 days after the year in which the wages were paid or the self-employment income was derived."1

Your Social Security statement shows the number of work credits you've earned over time and provides estimates for your retirement, disability and survivor benefits. To access your personal statement online, follow the instructions to set up your account at www.ssa.gov/myaccount. Then, review the following sections of your statement carefully:

Work Credits - If you've already earned 40 work credits, the minimum required for most benefits, your record will show estimates for retirement, disability and survivors benefits. Otherwise, the statement will show how many credits you still need to qualify for benefits.

Earnings Record - Review your yearly earnings history for accuracy. If any information is incorrect or missing, you may not receive all the benefits you are entitled to in the future. If you need to correct earnings information, follow the instructions provided at www.ssa.gov.

Benefit Estimates - Review your retirement and disability estimates, as well as your survivors benefits estimate for your family.

If you'd like to learn more about the role Social Security benefits play of your comprehensive retirement income strategy, or would like help determining the right time to begin taking benefits, contact the office today. Retirement preparedness varies by age and personal financial situation. If you have questions or concerns about your retirement plan, please give the office a call. As a valued 1st Nor Cal member, we invite you to contact us for a complimentary financial analysis. We also invite you to attend any of our Retirement Planning workshops that we hold. For more information about our practice, our workshops, or to make an appointment, please call us at (925) 370-3750 or visit our website at www.vitucciintegratedplanning.com. Please note our new office address in Walnut Creek.

Vitucci Integrated Planning

Securities through First Allied Securities, a registered broker dealer, member FINRA/SIPC. Advisory services offered through First Allied Advisory Services, Inc. Registered Investment Advisor. Investments not FDIC or NCUA/NCUSIF insured, not insured by Credit Union, may lose value. Products offered are not guarantees or obligations of the Credit Union, and may involve investment risk including possible loss of principal. 1st Nor Cal CU, Bay Area Retirement Solutions and First Allied are all separate entities. Jason Vitucci CA Insurance Lic.: 0F59894, Gene A. Schnabel CA Insurance Lic.: 0663016

|

FREE Financial Counseling FREE Financial Counseling

|

Are you in need of financial counseling?

1st Nor Cal is here to help. Timely and honest debt advice is available to our members at no cost or obligation. Learn how to manage your finances.

Make your appointment TODAY!

Just a reminder, you can annually request FREE Credit Reports from all 3 credit reporting agencies online by going to:

For FREE Financial Counseling, don't hesitate to contact:

Shelley Murphy

Senior Vice President of Lending & Collections

(925) 228-7550 Ext.824

(SEVEN TWO ONE THREE THREE)

|

YouTube - Music Video YouTube - Music Video

|

Did you know we're on Social Media? Did you know we're on Social Media?

|

|

|