China Financial Contagion Fears Come And Go In A Few Days

Updated Published Friday, September 24, 2021 at: 5:53 PM EDT

Updated Published Friday, September 24, 2021 at: 5:53 PM EDT

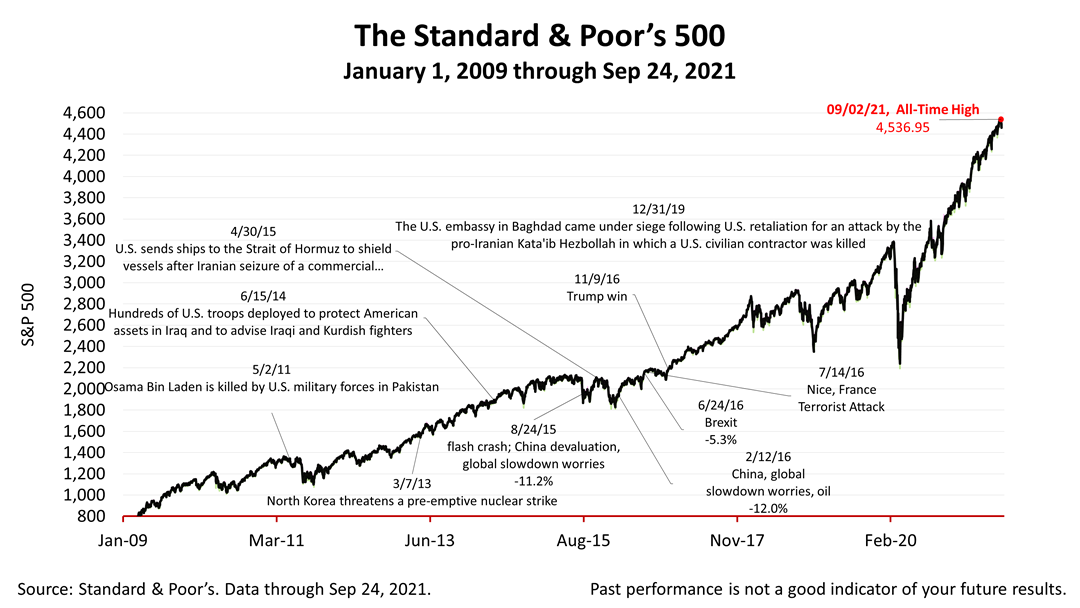

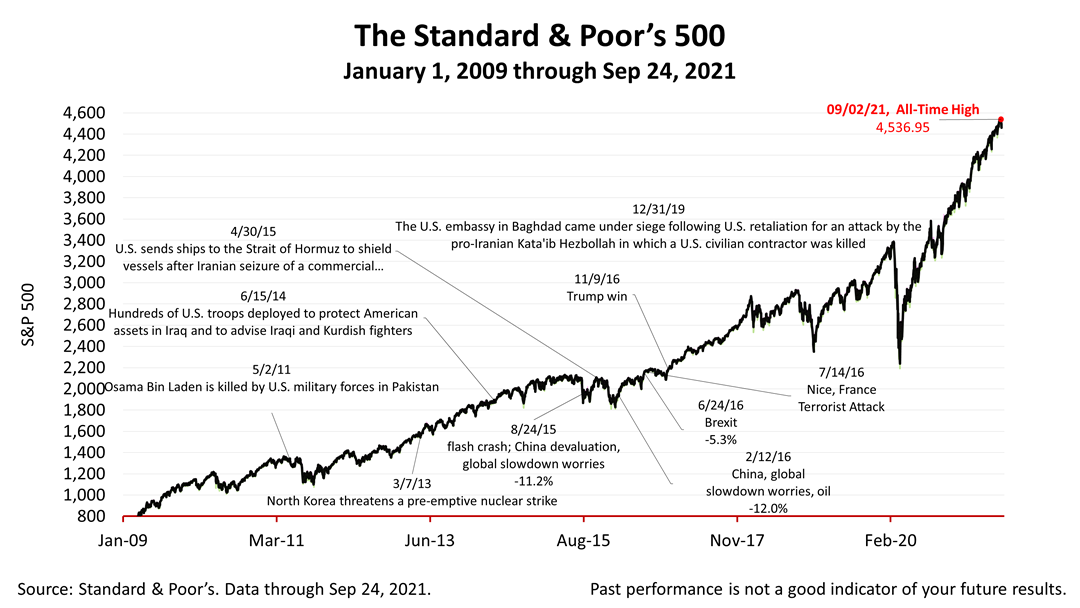

Fears of a China financial contagion infecting the global economy caused a plunge in the U.S. stock market on Monday, but the Standard & Poor’s 500 stock index recovered and closed with a one-half of 1% weekly gain.

Authorities in Beijing have signaled that Evergrande, one of China’s biggest real estate developers and reportedly the most indebted company in the world, may not be too big to fail. Unless Beijing rescues Evergrande, it is expected to default on its $300 billion in debts. The Chinese government has previously bailed out troubled companies, but it is cracking down on risk – including overleveraged companies; in a separate action Thursday, government authorities banned cryptocurrency transactions.

Fears of a contagion subsided after Federal Reserve Board Chairman Jerome Powell pointed out at a press conference Wednesday that the fortunes of Evergrande did not pose a systemic risk to the U.S.. Financial fallout would be contained to China.

