The Explosion In Real Retail Sales You Never Hear About

A retail sales boom is being muted by inflation, but it is real and becomes visible only after factoring in inflation.

Since consumers drive 70% of U.S. growth, retail sales are an important fundamental in measuring the strength of the economy relative to history.

The retail sales numbers, when adjusted for inflation, reveal that a retail explosion has been ongoing for years, but the media has missed it. A search of Google for news about "retail sales" returned these top stories on Friday afternoon, hours after the release of the May retail sales figures by the U.S. Census Bureau.

The media gets a press release with the nominal retail sales data, which masks the retail explosion underway for a decade. They're not economists and they don't know that adjusting retail sales data for inflation better reflects the surge in purchasing power underway for a decade.

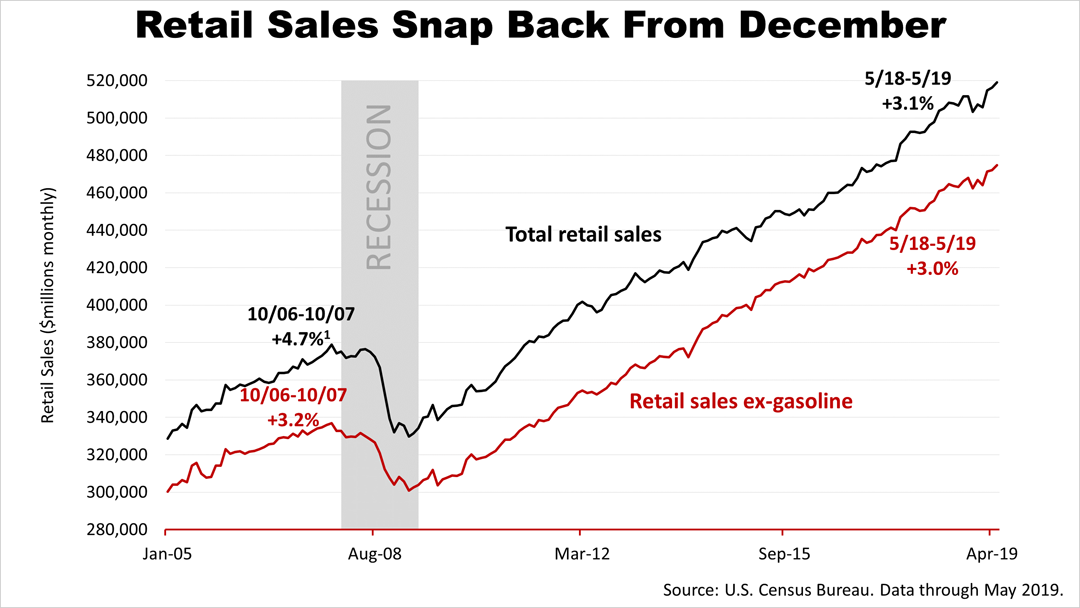

Based on Friday's release, retail sales in the 12-months through May 31st were up 3.1%. Excluding volatile gasoline prices, which can distort the monthly figures, retail sales in this 12-month period through May rose 3%, which is not bad but not a boom.

Compared with the 3.2% peak 12-month period in the last economic boom, in 2006 and 2007, the 3% improvement in retail sales in the most recent 12 months is not impressive.

After adjusting for inflation, however, the boom is clear and loud.

"Real" after-inflation retail sales, excluding gasoline, were up 2% in the 12 months through May, but what's more important is the longer-term. Compared with the 2006-2007 economic expansion, retail sales of the last 12 months were booming.

Real retail sales were flat throughout the peak years of the last economic expansion. This 10-year expansion, which is only days away from officially becoming the longest expansion in modern U.S. history, is largely fueled by the steep growth trajectory in real retail sales for the last decade, and it gets no coverage in the media!

The Standard & Poor's 500 index was up fractionally from a week ago, closing on Friday at 2,886.98, just 3% from its April 30th all-time high.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.