|

Alyssa, don't miss these important MBA updates...

| |

|

PROFESSIONAL DEVELOPMENT

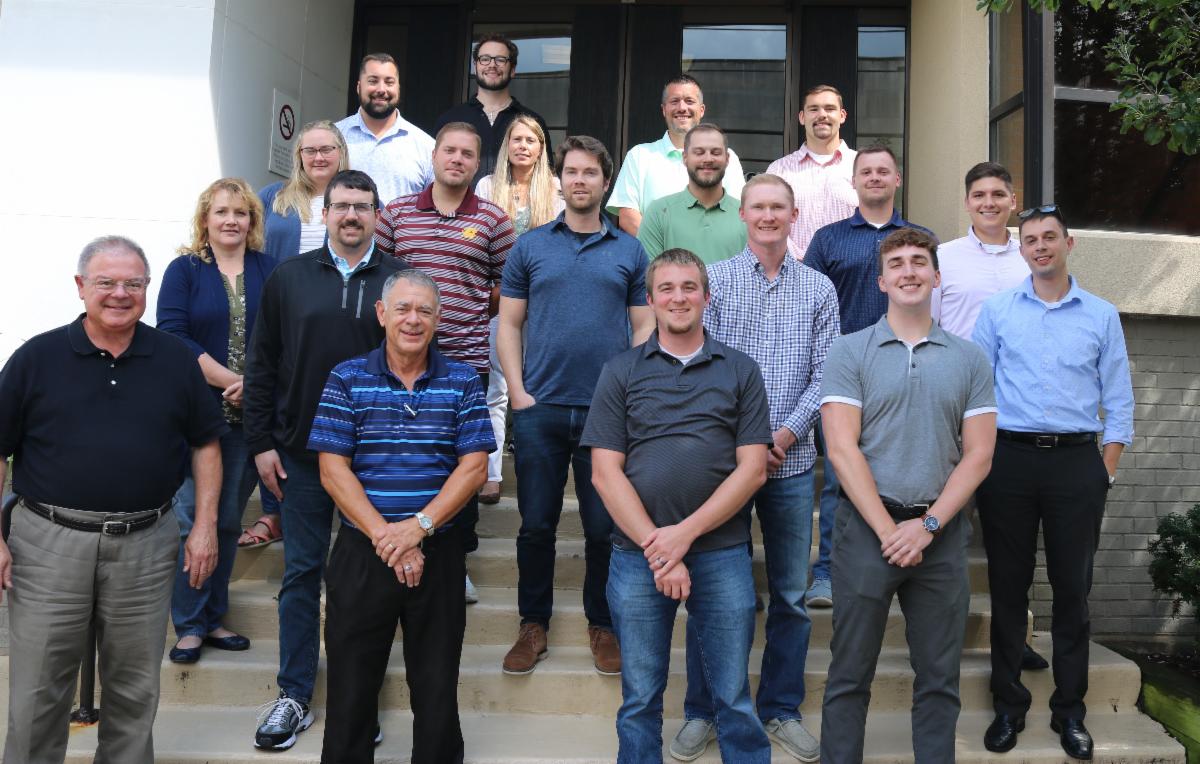

Congratulations to the Michigan Ag Lending School Participants!

MBA collaborated with the Department of Finance and Insurance Services (DIFS) to host an inaugural Michigan Agriculture Lending School last week, led by instructor Freddie Barnard, a pioneer in the development of the Farm Financial Standards who has taught extensively at various banking schools throughout the country. The school kicked off with an emerging issues segment featuring a panel of local ag lenders and update from Michigan Department of Agriculture and Rural Development (MDARD) Director, Tim Boring. Three additional days focused on Agribusiness analysis and a simulation led by Professor Barnard. Thanks to our banks who sent their ag lenders and to DIFS for the great partnership.

