Expect Inflation To Make Investors Nervous Through 2021

Updated Published Friday, May 14, 2021 at: 8:36 PM EDT

Updated Published Friday, May 14, 2021 at: 8:36 PM EDT

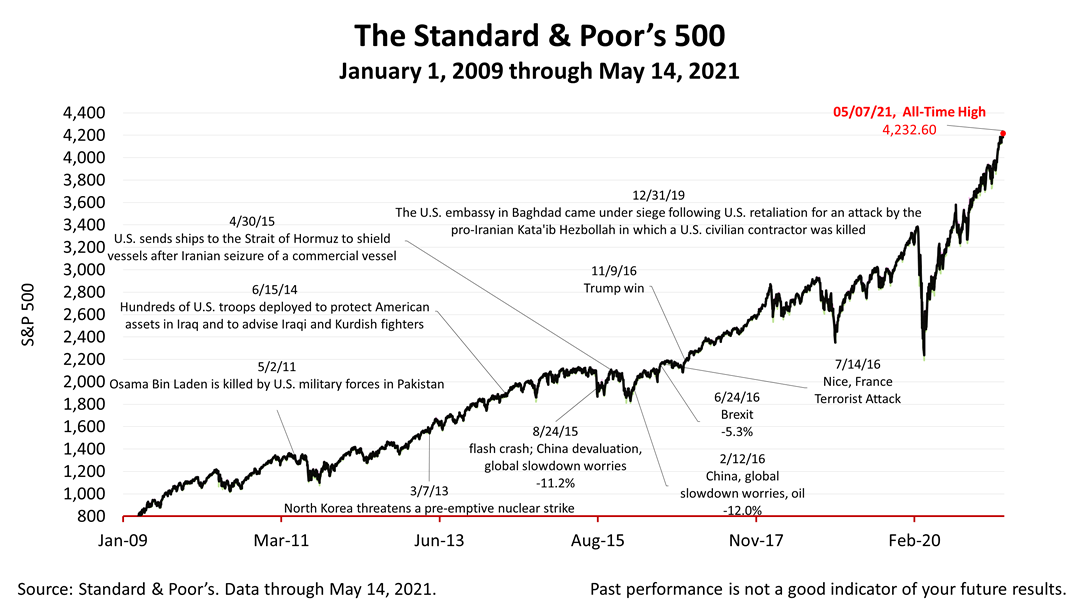

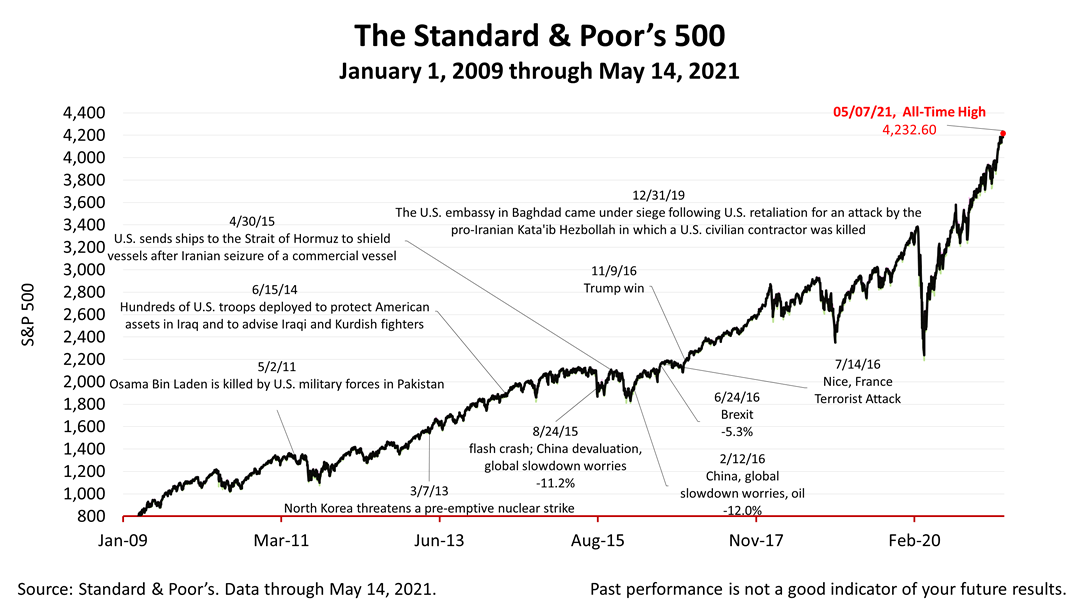

Heightened volatility experienced this past week should be expected for the foreseeable future.

Inflation fears are likely to persist for many months because the Federal Reserve has repeatedly said it will not raise rates to slow the economy even if the inflation rate continues to rise to 3% or higher. So it is likely to be a nervous stock market for many months, as the inflation rate continues to rise and the Fed stands on the sidelines and does nothing to quell the spike in consumer prices in the works.

