Stocks Soared 5.2% In April; Now, For The Good News

Updated Published Friday, April 30, 2021 at: 8:34 PM EDT

Updated Published Friday, April 30, 2021 at: 8:34 PM EDT

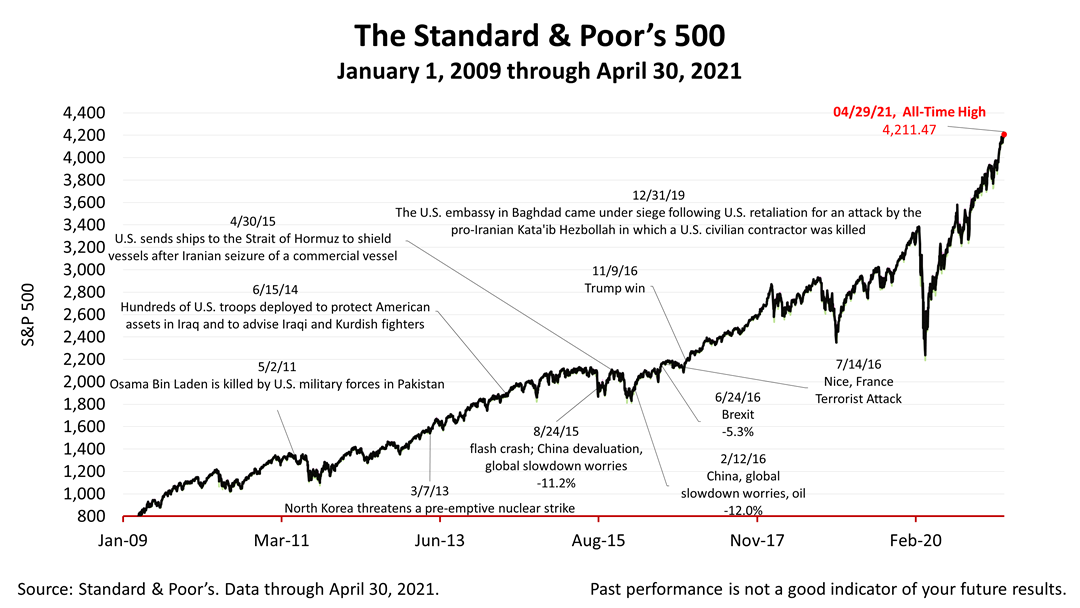

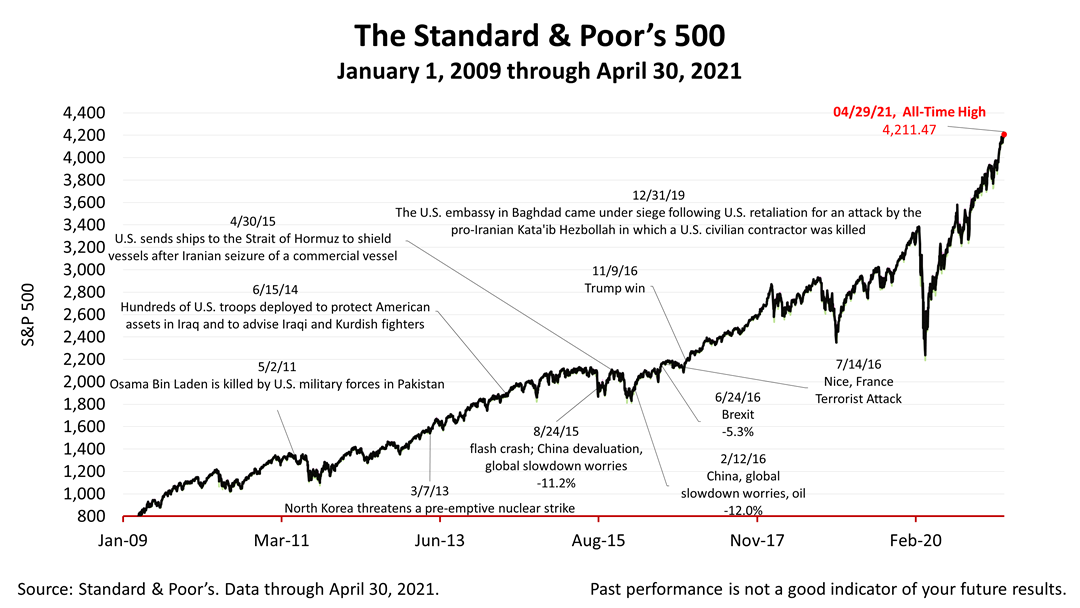

After closing at a record high yesterday, the Standard & Poor’s 500 stock index dropped about seven-tenths of 1% today. The index returned 5.2% in April -- more than five times the monthly gain stocks averaged for nine decades.

And, now, for the good news.