Pictured are Perry Allen, DIFS Office of Banking; Garrett Anders, Greenstone FCS; Ryan Saddler, Century Bank and Trust; Zach Ball, DIFS Office of Banking; Dan Bearman, Chelsea State Bank; Harrison Jautau, Southern Michigan Bank & Trust; Mitchell Miller, County National Bank; Brigid Drake, FRB of Chicago; Dan Hale, Eastern Michigan Bank; Adam Klaus, DIFS Office of Banking; Jacob Modert, Century Bank and Trust; Beanna Hall, County National Bank; Dawn Morrison, DIFS Office of Banking; Zach Paulus, Isabella Bank; Russell Wigent, Union Bank; Jen Bellamy, ChoiceOne Bank; Alex Messing, Eastern Michigan Bank; and Wayne Sevilla, Greenstone FCS.

|  | |

|

Join us in Grand Rapids for the Bank Management and Directors Conference, November 5-7.

This event aims to bring together bright minds focused on a wide range of topics, fostering learning, inspiration, and meaningful conversations. In today’s dynamic environment, our speakers will guide you in exploring, evaluating, and challenging your strategic thinking. By continuously learning and strategically thinking, you and your bank will be better equipped to face challenges and drive progress.

| |

|

MBA SERVICE CORPORATION ENDORSED PARTNER

VIRTUAL Michigan Planners Road Show

Join the MBA Service Corporation and the Michigan Planners Medicare Team as we steer you and your customers through the complexities of Medicare, and the anticipated 2025 changes, which are a result of the Inflation Reduction Act. This event, including any resulting service and support on Medicare services from Michigan Planners Medicare Team, are provided at NO COST to you or your customers. View the brochure.

The Michigan Planner’s Medicare Team will discuss the anticipated changes in 2025 of:

- Increased Premiums

- Prescription Drug Deductibles

- Certain Drugs Removed Completely from Medicare Coverage

- Reduction of Other Medicare Benefits

Approved for 1 SHRM Credit.

| |

|

September 10

10:00 a.m. - 11:00 a.m. EST

| |  |

|

September 17

2:00 p.m. - 3:00 p.m. EST

| |

|

RESOURCES

AI Resources and More

With the potential to revolutionize business operations across industries, all eyes are on the future of artificial intelligence. Below are a few resources to help you keep you on trend.

Webinars

Articles and Videos

Recent MBA Presentations

| |

|

Please join us for a day of grassroots relationship building in Lansing! MBA Banker Day at the Capitol will be held on Thursday, September 19th at the Michigan Bankers Association. We will have a panel of legislative committee leadership from both chambers, a fire-side chat with a banker and the MBA Advocacy team, and a political pundits discussion about the political landscape for the upcoming election!

Meet and greet your Representative and Senator at our legislative lunch followed by a capitol tour for those interested. Our goal is to have at least 80 bankers from across the state raising the voice of our industry together.

| |

ELECTIONS

Key Congressional Races

* FOB = Friends of Banking

District 21 (Oakland County)

Sitting State Representative Kelly Breen faces off with Republican Thomas Konesky. This race would have less interesting, but the presence of third-party Libertarian candidate James Young could have this Southeast Michigan district in play on election night.

District 22 (Wayne County)

This race pits 3rd term State Representative Matt Koleszar (FOB) against challenger Adam Stathakis (FOB). Stathakis, a business owner and Hillsdale College grad, will face less head winds than Koleszar’s 2022 opponent in a district that only went 54% for the incumbent Democrat last election.

District 27 (Wayne County)

First term incumbent Representative Jaimie Churches (FOB) only carried the district by 600 votes in 2022. The Republican challenger Rylee Linting is freshly out of undergrad with little name I.D., but the makeup of the district should ensure this race stays in-play.

District 28 (Monroe, Wayne)

Republican incumbent Jaimie Thompson (FOB) won this seat by just over 700 votes in 2022, making this race another one to watch that will have implications on which party holds the gavel when the dust clears on November 5th.

District 29 (Monroe, Wayne)

Republican incumbent James DeSana carried this district by 1,000 votes in 2022 in a race that saw over 35,000 people vote. Challenger Kyle Wright most recently served on the Taylor school board and is looking to unseat the first term DeSana.

