Forget Everything You Know About Inflation

If you grew up in the 1960s, '70s or '80s, you may want to forget everything you know about inflation.

It's very possible that the financial and economic conditions of your youth were an aberration in American history. Of course, this is important to how you manage your portfolio, especially a retirement portfolio.

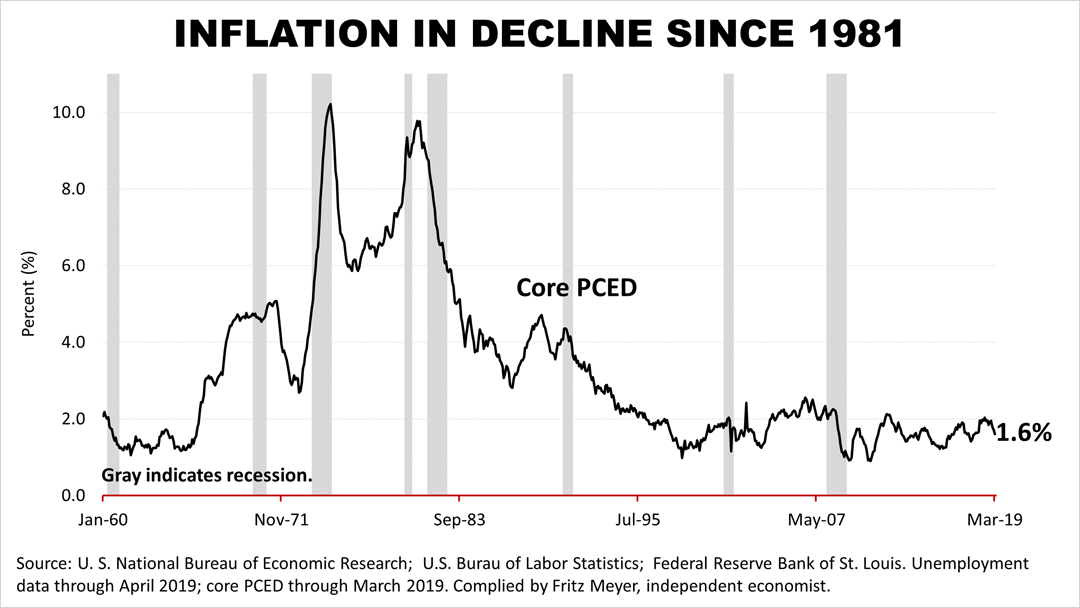

Shown in the black line is the Core Personal Consumption Expenditure Deflator (PCED), the inflation benchmark used by the Federal Reserve in setting interest-rate policy. The PCED is not as well-known as the Consumer Price Index, which is the inflation measure most often quoted in the media.

Core PCED, which excludes from the inflation calculation of volatile monthly household expenses, like energy, peaked in February 1975. It plunged for a couple of years before peaking again in January 1981. Since then, inflation has been in a steady decline.

For many decades before the aberrant period of the 1970s and '80s, the rate of inflation was about the same as today, according to data from independent economist Fritz Meyer, and investors don't think it's going higher.

