Five Observations For Investment Planning For The Decades Ahead

Updated Published Friday, November 12, 2021 at: 8:08 PM EST Updated Published Friday, November 12, 2021 at: 8:08 PM EST

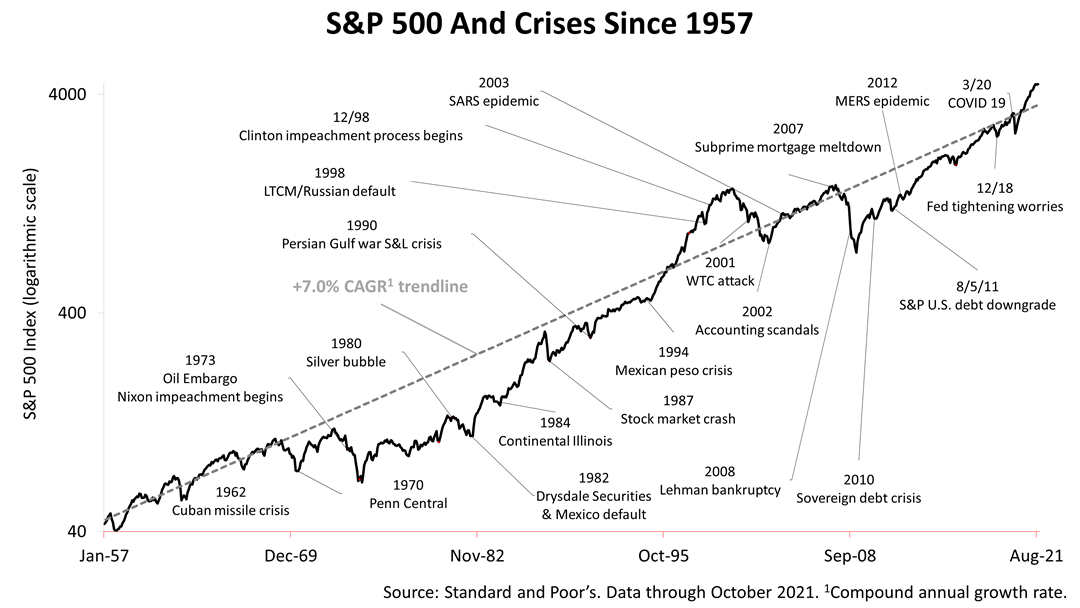

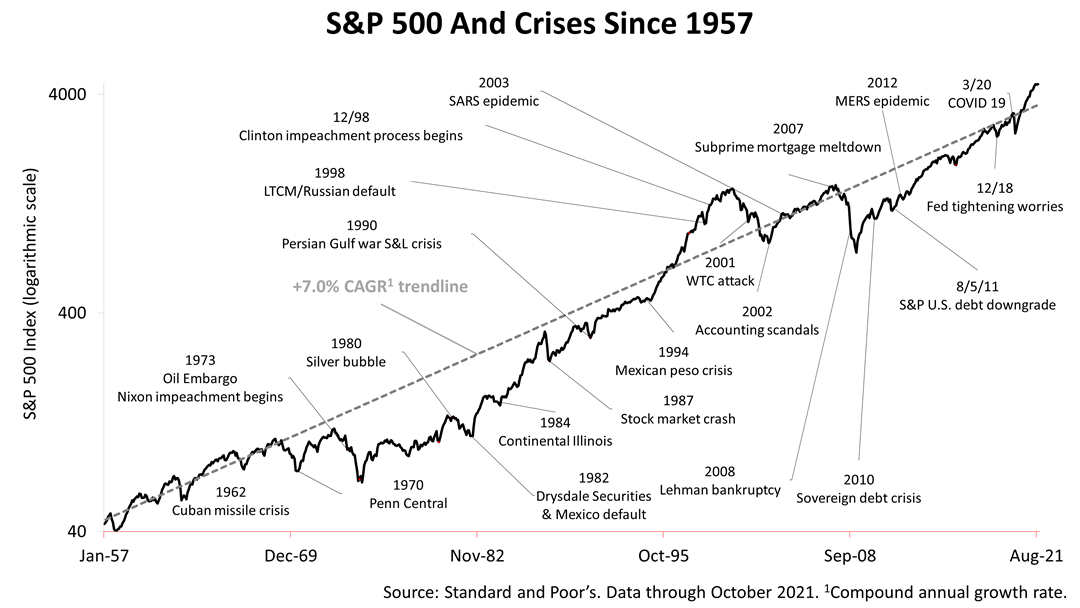

Here are 21 crises that occurred since 1957 charted against the performance of the Standard & Poor’s 500 index, a benchmark of the stock market and proxy for measuring the progress and strength of the United States.

Looking back on 64 years of modern American history, here are five observations to help investors plan for the decades ahead:

- From the late 1960s through 1995, stocks annually averaged less than the 7% rate averaged over the past 64 years.

- In 1997, the tech bubble began to form, and stocks soared for three years, through June 2000. It was the tech-stock bubble. It burst in mid-2000, and stocks plunged for nearly three years, through March 2003.