Access the MBA Friends of Banking Guide.

| |

REGULATORS

FHLBs: Treasury Department’s affordable housing proposal not sustainable

A Treasury Department request to have FHLBs voluntarily raise the percentage of net income they set aside for affordable housing “will not address the underlying complexities of the housing crisis,” the FHLB chairs said in a joint letter. Read more.

| |

|

REGULATORS

Updated FFIEC IT Examination Handbook – Development, Acquisition, and Maintenance Book

The Federal Financial Institutions Examination Council (FFIEC) issued the Development, Acquisition, and Maintenance (DA&M) booklet, which is part of the FFIEC Information Technology Examination Handbook. The booklet replaces the Development and Acquisition booklet issued in April 2004. Read more.

| |

|

REGULATORS

Federal Reserve Board Announces Final Individual Capital Requirements For All Large Banks, Effective on October 1

Following its stress test earlier this year, the Federal Reserve Board last week announced final individual capital requirements for all large banks, effective on October 1.

Large bank capital requirements are informed by the Board's stress test results, which provide a risk-sensitive and forward-looking assessment of capital needs. The table shows each bank's common equity tier 1 capital requirement, which is made up of several components, including:

- The minimum capital requirement, which is the same for each bank and is 4.5 percent;

- The stress capital buffer requirement, which is based in part on the stress test results and is at least 2.5 percent; and

- If applicable, a capital surcharge for the largest and most complex banks, which is updated in the first quarter of each year to account for the overall systemic risk of each of these banks.

Read more.

| |

|

REGULATORS

U.S. Department of the Treasury Releases New Report Highlighting $3.5 Billion in Clean Energy Investments in Low-Income Communities

The U.S. Department of the Treasury released a report with new data on the success of the 2023 program year of the Inflation Reduction Act’s Low-Income Communities Bonus Credit Program. The report demonstrates how the program is lowering American families’ energy costs as part of the Biden-Harris Administration’s economic agenda. View the report.

| |

|

DE&I

Diversity, Equity and Inclusion Summit

Don’t miss the Diversity, Equity and Inclusion Summit on Sept. 12, covering topics on expanding board diversity, inclusive leadership and more. Register now.

| |

Register for the Rising Leaders Fall Summit, September 25 in Grand Rapids. Reserve your room by September 9! | |

|

Join Us For The Internal Audit School

September 26-29 | Lansing

This two-day course will discuss the establishment and execution of an effective and efficient internal audit program. Attendees will learn the objectives of internal audit, and helpful techniques to reach those objectives. Internal audit should be a value-added function and not just a “check the box” cost center. This course will teach attendees how to create and maintain a value-added internal audit function.

| |

|

MBA Webinar: Finding Funding for Your Training Budget

Complimentary

Presented by the MI Department of Labor and Economic Opportunity and Michigan Bankers Association

September 24 | 10:00 – 10:30am EST

The Going PRO Talent Fund makes awards to employers to assist in training, developing and retaining current and newly hired employees. The Going Pro grant has been a transformative experience for our organization. The funds have allowed us to invest in comprehensive training programs for our Honor Bank employees, equipping them with the latest skills and knowledge to better serve our customers. The helpful team at Networks Northwest makes gathering data a lot less overwhelming. They provide great direction and do what they can to ensure your grant request is set up so well that the State of Michigan will approve it!

Pracilla L. Venhuizen, SHRM-CP | Honor Bank | Assistant Vice President | Human Resource Manager

| |

|

PROFESSIONAL DEVELOPMENT

Training the Bank Trainer

October 8 | Lansing

Your learning and professional development role is more critical now than ever. Studies show that engaged employees making a difference in their role who feel connected to the mission, have access to a variety of benefits, and receive training and career development opportunities stay longer.

In this hands-on train-the-trainer workshop, learn to provide the knowledge and skills you and your training team need to create, deliver, facilitate, evaluate, and manage successful training sessions for your bank employees.

| |

|

Risk and Compliance Workshop

October 2-3 | Lansing

Join us in Lansing for this 1.5 day risk and compliance workshop to dig deeper into the risk and compliance issues you care about. You will walk away with a deeper understanding of the regulatory and compliance landscape and the critical issues you need to monitor going forward.

| |

|

MBA SERVICE CORPORATION ENDORSED PARTNER

Tackle Carrier Rate Increases: Unlock Cost Control Strategies in Our 4-Part Webinar Series

Join Michigan Planners for a Mini Cost Control Webinar Series, where we’ll deep dive into the anticipated 2025 carrier rate increases and explore long-term strategies to manage these rising costs.

