|

Win $50!

|

|

There are two member numbers spelled out within the text of this eNewsletter. Find your number and give us a call at (888) 387-8632 to claim $50!

|

|

|

|

|

Learn why you should avoid the loan shark!

|

President's Corner President's Corner

|

Americans are infatuated with technology. E-mail and texting has made communication faster and more efficient, even if some of our kids fail to reply to the text, "Where are you, and when are you coming home?" Technology has made shopping easier; buying tickets to the opera, sporting events, and theme parks effortless; and even most recently put the Kardashians' clothing store out of business. The Yelp app can help find the perfect restaurant, and the flashlight app is great to read the menu in that poorly-lit but otherwise perfect restaurant.

Technology has changed the perception of commerce. It appears much faster to order clothes than drive to the mall, get a coffee, take a detour to the sports store (OK, I would do that, but not most people), find the clothing store, try on the clothes, pay, and drive home. With online shopping, it's scan, click, and pay. That may sound more cost-effective, but is it really? Are online purchases less expensive than the old fashioned way? Now that clothing and the Kardashians have been technologically disrupted, banking is next. The apps include slick advertising with promises of total financial freedom.

Anyone who watches TV or their smartphone has seen ads for SoFi, which positions itself in the marketplace as the leader in student loan refinances, but their website says they are "a new kind of finance company taking a radical approach to lending and wealth management." In other words, it's not just about student loans. They want an individual's entire financial relationship - mortgages, personal loans, investments, and even life insurance. Their management team is not comprised of junior Mark Zuckerbergs inventing a cool new app in their college dorm rooms. They are long-time mega banking veterans who take no prisoners, which means it is all about their bottom line and not about saving money for consumers. SoFi also is not required to follow all the consumer protection laws your Credit Union must abide by.

Rocket Mortgage, a division of Quicken Loans which is owned by Intuit which also owns Quicken, QuickBooks and TurboTax, touts "super hero levels of confidence" with their mortgage products in their very slick commercials. This year, Rocket became the largest mortgage lender in the U.S., surpassing Wells Fargo. Generally, when homeowners and prospective homeowners are shopping for loans, they will first ask for rates. With Rocket, the rates are not disclosed until after the application has been completed. Most borrowers probably would not bother looking around so as to not have to spend more time on paperwork. The facts are that the process is not faster, the rates are not better, and the costs are not less. The benefits are, at best, minimal.

Perceived speed does not always equal better.

When Bud Fox's father Carl (played brilliantly by Martin Sheen) confronted the infamous corporate raider Gordon Gekko in the 1987 classic movie Wall Street, Mr. Fox disputed Gekko's argument that selling Bluestar Airlines, where Fox worked, to Gekko was good for the employees. "There came into Egypt a Pharaoh who did not know...The rich have been doing it to the poor since the beginning of time. The only difference between the Pyramids and the Empire State Building is the Egyptians didn't allow unions. I know what this guy is all about, greed. He don't give a damn about Bluestar or the unions. He's in and out for the buck, and he don't take prisoners." Meet the new economy, same as the old economy; we don't get fooled again (apologies to The Who).

David M. Green

President/CEO

(925) 335-3802

|

Stat of the Month Stat of the Month

|

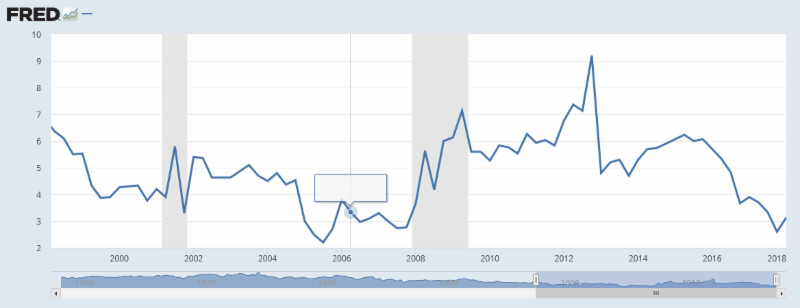

Personal Savings Rate March 1998 - March 2018

Sources: U.S. Bureau of Economic Analysis and Federal Reserve Bank of St. Louis

Typically, consumer savings rates decrease when spending increases as a result of the economy doing well. Conversely, savings rates increase during economic downturns (the gray bars on the chart) because consumers become unsure of their employment status and save for that rainy day. Current savings rates are at its lowest point since 2005 just before the onset of the Great Recession. This may indicate a recession within the next two years.

|

New Branch Coming Soon! New Branch Coming Soon!

|

We are pleased to announce that we will be opening a new Pittsburg/Antioch branch this Summer in the Pittsburg Century Plaza, next to Target. In the interim, please feel free to visit our branch at 1870 A Street in Antioch, or any of our other branch locations.