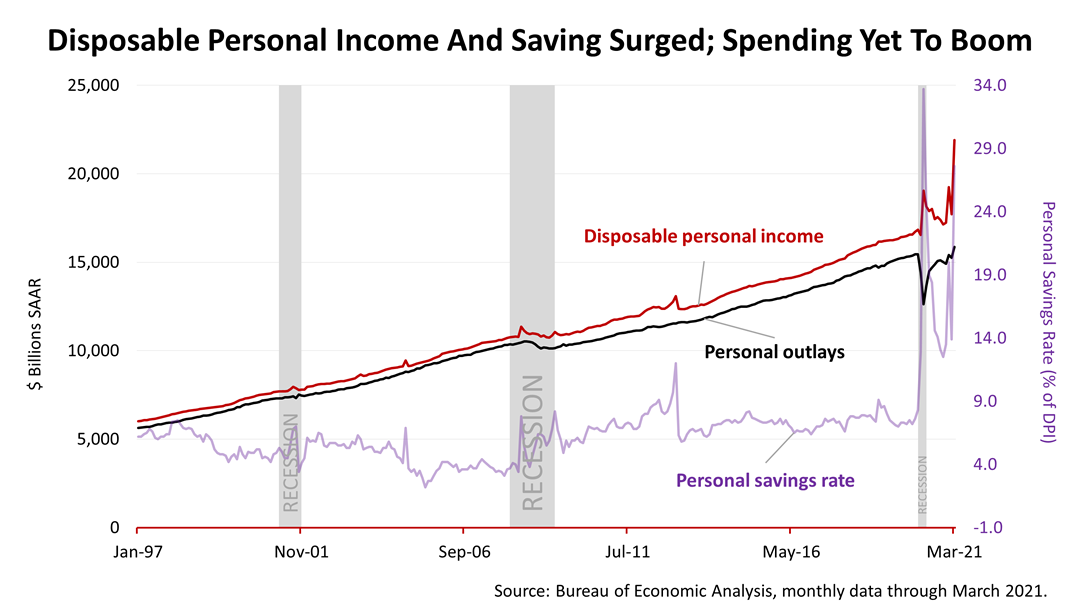

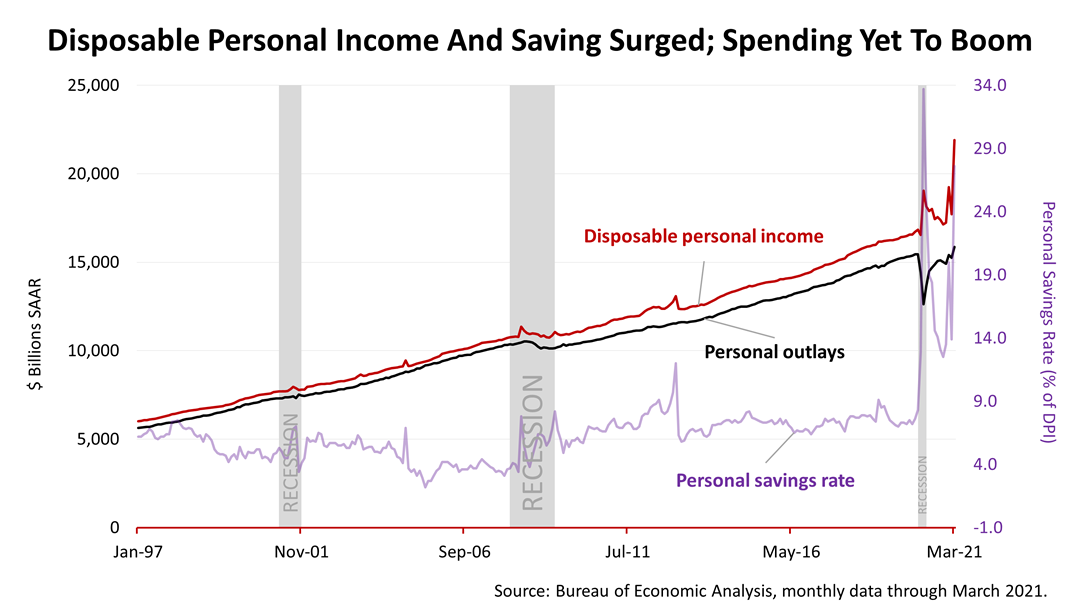

Disposable personal income and the savings rate, according to today’s report from the Bureau of Economic Analysis, went parabolic again in March. The surge is attributable to the third round of government stimulus checks hitting the accounts of Americans who qualified. Thirty-seven million economic stimulus checks we sent out this week, the IRS said, upping the total number distributed to Americans to 127 million.

Though the astronomical rise in income and savings had been expected, it is entirely another thing to see this chart from independent economist Fritz Meyer, showing key drivers of the growth boom to levels unimaginable before the pandemic. The spending boom is yet to happen.

And here’s the kicker: income and savings are exploding at the same time as the U.S. achieves herd immunity from Covid-19 and returns to something close to normalcy!

The Standard & Poor’s 500 stock index closed Friday at 4181.17. The index lost -0.72% from Thursday’s all-time closing high and is up a scant +0.02% from last week. It is up a remarkable +60.56% from the March 23rd Covid bear-market low.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.