This series is designed to demonstrate our proactive approach in addressing cost increases, offering proven solutions that could benefit your organization. The series as whole is approved for one SHRM credit! We aim to provide long-term solutions to help control costs throughout 2025. Plus, they are raffling off a pair of Lions tickets—each session you attend gives you a chance to win!

| |

MBA SERVICE CORPORATION ENDORSED PARTNER

Institutional Risk + VCO Oversight = Core Resiliency

It’s a formula for success used by hundreds of banks across the U.S. right now—maybe even your cross-town competition! And why should they be more fundamentally ready for agency examinations than you, right?

We’re talking about Virtual Compliance Officers. A VCO is your new right-hand working with you one-on-one to fight fires, move mountains, and grow your business. They do this by handling your worst items; your straggler projects, your last-minute asks, the buildups and the buildouts, the long-range projects that are now shortly due, and through it all, they’ll be your gap-fillers.

If you’re ready to stop faking it until you make it, talk to our Membership team about a VCO of your own. Call Compliance Alliance at (833) 683-0701 or info@bankersalliance.org.

| |

MBA SERVICE CORPORATION ENDORSED PARTNER

Turning the Screws: The Pressure Tactics of Ransomware Gangs

Back in 2021, Sophos X-Ops published an article on the top ten ways ransomware operators ramp up pressure on their targets, in an attempt to get them to pay. Last year, X-Ops revealed that threat actors have since developed a symbiotic relationship with sections of the media, leveraging news articles as extortion pressure. Three years on, threat actors continue to adapt and change their tactics to increase leverage against their targets. Read more.

| |

MBA SERVICE CORPORATION ENDORSED PARTNER

A Buyer’s Blueprint For Breakthrough Deposit Acquisition

Today's bankers confront an array of challenges that complicate the path to acquiring new checking customers while simultaneously managing costs and maximizing efficiency. The drive to lower cost per acquisition (CPA) is more pressing than ever, especially against a backdrop of shrinking marketing budgets tied to slower revenue growth and an increasingly competitive field not just from within, but also from non-financial institutions. Marketers face the immense task of adapting to changing consumer behaviors and preferences across channels, all the while under pressure to prove the effectiveness of their marketing efforts. Read more.

| |

|

Exciting News! We're Going VIRTUAL!

We've listened to your feedback, and to better serve our members, we're transitioning the Medicare Update from Michigan Planners to virtual webinars!

Join the MBA Service Corporation and the Michigan Planners Medicare Team as they guide you and your customers through the complexities of Medicare, including the anticipated 2025 changes brought about by the Inflation Reduction Act.

Don't miss out—Register Now by clicking the links below:

September 10, 10:00 - 11:00 a.m.: https://conta.cc/4cPCUES

September 17, 2:00 - 3:00 p.m.: https://conta.cc/4cOCmin

| |

#FrameOfMindFriday How many hours of sleep are you getting at night? https://conta.cc/3gbgELk | |

|

Congratulations to Congressman Jack Bergman on receiving the 2024 MBA Economic Impact Award!

This esteemed award honors public officials whose leadership and dedication have significantly shaped policies that bolster Michigan's economy.

"The MBA is proud to recognize Congressman Jack Bergman for his unwavering commitment to strengthening and uplifting our great state," said T. Rann Paynter, President and CEO of the MBA.

We applaud Congressman Bergman for his remarkable contributions to Michigan's economic prosperity and are proud to present him with this well-deserved award. His tireless efforts and visionary leadership set a high standard for public officials across the state.

Read more here: https://bit.ly/2024MBAEIA

| |

Like Us. Follow Us. Share with Us! | |

Looking for a past MBA Bank Beat? Click here to access the archives. | | | | |