(THREE SIX SIX TWO FIVE)

|

1st Alerts 1st Alerts

|

- We upgraded @ccessOnline Home Banking! Learn more: www.1stnorcalcu.org/online-banking/upgrade

- Click here for information regarding the Equifax Breach.

- If you have @ccessOnline Home Banking with us, simply transfer a payment to your Visa card. Setting up a regular payment using Bill Pay in @ccessOnline Home Banking will generate a check and that will delay your payment. Instead, you can set up a single or recurring transfer. A transfer is immediate.

|

1st in the Community 1st in the Community

|

Animal Shelter Donation Drive

Now through June 15th, we're hosting a donation drive benefiting the

Animal Services of Contra Costa County.

If you would like to participate, check out the

Shelter's Wish List and drop off your donation at any of our

branch locations.

|

Car Buying Tips Car Buying Tips

|

Check out these car buying tips before you start shopping!

- Do your research before you walk into the dealership.

- Used cars have a Kelley Blue Book value. Visit www.kbb.com before you go to the dealer.

- Use Autocheck or CarFax to check out the car.

- Negotiate on the value of the car/truck, not the monthly payment.

- For the best value, instead of a new car or truck, buy used with low mileage.

- Never pay "sticker price". Everything is negotiable!

- Know your credit score and demand the best interest.

*Annual Percentage Rates (APR) are subject to change. Rate, maximum term, maximum loan amount and advance amount are based on credit qualifications. Maximum terms vary based on loan amount. We reserve the right to determine collateral value based on industry recognized guidelines or full appraisal. Must be 18 years old or older to apply for a loan. Loans are subject to all Credit Union policies and procedures. Auto loan at 2.75% APR requires a minimum FICO® 750 Credit Score. 72 months term at 2.75% APR is $15.09 per $1,000.00 borrowed.

|

We all love saving time and money.

|

Check out how simple it can be!

With a $400,000.00 Mortgage

30 year, fixed rate mortgage at

4.25% APR

1

has a principal and interest payment of

$1967.76

with finance charges estimated at

20 year, fixed rate mortgage at 3.875% APR

1

has a principal and interest payment of

$2397.66

and finance charges estimated at

$175,436.86

So for about $430.00 more per month, you can

Save 10 Years and around $133,000.00

in finance charges!

Call us today to save some

serious time and money!

(925) 335-3870

1: APR = Annual Percentage Rate. Mortgage amount, rates and terms are only examples and estimations.

Call our Mortgage Department at 925 335-3870 for actual costs. Example Quotes: 4.302% APR for 30 years and 3.946% APR for 20 years. Taxes and insurance are not included in these calculations. Rates cannot be guaranteed and are subject to change without notice. Loans subject to all policies and procedures. Quoted conforming rates are based on a loan amount of $400,000 with loan-to-value (LTV) not to exceed 75% of appraised value. There are no pre-payment penalties on these quotes.

1st Northern California Credit Union does not charge points.

1st Northern California Credit Union - NMLS ID # 580488

|

Tips for Teens Tips for Teens

|

Movie Subscriptions Movie Subscriptions

There's no shortage of articles on the Internet about dying stores, malls, and restaurants due to the internet and the younger generation. Each published article seems to blame a change in consumer habits, a failure to manage spending after the 2008 recession, and a high on-time delivery expectation set by Amazon. Movie theaters were hit especially hard after 2008, since consumers were trying to save as much money as possible. Over time, as the economy recovered from the crash, people started going back to the theaters but not as frequently as before. At the end of last year, I came across a list of all the new movies that would be coming out in 2018. I knew I had to see some of them - at the very least, Marvel's Infinity War (go now if you haven't seen it yet). Around the same time, I found a deal on a service called MoviePass, a movie theater subscription where you could go see one movie a day for a small monthly charge. I signed up for a year, which came out to be about $7.50 a month. This was a huge savings for me, given that the cheapest movie ticket in my area is $10.50 (unless I go on Tuesday). Just one visit a month was worth it, but twice would really be saving me money. It allowed me to go see movies I wouldn't normally see in theater and not feel like I was gambling my money.