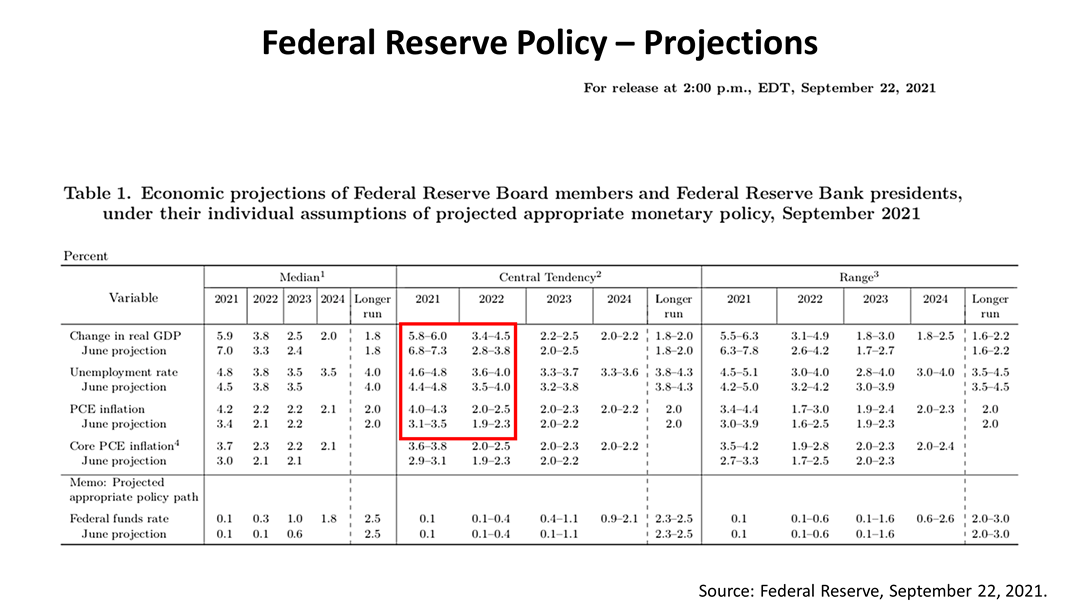

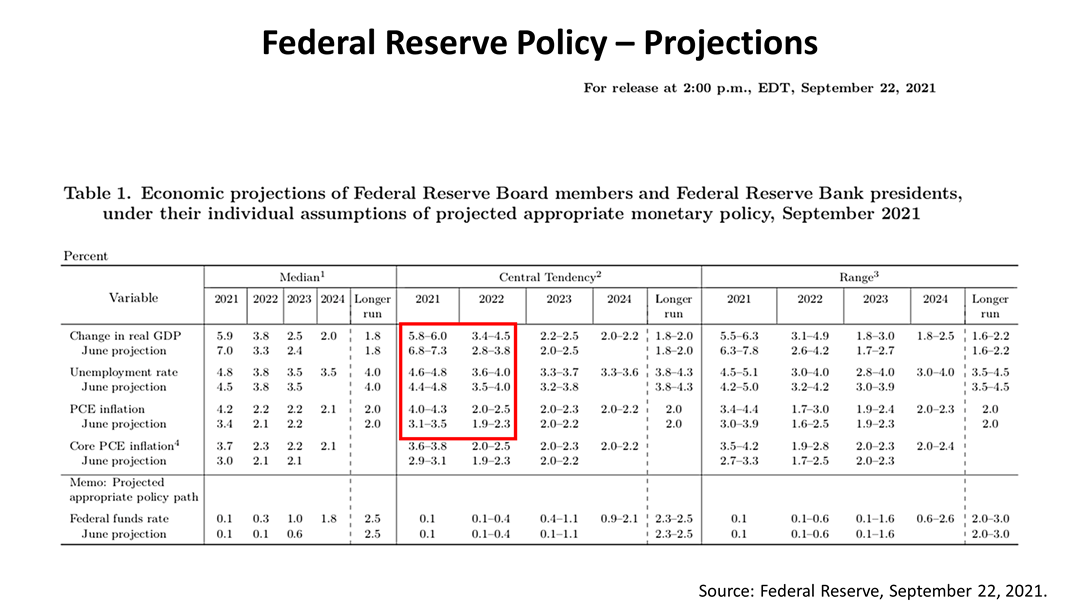

The other news for investors this week was in the Fed’s release of its latest projections for growth of the economy in 2021 and 2022. Compared to its June forecast, the Fed shaved its 2021 forecast for growth of gross domestic product. The GDP forecast was changed to reflect a slightly higher unemployment rate and a not-so-slight increase in expectations for inflation. The Fed is sticking with its story, forecasting that the inflation spike will be transitory and, by 2022, the inflation rate will revert to between 2% and 2.5%. Whether the Fed is right may not be clear until February 2002.

