August 2021 | vol. iv, #8

_________________________________________________________________

_________________________________________________________________

WILDFIRES WREAK HAVOC ON LUMBER SUPPLIES

Wildfires throughout the country have posed a challenge for supply chains. Ontario, British Columbia, and the Northwestern U.S are currently combatting wildfires, which have led to a bit of a burn in the lumber industry.

Some 300 fires are blazing in western Canada and Northern Ontario has seen more than 150 wildfires this summer, which is unusual for the province. In efforts to reduce the fires, the use of some industrialized lumber equipment was prohibited by the Ontario government on July 21.

The wildfires in British Columbia have left a bit of a dent in the lumber industry. One of North America’s largest lumber producers, Canfor Corp., announced that it will reduce about 115 million board feet of production capacity at its Canadian sawmills during Q3. The decision comes as wildfires in western Canada are creating significant supply chain challenges and a transportation backlog.

After a year of inflated lumber prices, prices just started to decline as sawmills caught up with demand. But the wildfires have led to a bit of an unknown for the lumber industry.

“The wildfires burning in w estern Canada are significantly impacting the supply chain and our ability to transport product to market,” Stephen Mackie, EVP for North American operations at Canfor, said in a release. “As a result, we are implementing short-term production curtailments at our Canadian sawmills beginning July 26. We are developing site-specific plans to minimize the impacts to our employees and contractors.”

_________________________________________________________________

_________________________________________________________________

COVID CREATES A RECORDING-BREAKING YEAR FOR DEALERS

According to the 2021 Hardlines Retail Report, 2020 growth by hardware and home improvement dealers in Canada set a record.

The sector faced a year of unprecedented sales activity in this sector under COVID in 2020. The year resulted in an average sales increase from all stores measured in this study of more than 15 percent, a rate of growth not seen since Hardlines began tracking the industry 25 years ago.

Unlike in previous years, the increase was seen across the country. The Maritimes, which in other years have seen only slow or flat growth, also saw an increase.

Hardware stores as a sector saw the slowest growth of all the store formats.

However, this reflects the ongoing reduction in the number of these stores in favour of more full-line building centres. They account for less than seven percent of sales in the industry. Hardware stores had some of the biggest same-store sales of any sector, many of them reporting sales increases over 25 percent.

Building centres and big boxes reported healthy double-digit increases, reflecting the surge in renovations and improvements that consumers undertook during COVID. Big boxes also made gains in their overall share of the market. This store format now accounts for almost 30 percent of sales by home improvement retailers in Canada.

_________________________________________________________________

_________________________________________________________________

BUYING GROUPS HOLD STRONG THROUGHOUT THE PANDEMIC

The LBM buying groups are unique in Canada since they have no direct parallel in other markets like the U.S. Their operation and structure are quite distinct from the large retail banners and big-box chains that make up such a large part of the U.S. market.

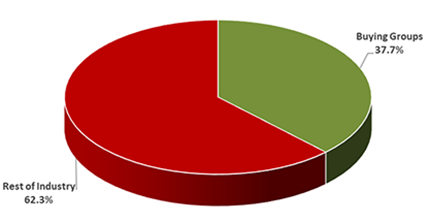

Since 2016, buying groups have represented at least one-third of sales by the Canadian retail home improvement market—a market worth more than $50 billion in 2020. Last year, the market share of the buying groups grew to almost 38 percent of the overall market.

Those sales were generated by more than 2,500 independently owned outlets that are members of eight buying groups across the country.

The largest of the buying groups is Home Hardware Stores with more than $5.5 billion in retail sales. Next is Independent Lumber Dealers Co-operative, whose combined membership accounts for an estimated $4.4 billion. The other buying groups are, in order of size, TIMBER MART, Sexton Group, Castle Building Centres, BMR Group, Delroc Industries, and TORBSA.

________________________________________________________________

_________________________________________________________________

Video Content Provided by Trusted

Hardlines Media Partners

|