But all good things must come to an end. MoviePass is actively bleeding cash and consistently changing their Terms of Use (ToU). Recently, they removed their most popular monthly subscription for new users, allowing them to see one movie per day per month, but brought it back ten days later with the restriction that you can't see the same movie twice. Some users have reported that the app now requires them to submit a photo of their ticket stub at the end of their visit or be banned from using the service. Once banned, there is no way to resubscribe to the service as listed in the always changing ToU. It also lists in the ToU that users can be banned without warning. This happened to some users back in February and they had no way of disputing their ban. They also have the ability to ban some theaters, which I believe has only happened with some AMC locations. On one hand, this service is a huge welcome to penny savers, but on the other hand, their constantly changing terms are frustrating to keep up with.

Certain institutions, such as bulk warehouses (like Costco) and insurance offices (like AAA), offer discounted movie tickets for around $8 dollars, only 50 cents more than I'm paying now per month. If I cancel my MoviePass subscription and only go to the theater twelve times or less per year, I won't be spending more and I'll avoid playing

Keeping up with the MoviePass. I've spoken out against subscriptions before, how it's an investment where you won't see a penny after you quit and how you're limited on what is being offered. This one is no different. Advertising may try to convince you otherwise, as it did with me, but the frustration I'll avoid in the long run by paying per ticket is well worth it to me.

Luis Dominguez

Student Social Media Intern

1st Nor Cal Credit Union

|

Insurance Tips Insurance Tips

|

Pet Health Insurance: A Necessity or a Scam?

In today's culture many of us have dogs or cats that are family members or in some cases support animals which we depend on. Like us they occasionally have health issues and should be examined annually by their veterinarian for preventative health exams, vaccinations, and other routine checkups. This goes far beyond the occasional visit to the groomer to get bathed and cut, and it can often get quite expensive.

If you have not known this before, like human health insurance, there are a number of high quality and flexible health insurance plans for you pets. Many health plans whether human or pet, offer coverage that may not fit your needs, and may lead to buyer's remorse or even cause you to feel scammed. This makes it so important to have a good insurance agent to help you focus on what is important, to get the best coverage, for the best value. Since cats and dogs live to 10 or 20 years and often have health issues along the way, the best way to make sure they reach that age in peak health is to regularly visit the vet.

Pet policies like your own health plan can have variable deductibles, co-pays and annual coverage caps. Pet insurance deductibles are far less than our health deductibles, so it is actually quite affordable. Some policies can reduce the cost of vet visits, include immunizations, and have the option of specialty coverages for things such as cancer treatment.

The best time to get the health coverage is when you first get your dog or cat, as the coverage is always cheaper while the pet is young and healthy. But even if you have an older pet, and have not had prior insurance, there are policies for those pets too. Our policies offer discounts for multiple pets, and multi-policy discount is possible also. Call us to explore what is offered, how we can help your pet live a long and healthy life.

As an added benefit of your 1st Nor Cal membership, we at Lou Aggetta Insurance will help you review the things that are important to you and provide you with options for reducing risk in your life. We are an independent insurance agent and can provide you with home, auto, life, business, and many other types of insurance coverage.

Contact us today to schedule your free review.

Denia Aggetta Shields

Lou Aggetta Insurance, Inc.

2637 Pleasant Hill Road

Pleasant Hill, CA 94523

(925) 945-6161

|

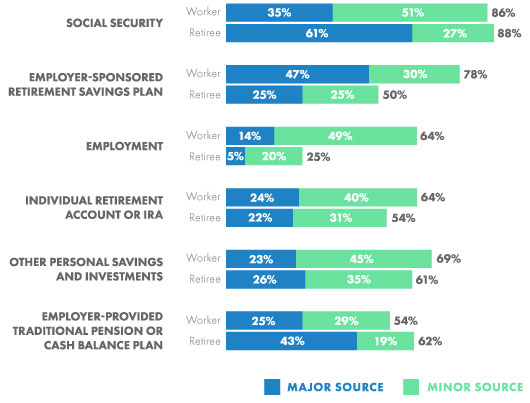

Where Will Your Retirement Money Come From?

