What Investors Should Expect And A Business Owner Alert

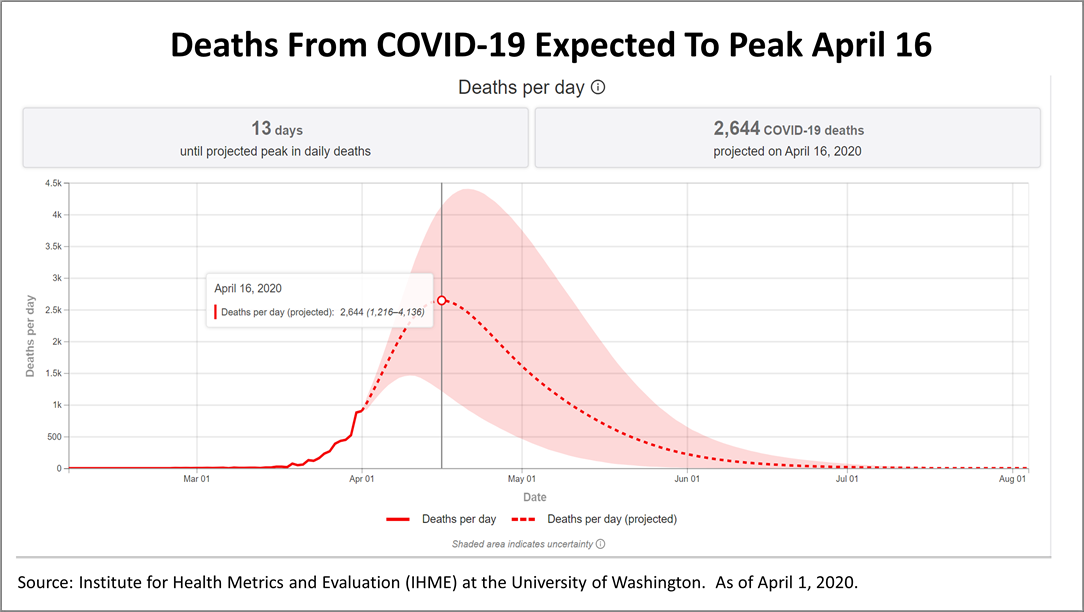

(April 3, 2020, 7 p.m. EST) - The latest forecasts indicate deaths nationwide from COVID-19 could peak April 15. Precisely when the worst will pass depends on adherence to social distancing, hospital utilization and other variables. Other models say the worst may not come for six or eight weeks.

The April 1 forecast from the Institute for Health Metrics and Evaluation (IHME) at the University of Washington, which is reportedly relied upon by the White House Coronavirus Task Force, indicates deaths in the U.S. from COVID-19 will peak April 16, assuming adherence to social distancing measures promulgated by states. The IHME receives funding from The Bill and Melinda Gates Foundation and the State of Washington.

Financial uncertainty may subside after the worst of the crisis passes.

Note- Uncertaintyis the range of values that is likely to include the correct projected estimate for a given data category. Larger uncertainty intervals can result from limited data availability, small studies, and conflicting data, while smaller uncertainty intervals can result from extensive data availability, large studies, and data that are consistent across sources. The model presented in this tool has a95% uncertainty intervaland is represented by the shaded area.