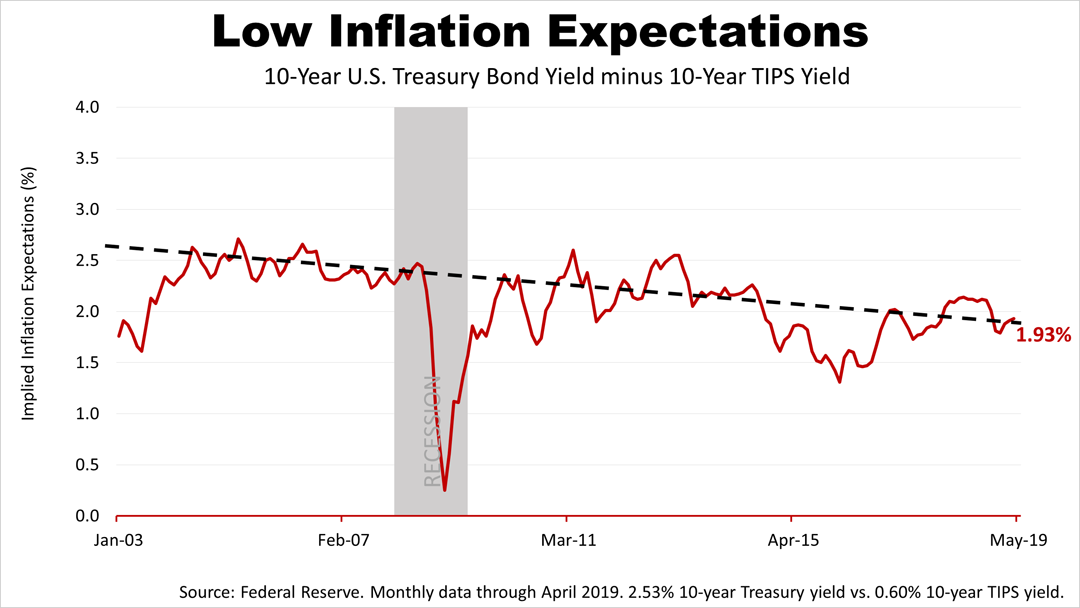

This chart gives you an idea of the dramatic change in the psychology of investors with regard to inflation.

The red line shows the difference in yield between a 10-year Treasury bond and a 10-year TIPS bond (Treasury Inflation Protected Securities). The black dotted line shows the slope of the decline in inflation expectations over the last 15 years.

As recently as March 2013, the yield on the 10-year TIPS was 2.6%, and investors in March 2013 expected an inflation rate of 2.6% over the coming 10 years. Six years later, investors recently expected annual inflation of 1.9%.

The 10-year TIPS yield, at 1.93%, tells us that investors expect inflation to average 1.93% annually for the next 10 years.

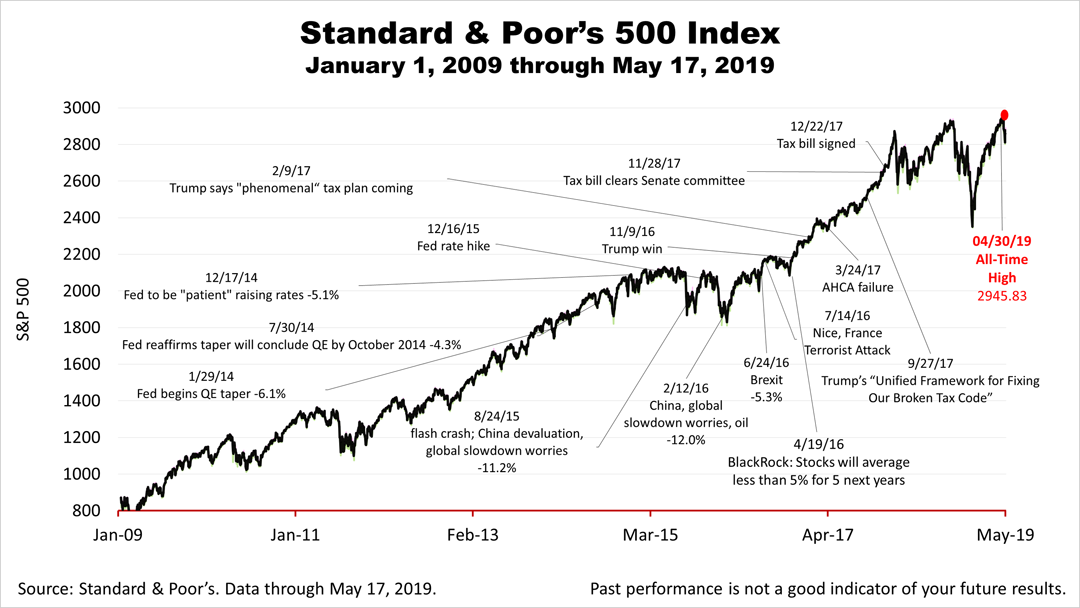

Over the long-run, economic fundamentals, like inflation, are a key underlying factor in corporate earnings, which drives stock prices. In the context of the lowest inflation rate in many decades and low inflation expected by investors for the decade ahead, economic fundamentals were strong recently. Confirmation of the strength came on Friday; the Index of U.S. Leading Economic Indicators, reported by the Conference Board, ticked up from its already historic recent highs.

The Standard & Poor's 500 closed lower for the week. At 2,859.53, the S&P 500 index was 3% from its all-time high on April 30th.

No one can reliably predict the market's next big move and past performance is not indicative of your future results. Stocks are only one asset class in a long-term strategically-designed portfolio and stock prices don't always reflect fundamental economic trends. However, over the long-run, economics and facts matter.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.