By Jason Vitucci, CFP® & Gene A. Schnabel

For many people, retirement income may come from a variety of sources. Here's a quick review of the six main sources:

Social Security

Social Security is the government-administered retirement income program. Workers become eligible after paying Social Security taxes for 10 years. Benefits are based on each worker's 35 highest earning years. If there are fewer than 35 years of earnings, non-earning years are averaged in as zero. In 2017, the average monthly benefit is estimated at $1,360.

2

Personal Savings and Investments

One survey found that nearly 70% of today's workers expected that their personal savings and investments outside their IRAs and employer-sponsored retirement plans will be either a major or minor source of retirement funds. The same survey found that only 61% of current retirees report personal savings and investments are a source of funds.

3

Individual Retirement Accounts

Traditional IRAs have been around since 1974. Contributions you make to a traditional IRA may be fully or partially deductible, depending on your individual circumstances. Distributions from a traditional IRA are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. Generally, once you reach age 70½, you must begin taking required minimum distributions.

Roth IRAs were created in 1997. Roth IRA contributions cannot be made by taxpayers with high incomes. To qualify for the tax-free and penalty-free withdrawal of earnings, Roth IRA distributions must meet a five-year holding requirement and occur after age 59½. Tax-free and penalty-free withdrawal also can be taken under certain other circumstances, such as a result of the owner's death. The original Roth IRA owner is not required to take minimum annual withdrawals.

Defined Contribution Plans

Well over one-third of workers are eligible to participate in a defined-contribution plan such as a 401(k), 403(b), or 457 plan.

4 Eligible workers can set aside a portion of their pre-tax income into an account, which then accumulates tax deferred.

Distributions from defined contribution plans are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. Generally, once you reach age 70½, you must begin taking required minimum distributions.

Defined Benefit Plans

Defined benefit plans are "traditional" pensions-employer-sponsored plans under which benefits, rather than contributions, are defined. Benefits are normally based on factors such as salary history and duration of employment. The number of traditional pension plans has dropped dramatically during the past 30 years.

Continued Employment

In a recent survey, 79% of workers stated that they planned to keep working in retirement. In contrast, only 29% of retirees reported that continued employment was a major or minor source of retirement income.

5

Expected Vs. Actual Sources of Income in Retirement

What workers anticipate in terms of retirement income sources may differ considerably from what retirees actually experience.

Employee Benefit Research Institute, 2016 Retirement Confidence Survey

We help our clients navigate through the confusing maze of financial issues as it relates to financial planning. If you feel that we may be a good fit to work together, please don't hesitate to contact our office. As a valued 1st Nor Cal member, we invite you to contact us for a complimentary financial analysis. We also invite you to attend any of our Retirement Planning workshops that we hold. For more information about our practice, or to make an appointment, please call us at (925) 370-3750 or visit our website at www.vitucciintegratedplanning.com.

Vitucci Integrated Planning

Securities through First Allied Securities, a registered broker dealer, member FINRA/SIPC. Advisory services offered through First Allied Advisory Services, Inc. Registered Investment Advisor. Investments not FDIC or NCUA/NCUSIF insured, not insured by Credit Union, may lose value. Products offered are not guarantees or obligations of the Credit Union, and may involve investment risk including possible loss of principal.

1st Nor Cal CU, Bay Area Retirement Solutions and First Allied are all separate entities.

Jason Vitucci CA

Insurance Lic.: 0F59894, Gene A. Schnabel CA Insurance Lic.: 0663016

2: Social Security Administration, 2017

3: Employee Benefits Research Institute, 2016

4,5: Employee Benefits Research Institute, 2016

|

FREE Financial Counseling FREE Financial Counseling

|

Are you in need of financial counseling?

1st Nor Cal is here to help. Timely and honest debt advice is available to our members at no cost or obligation. Learn how to manage your finances.

Make your appointment TODAY!

Just a reminder, you can annually request FREE Credit Reports from all 3 credit reporting agencies online by going to:

For FREE Financial Counseling, don't hesitate to contact:

Shelley Murphy

Senior Vice President of Lending & Collections

(925) 228-7550 Ext.824

(SEVEN THREE SIX TWO TWO)

|

Did you know we're on Social Media? Did you know we're on Social Media?

|

|

|