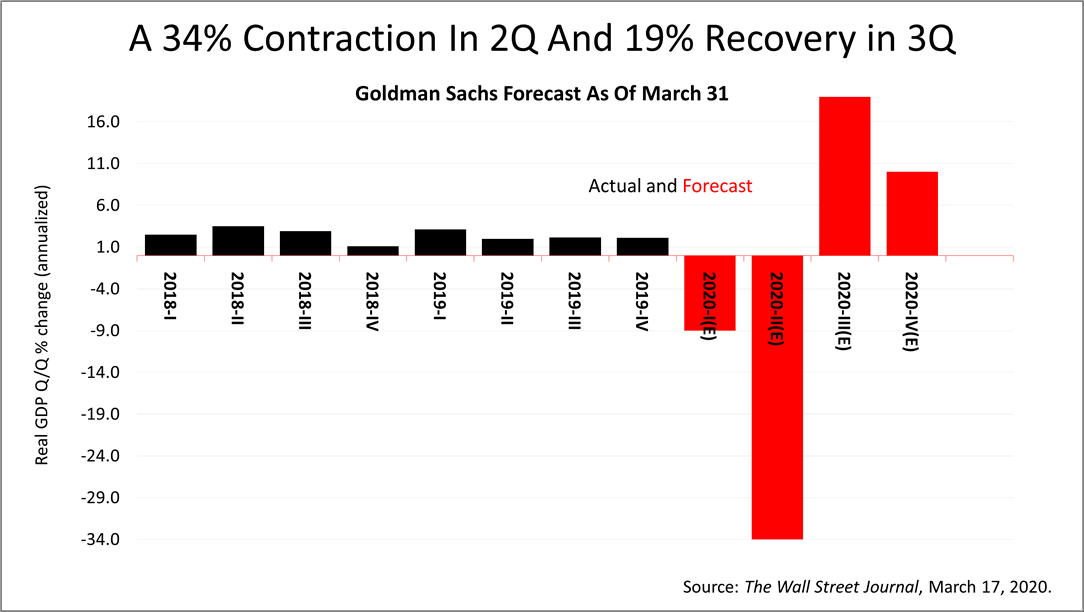

Wall Street's forecast for this second quarter of 2020, which began April 1, is exemplified in this prediction from Goldman Sachs Group. Goldman lowered its second-quarter forecast for U.S. economic growth from a week earlier, lowering its grim prediction for a 24% contraction to an even grimmer 34% drop in U.S. economic activity. Such a plunge is without precedent.

Almost as stunning is the recovery. Annualized, the growth rate in the third quarter is expected to be 19%! Goldman's forecast is more extreme than JP Morgan's, but they are in alignment directionally.

The bar chart shows the economic whiplash to expect, but the change will occur over weeks and not all in a day. The deadliest days will not flick a switch and the return to normalcy will take many months.

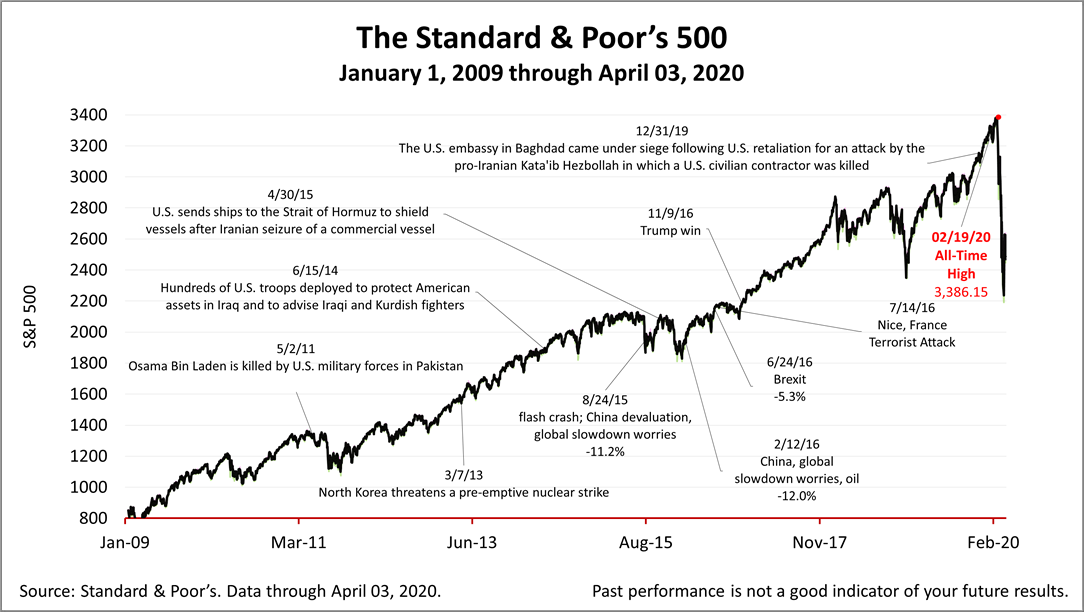

The Standard & Poor's 500 index, a benchmark of the value of America's largest 500 publicly traded companies, free markets, and a proxy for world progress, closed Friday at 2,488.65, down from 2541.46 a week ago.

While financial effects of the crisis are unfolding, the U.S. Government's response is massive. If you own a business and have questions about the Paycheck Protection Program or the CARESAct, please contact our office as soon as possible. Financial aid from the U.S. Government Small Business Administration is on a first-come, first-served basis.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial situation, or particular needs. Product suitability must be independently determined for each individual investor.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.