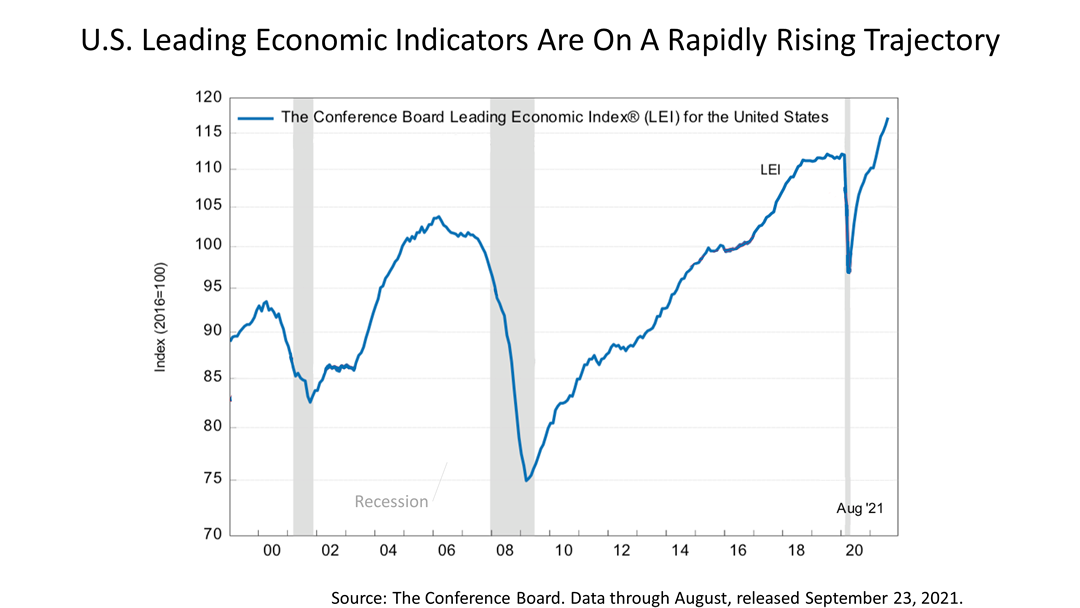

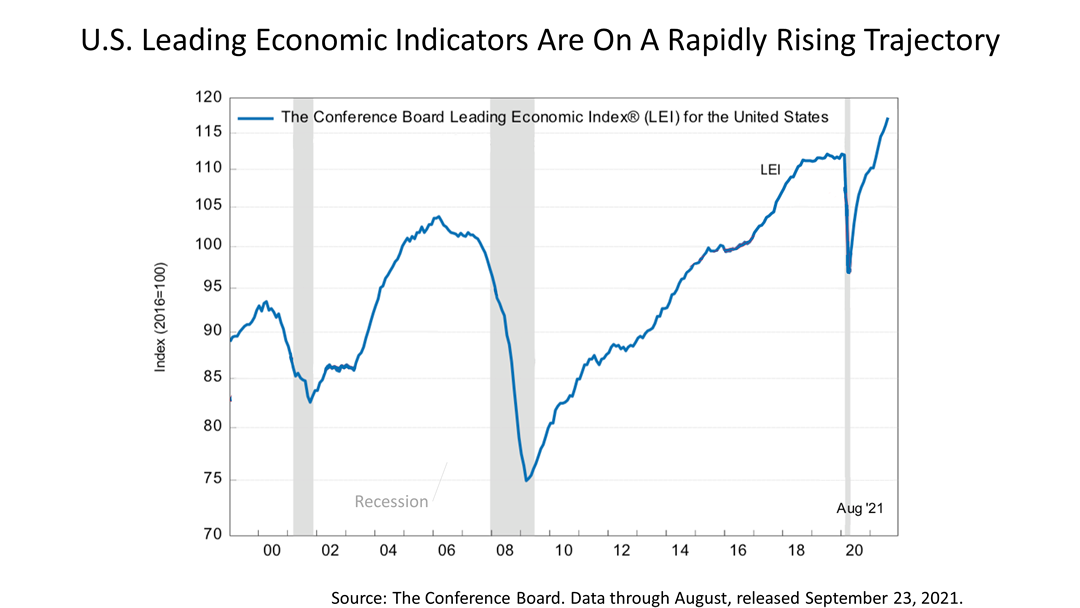

“The U.S. LEI rose sharply in August and remains on a rapidly rising trajectory,” according to The Conference Board, an association for large companies. “While the Delta variant—alongside rising inflation fears—could create headwinds for labor markets and the consumer spending outlook in the near term, the trend in the LEI is consistent with robust economic growth in the remainder of the year. Real GDP growth for 2021 is expected to reach nearly 6% year-over-year, before easing to a still-robust 4.0 percent for 2022.”

Apart from the Covid-induced recession, this chart shows that the LEI has definitively dropped months before the last two recessions. Nothing like a recession is happening now, as the LEI is higher than ever.

Every bear market in modern history was preceded by a recession, except for the Covid recession, which is why this is a key forward-looking indicator of financial economics.

The Standard & Poor’s 500 stock index closed Friday, Sept. 24, 2021 at 4,455.48. The index gained +0.15% from Thursday and +0.5% from a week earlier. The index was up close to its all-time high and has returned +66.28% since the March 23, 2020, bear market low.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.