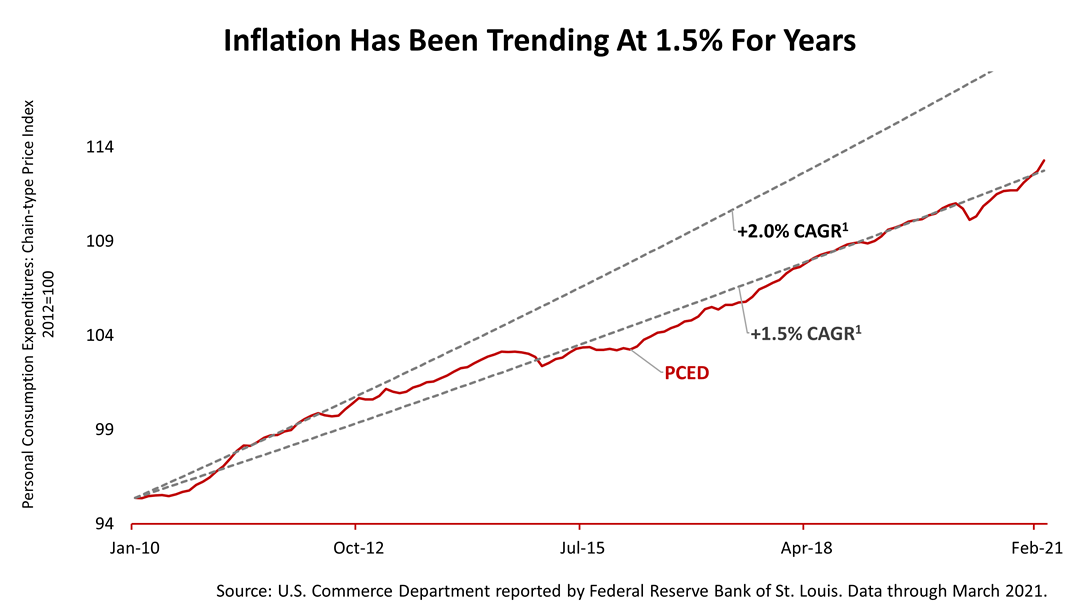

The Fed is banking on increased inflation to be short-lived. Fed policy is predicated on the central bank’s position that low inflation is deeply ingrained in the American consumer’s psyche.

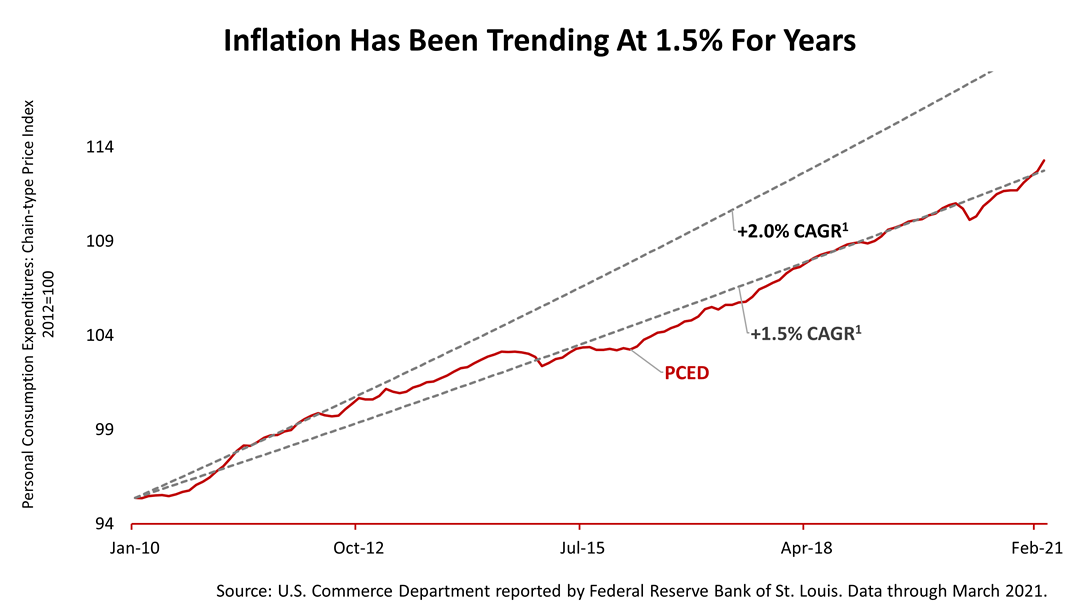

For the last decade, the Fed experienced just how deeply low inflation expectations are ingrained in the American consumer’s psyche. The Fed consistently predicted the Personal Consumption Expenditure Deflator (PCED) – the inflation index generally referenced by the Fed public pronouncements -- would rise to an annual rate of 2%. However, the PCED remained at 1.5%.