- Stocks have soared since the March 2020 Covid bear market low but are not even close to veering off the 7% trendline like they did in the tech-stock bubble of 2000.

- The Cold War with the Soviet Union does not figure prominently. A new cold war with China may also not be that important to American prosperity.

- Not reflected in this chart is that yields on bonds are lower than ever in U.S. history, which makes stocks more valuable relative to bonds than in the past. Stocks and bonds are the world’s two dominant investment asset classes. Stocks could veer further upward from the 7% trendline because of the new valuation paradigm of stocks versus bonds.

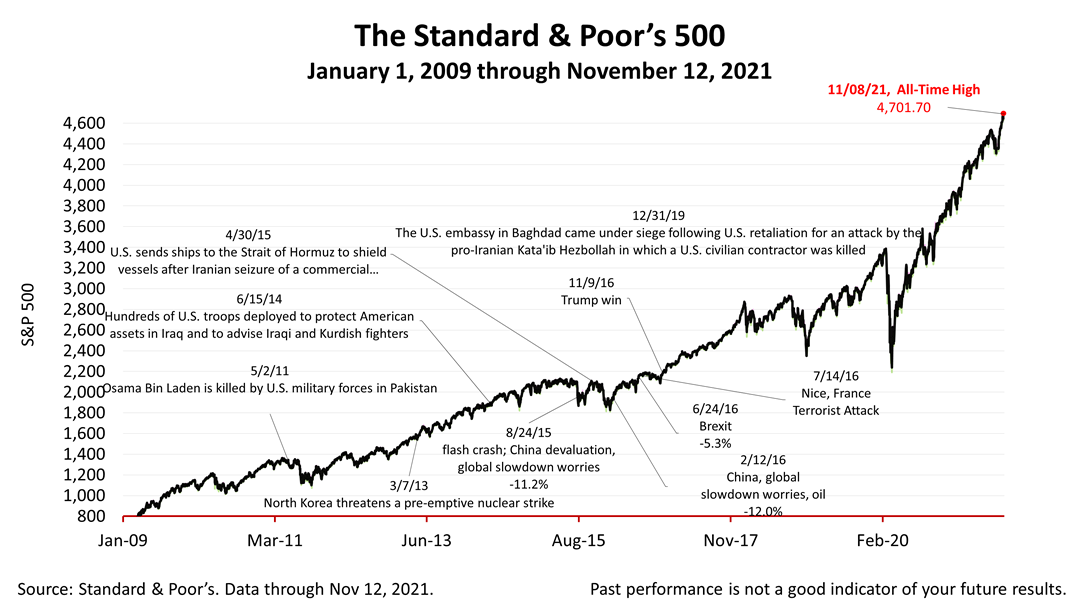

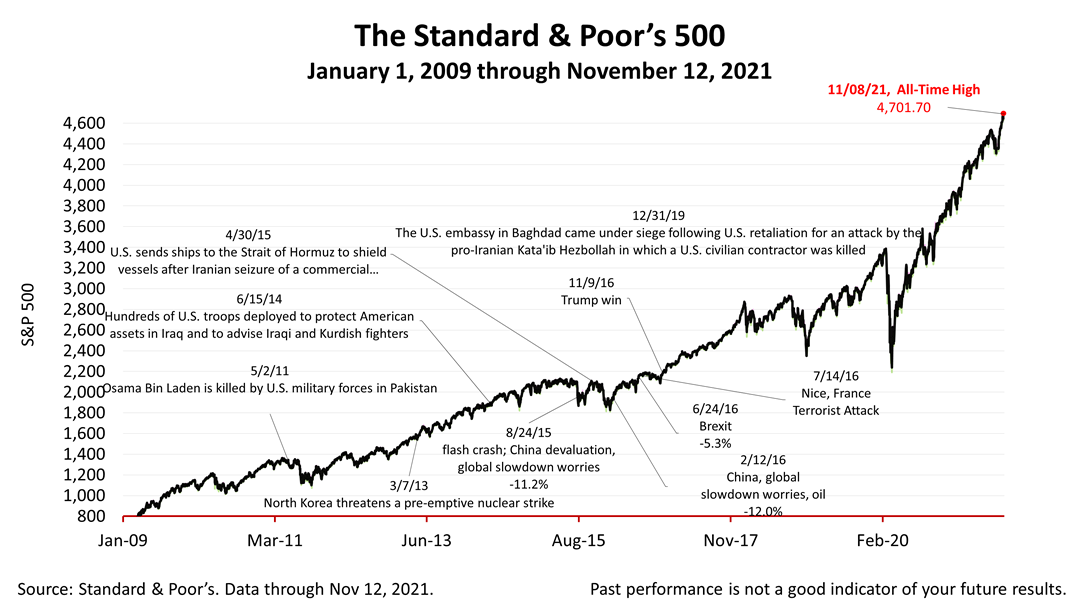

The Standard & Poor’s 500 stock index closed Friday at 4,682.85, fractionally off its all-time closing high reached earlier in the week. The index gained +0.72% from Thursday and is down -0.31% from last week. It is up +70.67% from the March 23, 2020, bear market low. For more information about the effect of the change in valuation of stocks versus bonds, please contact us.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

|

|