The Fed was wrong for the past decade about inflation, and it is essentially saying it learned its lesson and will not make the mistake of assuming the sharp rise in inflation will spiral out of control because lower inflation expectations have grown so deeply ingrained in the American consumer’s psyche gradually for the past four decades.

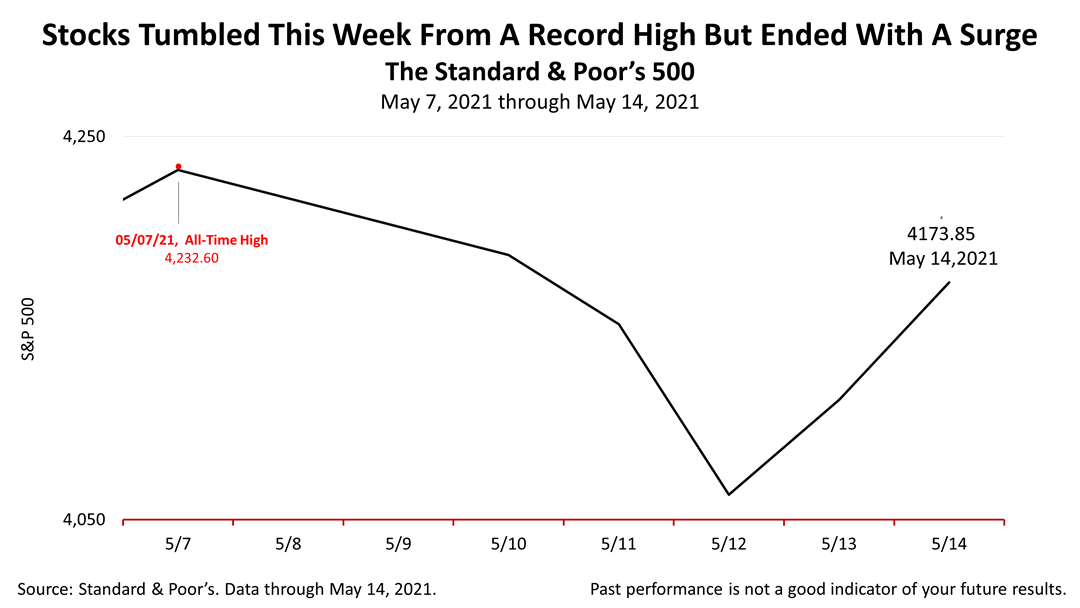

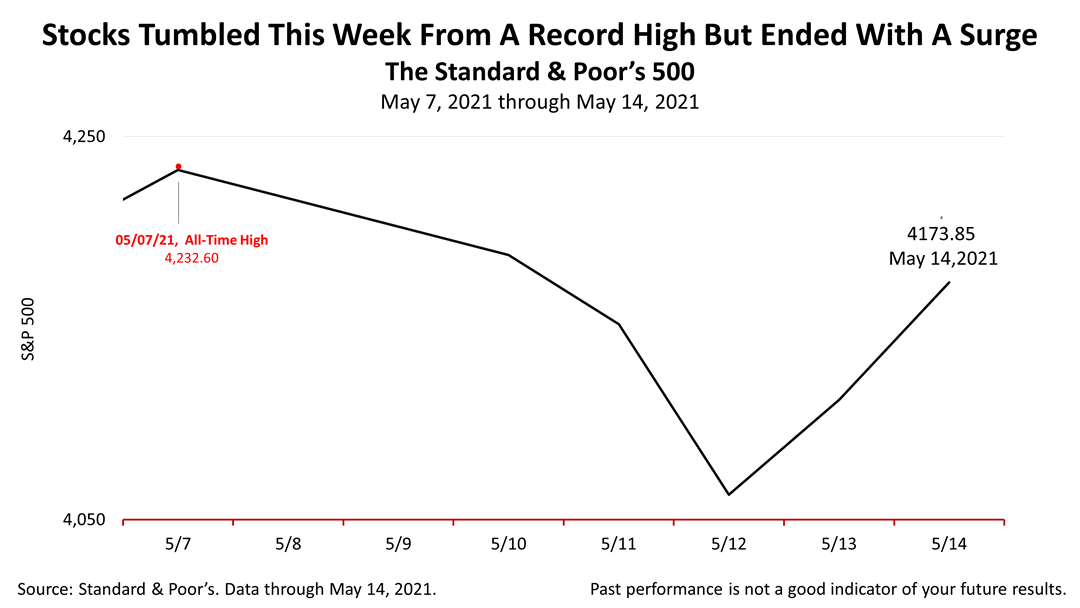

The Standard & Poor’s 500 stock index, after dropping the first four days of the week from an all-time high of 4232.60 achieved a week ago, rebounded sharply Friday, rising 1.5%. It closed at 4173.85, less than 2% off the record high.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.